Virginia Joint Trust with Income Payable to Trustors During Joint Lives

Description

How to fill out Joint Trust With Income Payable To Trustors During Joint Lives?

You have the capability to spend hours online searching for the legal document template that meets the federal and state criteria you require.

US Legal Forms provides thousands of legal documents that have been reviewed by professionals.

You can purchase or print the Virginia Joint Trust with Income Payable to Trustors During Joint Lives from the platform.

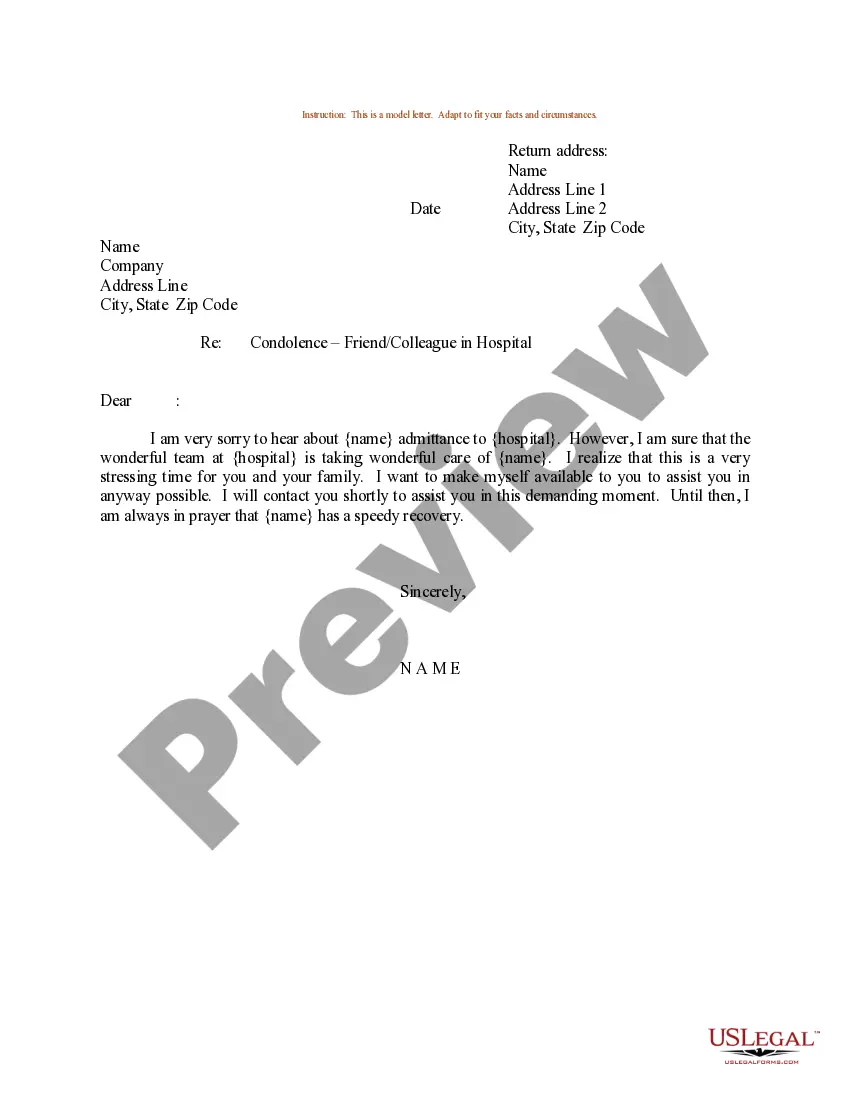

If available, use the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Virginia Joint Trust with Income Payable to Trustors During Joint Lives.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of a purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure that you have selected the correct document template for your state/region that you have chosen.

- Check the document description to confirm you have chosen the correct form.

Form popularity

FAQ

Joint trusts are also revocable living trusts, set up to hold all of the assets of a married couple and to provide access to the trust assets for both. Typically, at the first death, half of the assets receive a step-up in basis, but all of the assets stay in the trust.

The trustee will hold the legal title and the beneficiary will hold the equitable title. This division is what makes a trust legally valid. Without the division, the trust will no longer be legally effective.

TRUSTEE REQUIREMENTS If the settlor does not name a trustee, a court will appoint one. A trustee: 220e Must have active duties to perform. 220e Cannot be the sole trustee and the sole beneficiary.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

The short answer is yes, a beneficiary can also be a trustee of the same trustbut it may not always be wise, and certain guidelines must be followed. Is it a good idea for a beneficiary to be a trustee? There are good reasons for naming a trust beneficiary as trustee. For one, it is convenient.