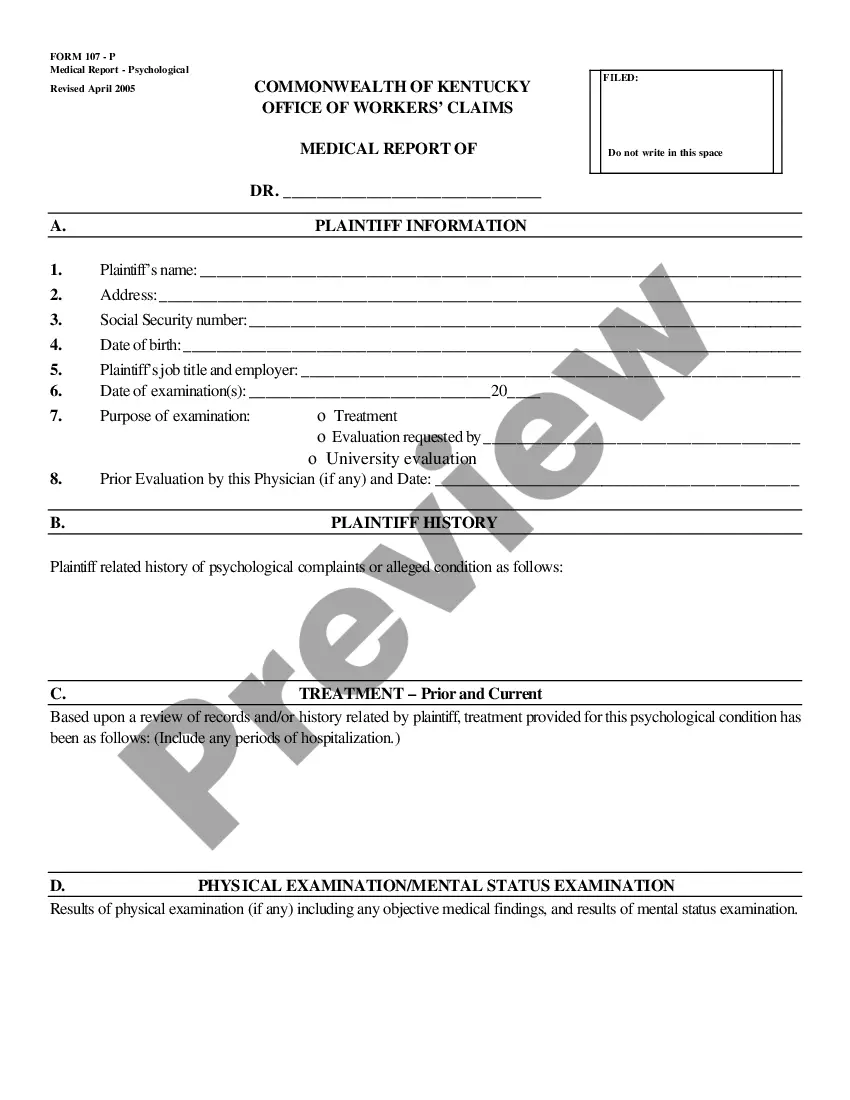

Virginia Sample Letter of Credit

Description

How to fill out Sample Letter Of Credit?

Finding the right authorized record format can be quite a battle. Needless to say, there are a lot of layouts accessible on the Internet, but how will you discover the authorized kind you require? Use the US Legal Forms website. The assistance offers a huge number of layouts, including the Virginia Sample Letter of Credit, which can be used for enterprise and private requirements. All the varieties are examined by specialists and fulfill state and federal requirements.

In case you are presently authorized, log in in your bank account and then click the Download key to find the Virginia Sample Letter of Credit. Make use of bank account to look throughout the authorized varieties you might have ordered in the past. Check out the My Forms tab of your own bank account and have yet another backup of the record you require.

In case you are a fresh customer of US Legal Forms, listed below are simple guidelines for you to comply with:

- First, ensure you have chosen the right kind for your personal town/state. You are able to look over the form making use of the Preview key and browse the form description to ensure this is basically the best for you.

- If the kind is not going to fulfill your requirements, make use of the Seach area to obtain the correct kind.

- Once you are positive that the form is acceptable, select the Acquire now key to find the kind.

- Select the costs plan you need and type in the needed info. Design your bank account and pay money for the order making use of your PayPal bank account or Visa or Mastercard.

- Pick the data file file format and acquire the authorized record format in your product.

- Comprehensive, change and printing and indicator the attained Virginia Sample Letter of Credit.

US Legal Forms is the most significant library of authorized varieties where you can discover various record layouts. Use the company to acquire expertly-created files that comply with state requirements.

Form popularity

FAQ

Example: An Indian exporter receives an export LC from his overseas client in the Netherlands. The Indian exporter approaches his banker with a request to issue an LC in favour of his local supplier of raw materials. The bank issues an LC backed by the export LC.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit.

An acceptance credit is a type of letter of credit that is paid by a time draft authorizing payment on or after a specific date, if the terms of the letter of credit have been complied with. The bank "accepts" bills of exchange drawn on the bank by the debtor, discounts them and agrees to pay for them when they mature.

A letter of credit is an instrument issued by a financial institution, usually a bank, which authorizes the bearer to demand payment from the institution. A letter of credit can be general, if it is not addressed to any specific person, or special, if it is addressed to a specific person or entity.

A Letter of Credit is an arrangement whereby Bank acting at the request of a customer (Importer / Buyer), undertakes to pay for the goods / services, to a third party (Exporter / Beneficiary) by a given date, on documents being presented in compliance with the conditions laid down.

An acceptance credit is a type of letter of credit that is paid by a time draft authorizing payment on or after a specific date, if the terms of the letter of credit have been complied with. The bank "accepts" bills of exchange drawn on the bank by the debtor, discounts them and agrees to pay for them when they mature.

Letters of Credit typically take a long time to issue. They are bound by Uniform Customs & Practice for Documentary Credits (UCP 600) trading rules, which are worth examining to ensure no laws will be broken in the trade.