Virginia Agreement for Conditional Gifts refers to a legal document that outlines the terms and conditions of a gift given to an individual or organization that is conditional upon certain circumstances or requirements being fulfilled. This agreement is primarily aimed at ensuring that the intentions of the gift giver are upheld and that the gift is used in a specific manner as specified by the donor. The Virginia Agreement for Conditional Gifts acts as a protective measure for both the donor and the recipient by clearly stipulating the conditions under which the gift will be given and utilized. It helps establish a mutual understanding and agreement between the two parties involved in order to avoid any potential conflicts or misunderstandings in the future. This type of agreement may encompass different types of conditional gifts. Some common types include: 1. Conditional Cash Gifts: Under this category, the donor provides a sum of money to the recipient, subject to certain conditions. The conditions may vary and could include requirements such as the funds being used for a specific purpose, project, or time duration. 2. Conditional Property or Asset Gifts: This type of conditional gift involves the donation of property, assets, or real estate, contingent upon certain conditions being met. The conditions specified in the agreement could range from using the property for a specific purpose, such as establishing a charitable organization, to maintaining the property in a particular condition. 3. Conditional Education Gifts: These conditional gifts are often made to educational institutions or individuals seeking education. The conditions specified in the agreement may include maintaining a certain grade point average, pursuing a specific field of study, or completing a specified educational program. 4. Conditional Charitable Gifts: This type of conditional gift is commonly made to charitable organizations or foundations. The conditions attached to these gifts may relate to how the funds are to be utilized, specific projects that must be undertaken, or certain goals that need to be achieved. The Virginia Agreement for Conditional Gifts is a crucial legal tool in facilitating transparent and effective gifting processes. It ensures that the intentions of the donor are accurately represented and respected, while providing clear guidelines for the recipients to adhere to. By clearly outlining the expectations and obligations of both parties, this agreement promotes harmonious relationships, responsible resource allocation, and the successful realization of the donor's philanthropic vision.

Virginia Agreement for Conditional Gifts

Description

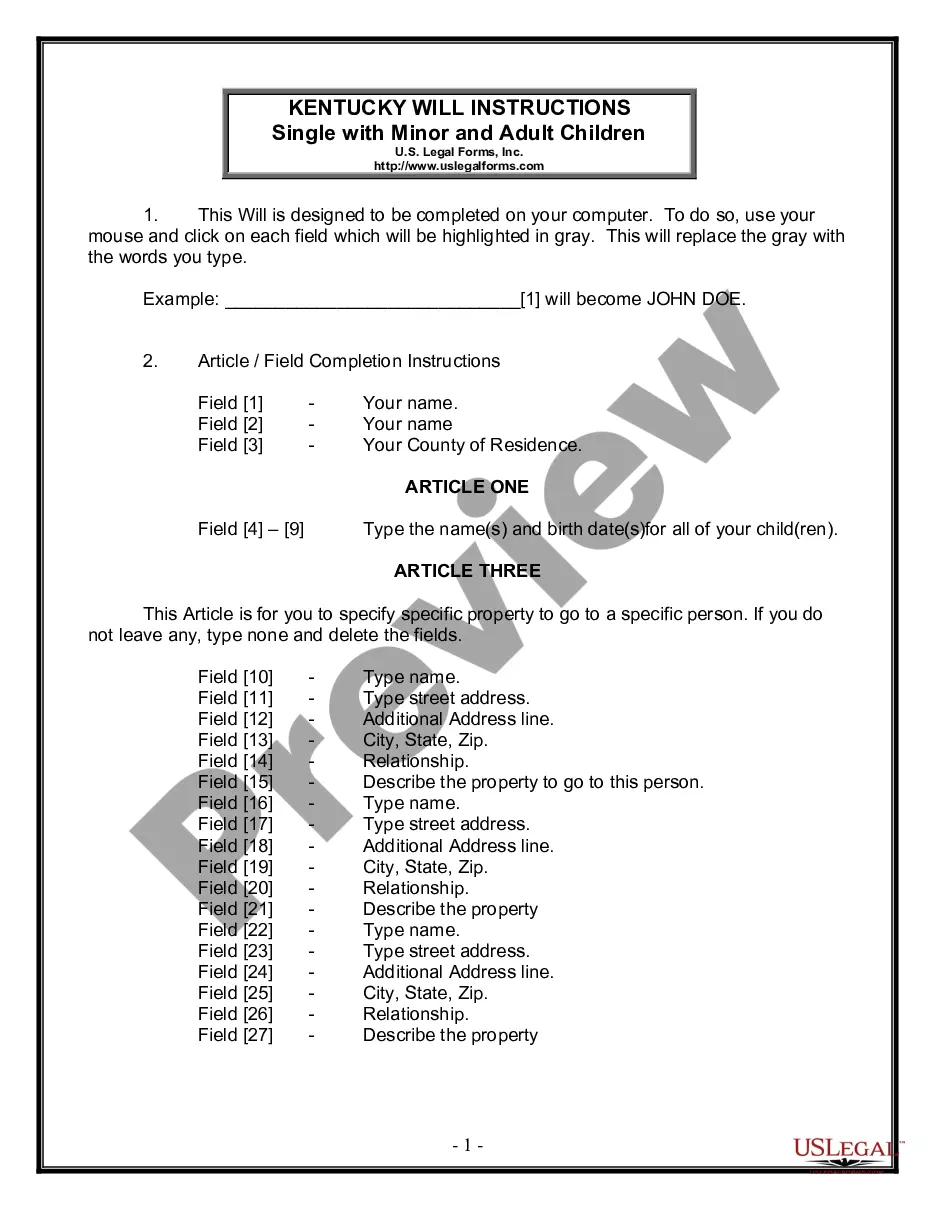

How to fill out Virginia Agreement For Conditional Gifts?

US Legal Forms - one of the most significant libraries of legitimate kinds in the States - delivers a wide range of legitimate record templates it is possible to download or print out. Making use of the web site, you can get a huge number of kinds for business and specific purposes, sorted by classes, says, or key phrases.You can find the latest types of kinds just like the Virginia Agreement for Conditional Gifts in seconds.

If you already have a subscription, log in and download Virginia Agreement for Conditional Gifts from the US Legal Forms catalogue. The Download switch can look on every single develop you perspective. You get access to all previously acquired kinds from the My Forms tab of your bank account.

If you would like use US Legal Forms the very first time, listed here are simple instructions to obtain began:

- Be sure to have selected the correct develop for your personal area/state. Go through the Preview switch to examine the form`s articles. Read the develop explanation to actually have chosen the right develop.

- When the develop doesn`t suit your requirements, use the Research area near the top of the screen to find the one who does.

- Should you be happy with the form, affirm your choice by visiting the Buy now switch. Then, pick the prices prepare you prefer and supply your qualifications to sign up for the bank account.

- Procedure the financial transaction. Make use of charge card or PayPal bank account to accomplish the financial transaction.

- Select the file format and download the form in your product.

- Make adjustments. Fill up, revise and print out and signal the acquired Virginia Agreement for Conditional Gifts.

Every single design you included with your bank account lacks an expiration particular date and it is the one you have forever. So, if you would like download or print out yet another duplicate, just check out the My Forms segment and then click in the develop you need.

Gain access to the Virginia Agreement for Conditional Gifts with US Legal Forms, the most comprehensive catalogue of legitimate record templates. Use a huge number of specialist and condition-certain templates that satisfy your business or specific requirements and requirements.

Form popularity

FAQ

In most states where engagement rings are considered conditional gifts, the recipient remains the owner of the ring only if the condition of marriage is met. In most cases, the ring goes back to the purchaser if the couple breaks up.

Engagement rings are conditional gifts. They are given with the condition or promise that the receiver will marry the giver. If they do not get married, then the engagement belongs to the giver. It does not matter if it was the giver who broke off the engagement or the receiver.

Is an Engagement Ring Considered Marital Property? Typically, an engagement ring is not considered marital property to be divisible. The Court will often look at the engagement ring as a gift that was given in anticipation of a wedding, which obviously took place or you wouldn't be going through a divorce.

In most states, including Maryland, an engagement ring is not considered just a gift from one to-be spouse to another, but a conditional gift. A conditional gift is given to the recipient with the expectation that some agreed-upon future event or action will occur.

Virginia, in general, does not require the return of an engagement ring. The Heart Balm Act, §8.01-220 of the Code of Virginia, provides that no civil action shall be maintained in Virginia for breach of promise to marry. The Act has been interpreted to not require the return of an engagement ring.

This is because one person gives the ring to the other person before you get married. Therefore it's considered a pre-marital asset. Additionally, engagement rings have been held by the courts to be conditional gifts. This means that they are gifted to the other person based upon a condition or conditions being met.

If the break up occurred before marriage, the giver of the ring has a right to take back the ring. This is because in Virginia we treat engagement rings as gifts. There are two types of giftsunconditional and conditional gifts. An unconditional gift is a gift given without any requirements or promises.

What Makes a Gift Conditional? If you give your fiance an engagement ring and then you get married, the ring belongs to them as it was given as a gift. A conditional gift is exactly what it sounds like: a gift with a condition. The condition is getting married.

Typically, the giver of the ring owns it. The court held that, under these circumstances, the giver of the ring owns the ring. The rational is that ownership of the ring is based on the law of conditional gifts and not the Virginia Heart Balm Act. 793 S.E.2d 336 (Va.

In general, a ring is considered a gift. The law requires three elements of gift giving, according to legal information provider : The intent to give it as a gift, the actual giving of the gift, and the receiver's acceptance of the gift.