Virginia Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncom petition Provisions is a legal document that outlines the terms and conditions under which the shareholders of a close corporation can buy or sell their stocks within the state of Virginia. This agreement includes provisions that are designed to protect the interests of the shareholders and the corporation by addressing issues related to ownership transfer, noncom petition, and the continuity of the business. The Virginia Shareholders Buy Sell Agreement typically includes the following key provisions: 1. Buy-Sell Provisions: This section of the agreement establishes the mechanism and procedure for the purchase and sale of shares between the shareholders. It may include provisions for the right of first refusal, buyback options, mandatory offers, and conditions for triggering a stock sale. 2. Valuation of Shares: The agreement outlines the methods that will be used to determine the fair market value of the shares in the event of a buy-sell transaction. This may include using an independent appraiser or agreed-upon formulas for valuation. 3. Noncom petition Provisions: This section aims to protect the interests of the corporation by preventing shareholders who sell their shares from competing with the business. It may include restrictions on starting a similar business, soliciting clients or employees, or disclosing proprietary information. 4. Non-Disclosure and Confidentiality: The agreement may include provisions to maintain the confidentiality of the corporation's trade secrets, strategic plans, financial information, and customer lists. This helps protect the corporation from any potential harm caused by the disclosure of sensitive information. 5. Dispute Resolution: This section outlines the process for resolving any disputes that may arise between the shareholders regarding the interpretation or enforcement of the agreement. It may specify mediation, arbitration, or litigation as the preferred method of resolution. Different types of Virginia Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncom petition Provisions may include variations based on specific needs or circumstances. Some possibilities include: 1. Standard Buy-Sell Agreement: A basic agreement that includes the essential provisions mentioned above, suitable for most close corporations. 2. Closely Held Corporation Agreement: This agreement may include additional provisions to address the unique challenges and characteristics of closely held corporations, such as restrictions on share transfers or approval requirements for stock sales. 3. Minority Shareholder Agreement: This type of agreement is focused on protecting the interests of minority shareholders by including provisions that offer them additional rights and safeguards against majority shareholder actions. 4. Trigger Events Agreement: This specific type of agreement may be triggered by certain events such as the death, disability, retirement, or voluntary resignation of a shareholder. It establishes the procedures for the purchase or sale of shares in these situations. In conclusion, the Virginia Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncom petition Provisions is a crucial legal document that helps govern the buy-sell transactions and protect the interests of both shareholders and the close corporation in Virginia. Different types of agreements may exist to accommodate various circumstances faced by close corporations or address the rights and protections of minority shareholders.

Virginia Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

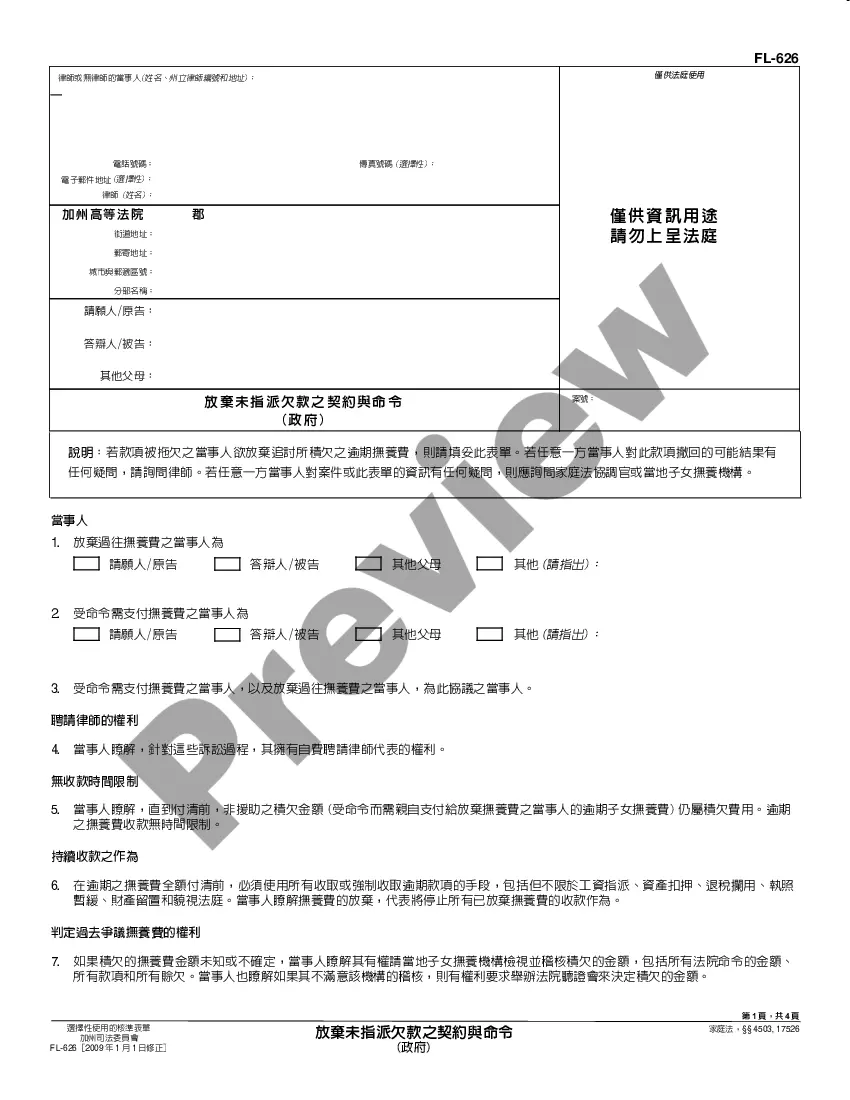

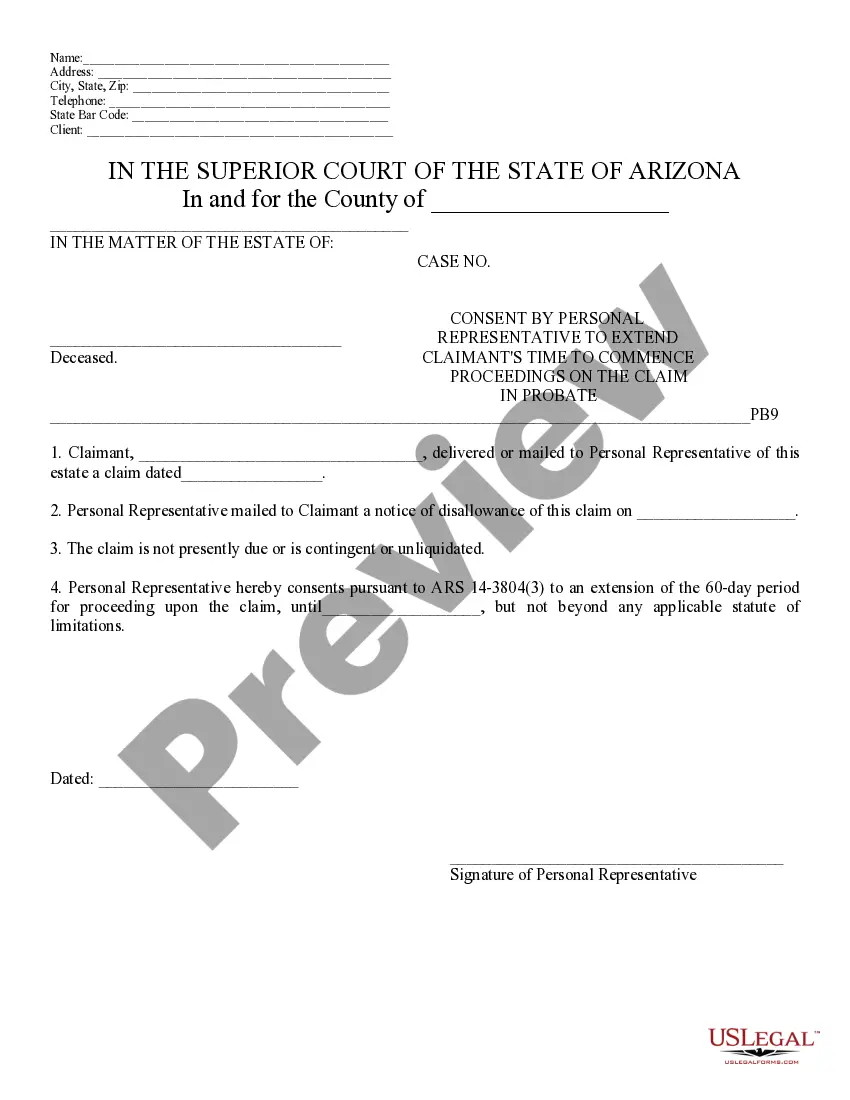

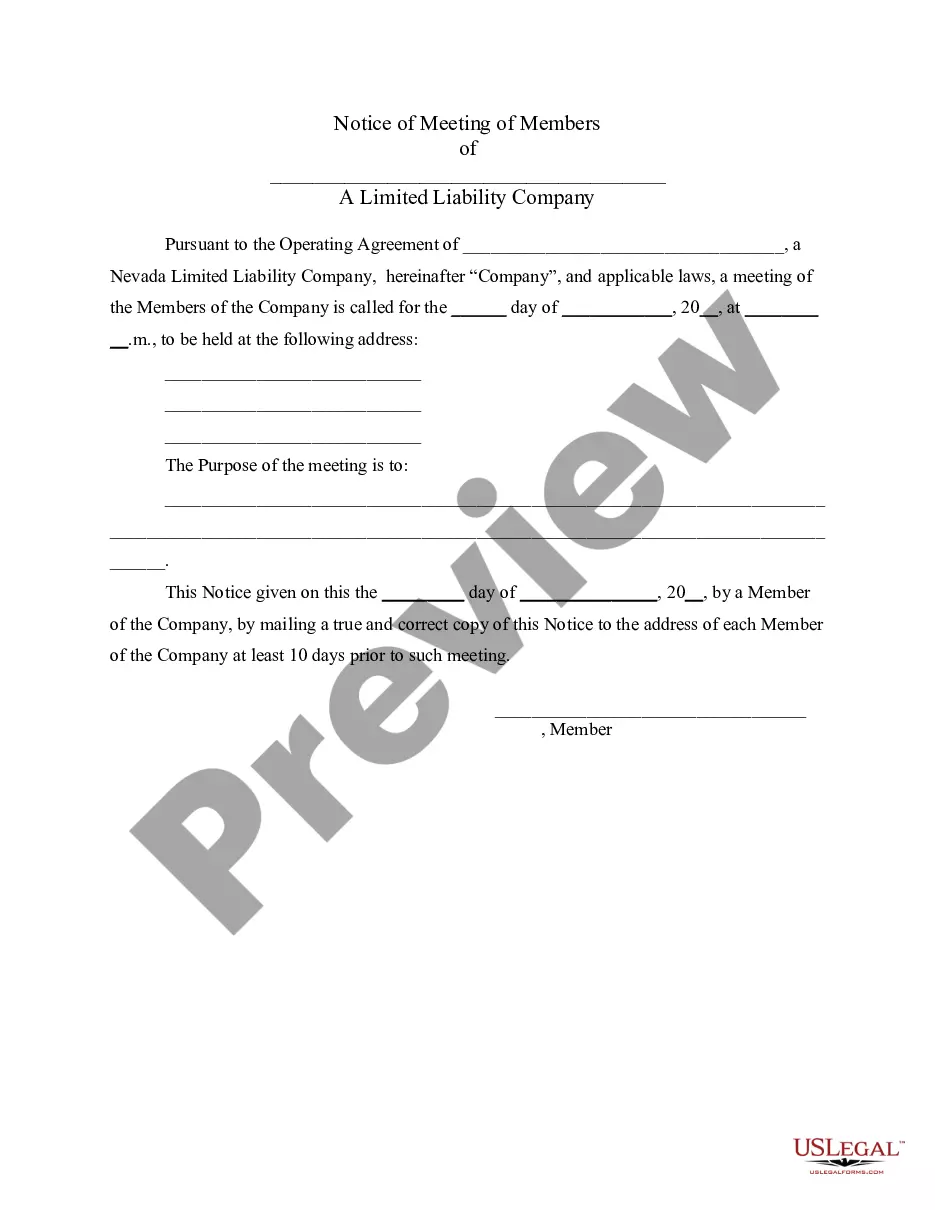

How to fill out Virginia Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

Choosing the right legal file format can be a have difficulties. Obviously, there are plenty of templates available on the Internet, but how would you discover the legal form you need? Utilize the US Legal Forms web site. The service offers 1000s of templates, including the Virginia Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, which can be used for business and private requirements. All the types are checked out by experts and meet up with federal and state specifications.

In case you are currently signed up, log in to your profile and click on the Acquire switch to obtain the Virginia Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions. Utilize your profile to look with the legal types you may have acquired in the past. Go to the My Forms tab of your own profile and acquire another duplicate of the file you need.

In case you are a brand new user of US Legal Forms, listed here are simple instructions for you to adhere to:

- Very first, make sure you have chosen the correct form to your area/county. You can examine the shape making use of the Review switch and browse the shape description to guarantee it will be the right one for you.

- When the form does not meet up with your expectations, utilize the Seach area to obtain the appropriate form.

- Once you are certain that the shape is acceptable, go through the Get now switch to obtain the form.

- Select the costs program you want and enter the essential information. Create your profile and buy an order making use of your PayPal profile or credit card.

- Pick the document structure and download the legal file format to your gadget.

- Comprehensive, edit and printing and sign the acquired Virginia Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions.

US Legal Forms may be the greatest catalogue of legal types in which you will find numerous file templates. Utilize the service to download expertly-created files that adhere to condition specifications.

Form popularity

FAQ

Does a shareholders' agreement override articles? No, a shareholders' agreement will not override the Articles if there is a conflict, then the articles will prevail.

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

What Are Buy-Sell Agreements? Buy-Sell agreements or forced buyouts are one way for the majority to force out a minority. This allows a majority to force a minority to sell their shares often in the context of a company-wide buyout.

Yes. Most companies that raise investment (on Crowdcube or elsewhere) include a drag along procedure in their articles of association. The procedure is designed to ensure that minority shareholders cannot block an exit by the majority.

Majority shareholders may not be able to sell Then all the company's shares are saleable if the majority want to do a deal. A typical drag along right enables a majority of shareholders to sell the company. Minority shareholders are dragged into the sale on the same terms.

A Share Sale and Purchase Agreement is an agreement for the sale and purchase of a stated number of shares at an agreed price. The shareholder selling their shares is the seller and the party buying the shares is the buyer. This agreement details the terms and conditions of the sale and purchase of the shares.

If an individual is purchasing or selling shares in the company or industry with another business or person, they should use a share purchase agreement. For instance, if there are two partners for a business, they have equal rights and shares.

The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

The answer is usually no, but there are vital exceptions. However, there are a few situations in which shareholders must sell their stock even if they would prefer to hold onto their shares. The two most common are when a company gets acquired and when it has an agreement among shareholders calling for forced sales.