A Virginia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name is a legal contract that enables an insurance company to seek compensation or indemnification on behalf of an insured party. This agreement allows insurers to recover the cost of expenses paid out to policyholders, arising from damages caused by a third party. Virginia, being one of the states in the United States, has specific regulations and requirements for such agreements. Keywords: Virginia subrogation agreement, insurer, bring action, insured's name, compensation, indemnification, insurance company, damages, third party, regulations, requirements. Different Types of Virginia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name: 1. Property Damage Subrogation Agreement: This specific type of agreement empowers the insurer to initiate legal action against a responsible party who caused damage to the policyholder's property. The insurer acts on behalf of the insured to recover the funds paid for repairs or replacement. 2. Personal Injury Subrogation Agreement: In cases where the insured suffers personal injuries due to the negligence of a third party, this agreement allows the insurance company to bring legal action to recover medical expenses, lost wages, and other associated costs incurred by the insured. 3. Auto Insurance Subrogation Agreement: This agreement is commonly used in motor vehicle-related incidents where the insurer steps into the shoes of the insured to seek reimbursement for damages caused by another driver's fault or negligence, including property damage and bodily injury. 4. Workers' Compensation Subrogation Agreement: When an insured employee is injured on the job, this agreement permits the insurer to pursue a claim against a liable third party whose actions contributed to the accident. By doing so, the insurance company seeks to recover the compensation paid to the injured worker. 5. Health Insurance Subrogation Agreement: In situations where a policyholder's medical expenses are incurred due to the acts or omissions of a third party, this agreement enables the insurer to take legal action on behalf of the insured to obtain reimbursement for the costs of medical treatment. It is important to note that these are general categories of subrogation agreements, and the specific terms and provisions may vary depending on the insurance policy, state requirements, and individual circumstances. Therefore, it is essential to consult legal professionals to ensure compliance with Virginia laws and to draft an appropriate subrogation agreement for each specific scenario.

Virginia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

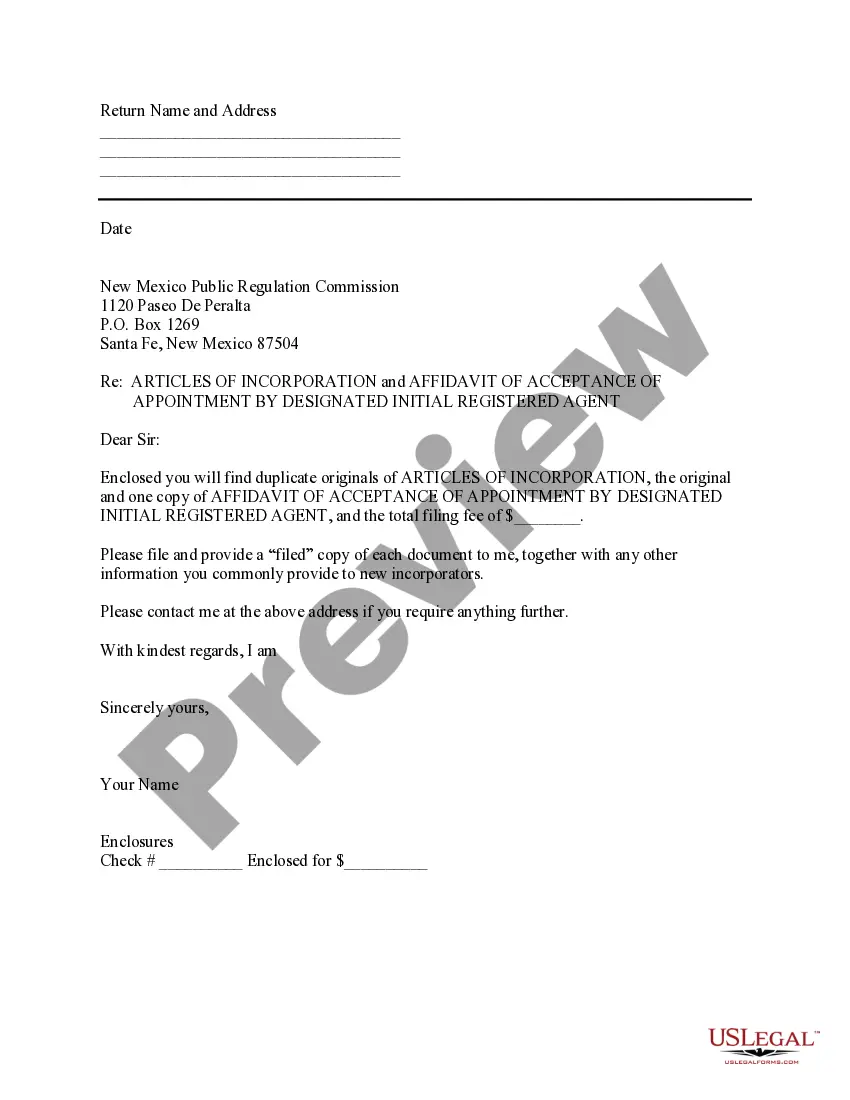

How to fill out Virginia Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

You can commit several hours on the web attempting to find the legitimate document design that suits the state and federal needs you will need. US Legal Forms provides thousands of legitimate kinds which can be reviewed by experts. It is possible to obtain or produce the Virginia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name from the services.

If you currently have a US Legal Forms account, you are able to log in and click the Acquire key. Afterward, you are able to total, modify, produce, or indication the Virginia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name. Every legitimate document design you buy is your own property for a long time. To get yet another version for any purchased type, go to the My Forms tab and click the related key.

If you work with the US Legal Forms web site for the first time, adhere to the simple guidelines below:

- Very first, be sure that you have chosen the proper document design for that region/area that you pick. Look at the type information to make sure you have picked the right type. If available, take advantage of the Preview key to search from the document design as well.

- If you wish to find yet another variation in the type, take advantage of the Search industry to get the design that fits your needs and needs.

- After you have discovered the design you desire, just click Acquire now to carry on.

- Pick the rates prepare you desire, enter your credentials, and register for an account on US Legal Forms.

- Total the purchase. You can use your Visa or Mastercard or PayPal account to cover the legitimate type.

- Pick the file format in the document and obtain it in your product.

- Make adjustments in your document if possible. You can total, modify and indication and produce Virginia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name.

Acquire and produce thousands of document web templates utilizing the US Legal Forms website, which offers the largest selection of legitimate kinds. Use specialist and status-particular web templates to deal with your company or individual needs.

Form popularity

FAQ

It can be claimed when the insured individual has suffered injuries due to a third party's mistake and intends to bear their expenses. For example, if an insured person receives ? 5 lakh while claiming their health insurance, the company can collect the same amount from the defaulter as part of subrogation.

And we hereby subrogate to you the rights and remedies that we have in consequence of or arising from loss/damage to our insured goods and we further hereby grant to you all power to take and use all lawful ways and means to demand, recover and to receive the said loss/damage and all and every debt from whom it may ...

A subrogation receipt transferring the insured's entire causes of action to the insurer allows the insurer to recover in the insured's name for the entire loss, not just to the extent of its payment.

Virginia Workers Comp and Subrogation Virginia Code Section 65.2-309 states that an employer has a lien against any verdict or settlement you receive in a third-party claim. Further, the employer is subrogated to the right to sue the third party for liability in civil court.

There is no requirement to respond, but it can be in your best interests to reply. The subrogation claim will likely be sent to a collection agency, and that collection agency may be willing to accept less than the total amount owed in order to settle the debt.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault. It's common in auto, health insurance and homeowners policies. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault.

At the minimum, your subrogation file should contain all elements corresponding to liability determination and proof of damages. Being able to prove who is at fault is essential. You'll want to include documentation and any information you've gathered, such as witness statements or police reports.

Additional Details letter creation date. insured name. claim number and policy number. date of loss. recipient name. damage amount. claims specialist name and title.