Virginia Loan Agreement for Car

Description

How to fill out Loan Agreement For Car?

US Legal Forms - among the largest libraries of legal varieties in the USA - gives a wide array of legal record layouts it is possible to obtain or printing. Using the site, you will get a huge number of varieties for business and individual purposes, categorized by groups, suggests, or search phrases.You will find the most up-to-date models of varieties such as the Virginia Loan Agreement for Car within minutes.

If you already possess a membership, log in and obtain Virginia Loan Agreement for Car from the US Legal Forms collection. The Obtain button can look on every kind you see. You have accessibility to all previously delivered electronically varieties within the My Forms tab of your bank account.

If you wish to use US Legal Forms the very first time, listed below are easy instructions to help you began:

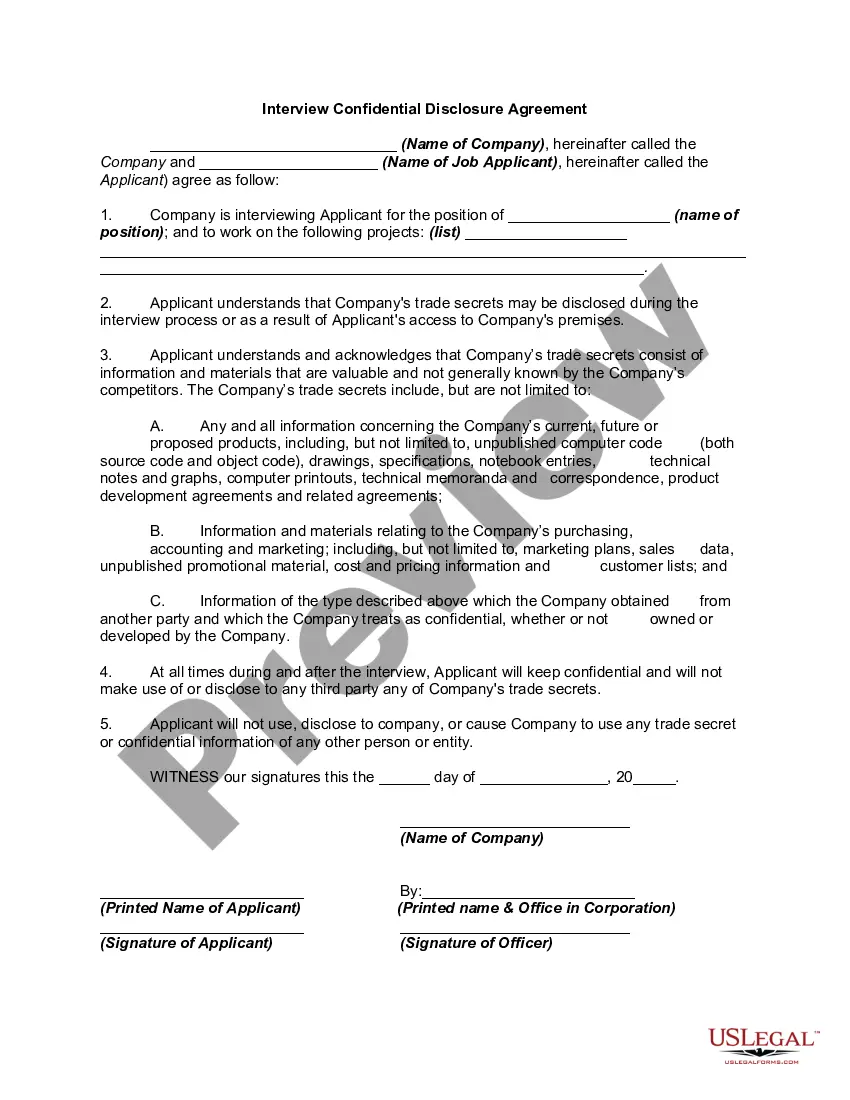

- Ensure you have chosen the proper kind for your metropolis/region. Select the Review button to analyze the form`s information. Read the kind explanation to actually have chosen the correct kind.

- In case the kind does not satisfy your specifications, make use of the Search field towards the top of the screen to obtain the the one that does.

- In case you are content with the shape, confirm your selection by clicking on the Get now button. Then, choose the costs program you favor and give your qualifications to register for an bank account.

- Method the financial transaction. Utilize your credit card or PayPal bank account to accomplish the financial transaction.

- Choose the formatting and obtain the shape on your own gadget.

- Make adjustments. Fill out, edit and printing and sign the delivered electronically Virginia Loan Agreement for Car.

Every single web template you put into your account does not have an expiry date and is also your own property forever. So, if you would like obtain or printing an additional copy, just check out the My Forms section and then click in the kind you require.

Get access to the Virginia Loan Agreement for Car with US Legal Forms, probably the most substantial collection of legal record layouts. Use a huge number of skilled and condition-specific layouts that fulfill your business or individual requires and specifications.

Form popularity

FAQ

10 States With the Lowest Auto Finance Interest Rates Michigan ? 3.03% 36-month loans: Community West Credit Union ? 1.49% ... Oregon ? 3.04% 36-month loans: First Community Credit Union (FCCU) ? 0.99% ... Alaska ? 3.04% ... New Hampshire ? 3.08% ... South Carolina ? 3.15% ... Vermont ? 3.17% ... Oklahoma ?3.23% ... Utah ? 3.28%

Does the VA Offer Auto Loans? Seeing as Veterans Affairs (VA) offers everything from purchase loans to cash-out refinances to help veterans buy homes, you might be surprised that there are no VA auto loans. This federal department doesn't currently have any general programs to help veterans purchase new cars.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates.

Auto Loans in Virginia Not only do we offer some of the lowest used car rates around, we're also very competitive in new car rates. Our terms are flexible and getting the loan itself is easy! Visit one of our credit union branches in Virginia, get pre-approved online, or get the loan directly from the dealership.

Does the VA Offer Auto Loans? Seeing as Veterans Affairs (VA) offers everything from purchase loans to cash-out refinances to help veterans buy homes, you might be surprised that there are no VA auto loans. This federal department doesn't currently have any general programs to help veterans purchase new cars.

So unless you have saved enough to buy a vehicle with cash, you'll need an adult to co-sign your car loan if you're under 18.

You can still apply for a title loan in Virginia without a traditional job! During your title loan inquiry, you will need to provide proof of an alternative source of income, such as workers' compensation, Social Security benefits, or retirement income.

Most used auto loans go to borrowers with minimum credit scores of at least 675. For new auto loans, most borrowers have scores of around 730. The minimum credit score needed for a new car may be around 600, but those with excellent credit often get lower rates and lower monthly payments.