Many so-called nonprofits are simply groups of people who come together to perform some social good. These informal groups are called unincorporated nonprofit associations. An unincorporated nonprofit association may be subject to certain legal requirements, even though it hasn't filed for incorporation under its state's incorporation laws. For example, an unincorporated association will generally need to file tax returns, whether as a taxable or tax-exempt entity. Additionally, there may be state registration requirements.

Virginia Articles of Association of Unincorporated Church Association

Description

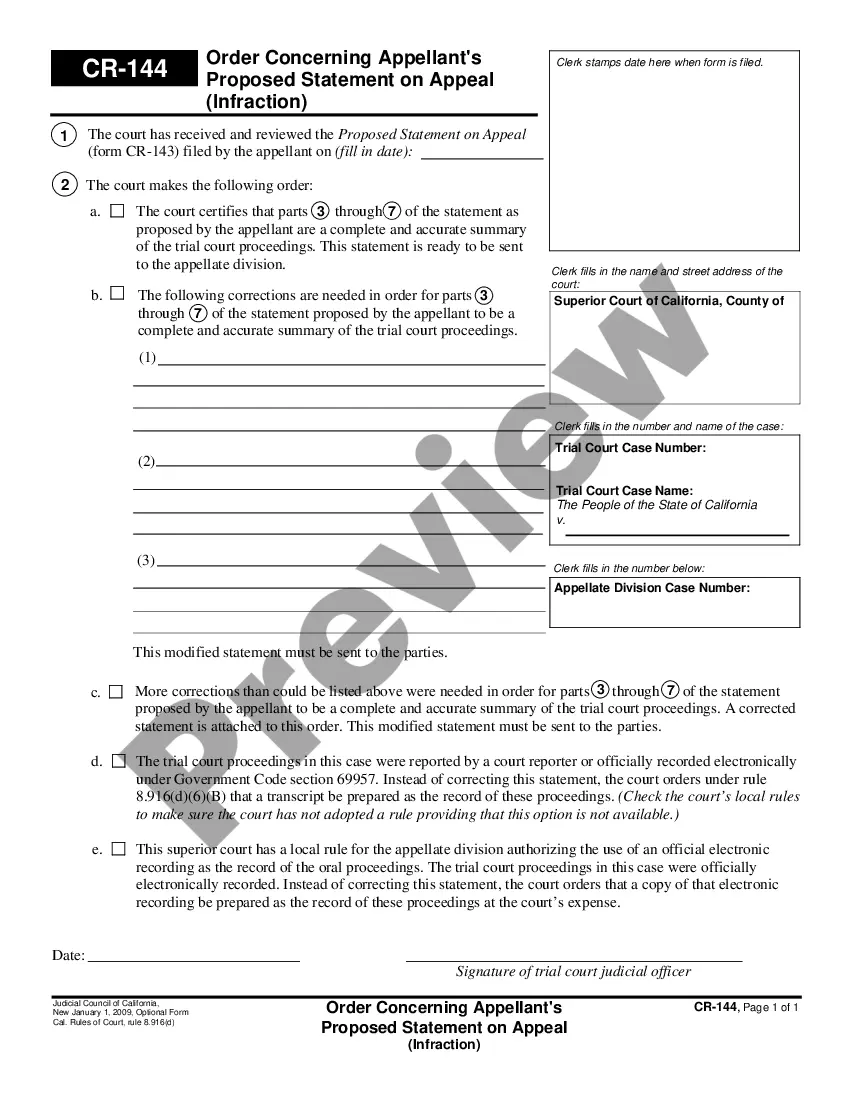

How to fill out Articles Of Association Of Unincorporated Church Association?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide selection of legal document templates that you can download or print.

By utilizing the website, you can find thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can quickly access the latest versions of forms such as the Virginia Articles of Association of Unincorporated Church Association.

If you already have a subscription, Log In and retrieve the Virginia Articles of Association of Unincorporated Church Association from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously purchased forms in the My documents section of your profile.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill it out, modify it, print, and sign the downloaded Virginia Articles of Association of Unincorporated Church Association. Each design you save to your account has no expiration date and is yours permanently. Thus, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Virginia Articles of Association of Unincorporated Church Association with US Legal Forms, one of the most extensive catalogs of legal document templates. Utilize a plethora of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/region.

- Click the Review button to examine the form's content.

- Refer to the form description to confirm you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

A church becomes tax-exempt by meeting criteria set by the IRS and state regulations, including operating primarily for religious purposes. Documentation, such as Articles of Association, plays a key role in establishing this status. For unincorporated churches, understanding the Virginia Articles of Association of Unincorporated Church Association is essential to ensure compliance and to maintain tax-exempt benefits effectively.

If a church is unincorporated, it may still operate effectively, but it faces some challenges with legal protections and tax status. Unincorporated churches must adhere strictly to the requirements set forth in the Virginia Articles of Association of Unincorporated Church Association to maintain both their tax-exempt status and legal standing. It is advisable to seek guidance when navigating these complexities to avoid potential issues.

In summary, churches qualify for tax-exempt status in Virginia if they meet specific criteria. This is true for both incorporated and unincorporated churches, as long as they operate primarily for religious purposes. Familiarizing yourself with the Virginia Articles of Association of Unincorporated Church Association can strengthen your organization's foundation and support your tax-exempt status.

Yes, most churches in Virginia are exempt from local property taxes, which significantly benefits their financial situation. This exemption hinges on their status as a non-profit organization engaged in religious activities. For unincorporated church associations, it's vital to properly document your status, referencing the Virginia Articles of Association of Unincorporated Church Association, to ensure you qualify for this exemption.

Churches in Virginia are generally considered tax-exempt under both state and federal law. This exemption applies to various taxes, including income and sales tax, provided they meet the necessary requirements. If your church operates as an unincorporated organization, understanding the Virginia Articles of Association of Unincorporated Church Association can be crucial for maintaining this status and benefiting from tax breaks.

Yes, nonprofits can achieve tax-exempt status in Virginia if they meet specific criteria set by the IRS and state law. This includes filing the appropriate forms, such as the Articles of Incorporation, in alignment with the Virginia Articles of Association of Unincorporated Church Association. It is essential for organizations to maintain transparency and adhere to regulations to retain their tax-exempt status in Virginia.

VA Code 58.1-3617 outlines specific provisions for taxation related to charitable organizations, including churches. This law plays a significant role in determining the tax-exempt status for unincorporated associations. Understanding this code can help you navigate the requirements for Virginia Articles of Association of Unincorporated Church Association. It can also assist you in ensuring compliance and maximizing your organization's benefits.

In Virginia, a minimum of three directors is required for a 501c3 organization. These board members must act in the best interest of the organization and fulfill fiduciary responsibilities. Including a diverse group can enhance governance and provide different perspectives. Establishing your Virginia Articles of Association of Unincorporated Church Association will also guide you in outlining the roles and responsibilities of the board members.

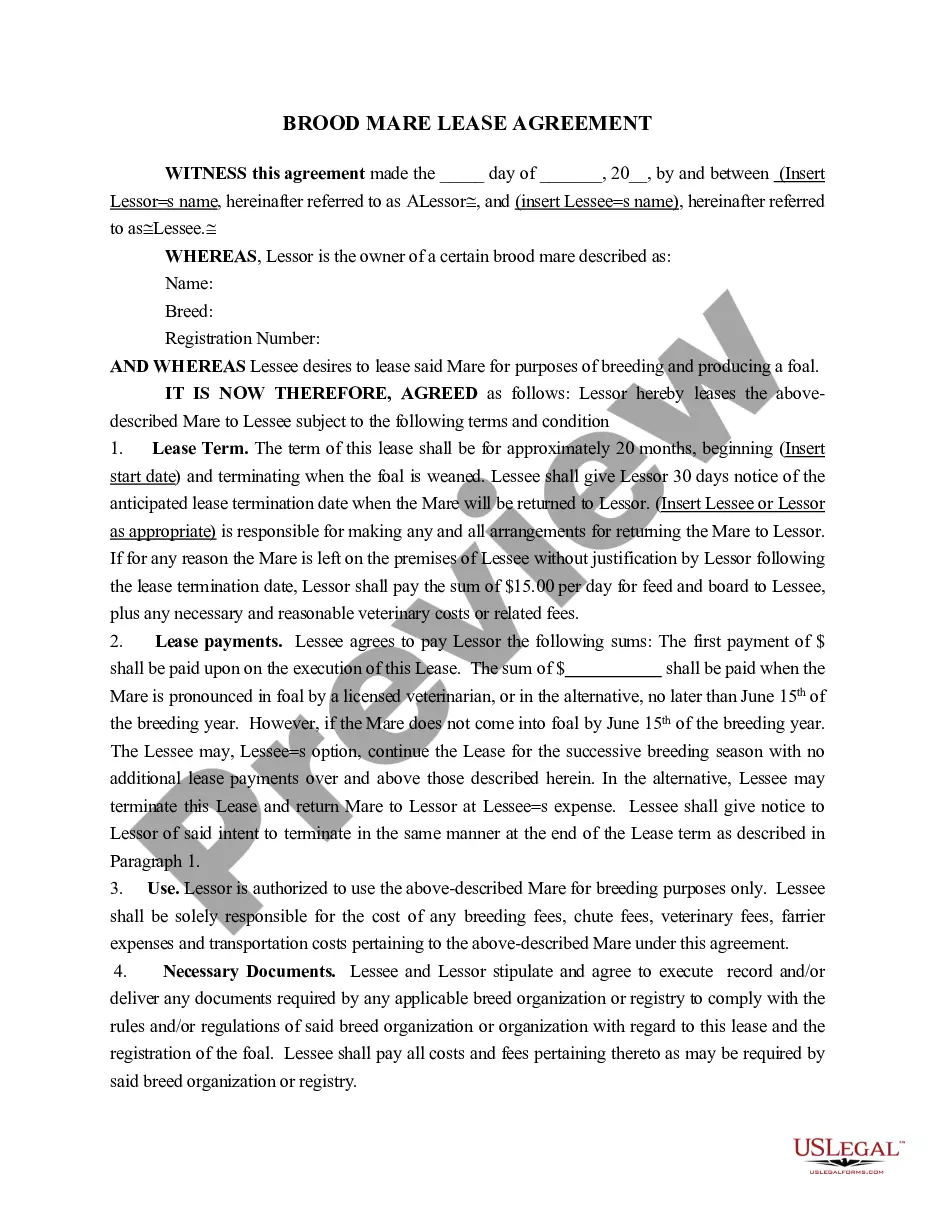

Starting an association in Virginia begins with defining the organization's purpose and drafting Articles of Association. Next, you’ll need to gather a group of interested individuals to serve as members and possibly incorporate the association by filing with the state. Remember, one key aspect is to create Virginia Articles of Association of Unincorporated Church Association, which helps clarify your mission and sets the groundwork for your operations.

Yes, a 501c3 organization must file Articles of Incorporation to qualify for tax-exempt status. This legal document outlines the purpose and structure of your organization, which is critical for compliance with federal and state regulations. By creating Virginia Articles of Association of Unincorporated Church Association, you ensure that your organization operates within the law and can benefit from tax deductions, grants, and other financial advantages.