Virginia Private Client General Asset Management Agreement

Description

How to fill out Private Client General Asset Management Agreement?

You can spend countless hours online searching for the proper document template that meets both state and federal requirements you will necessitate.

US Legal Forms provides a vast array of valid templates that are examined by professionals.

You can easily download or print the Virginia Private Client General Asset Management Agreement from your services.

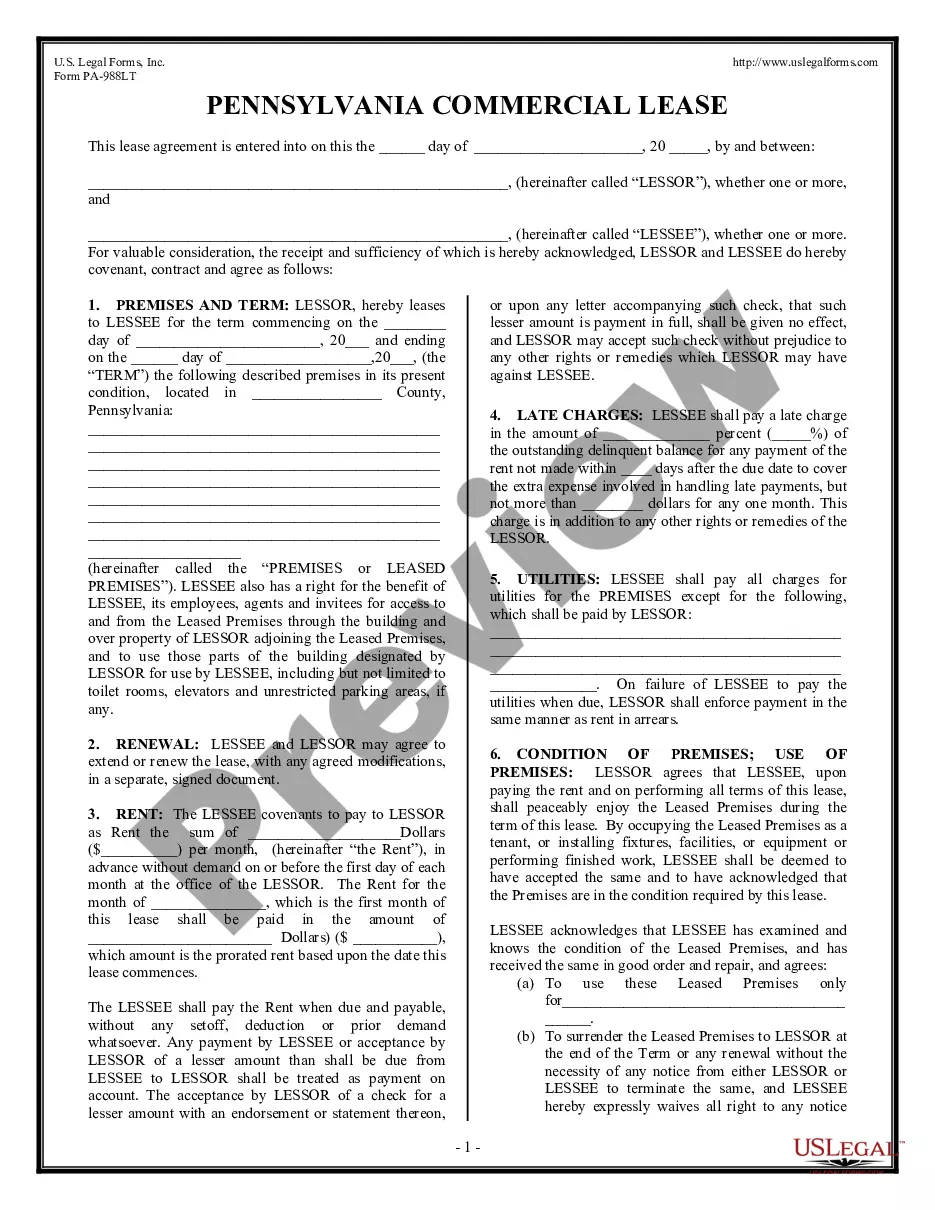

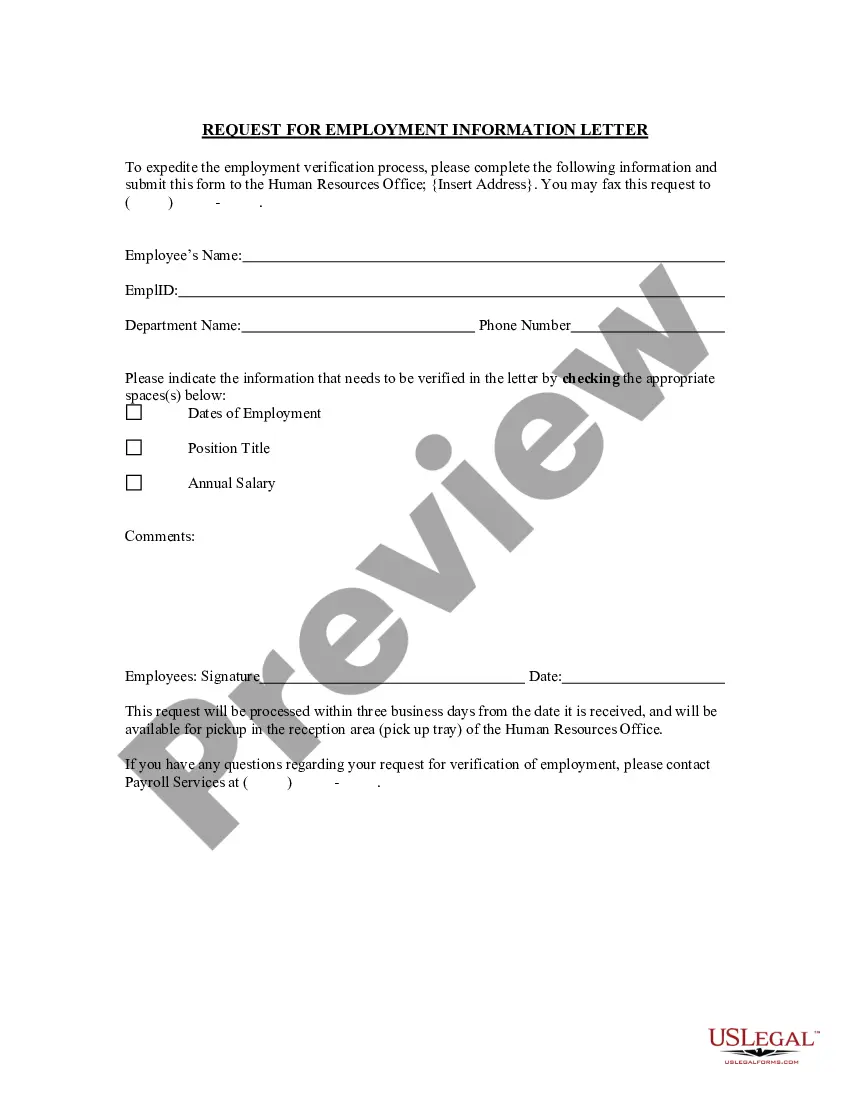

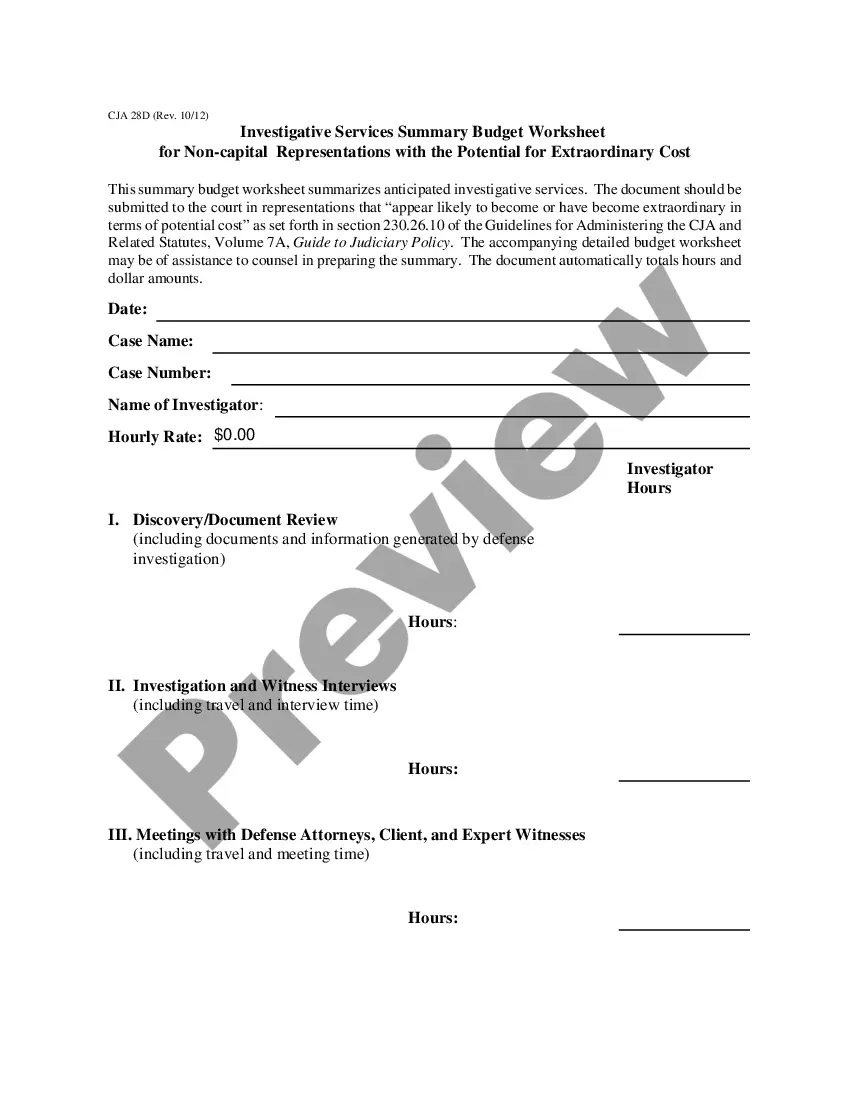

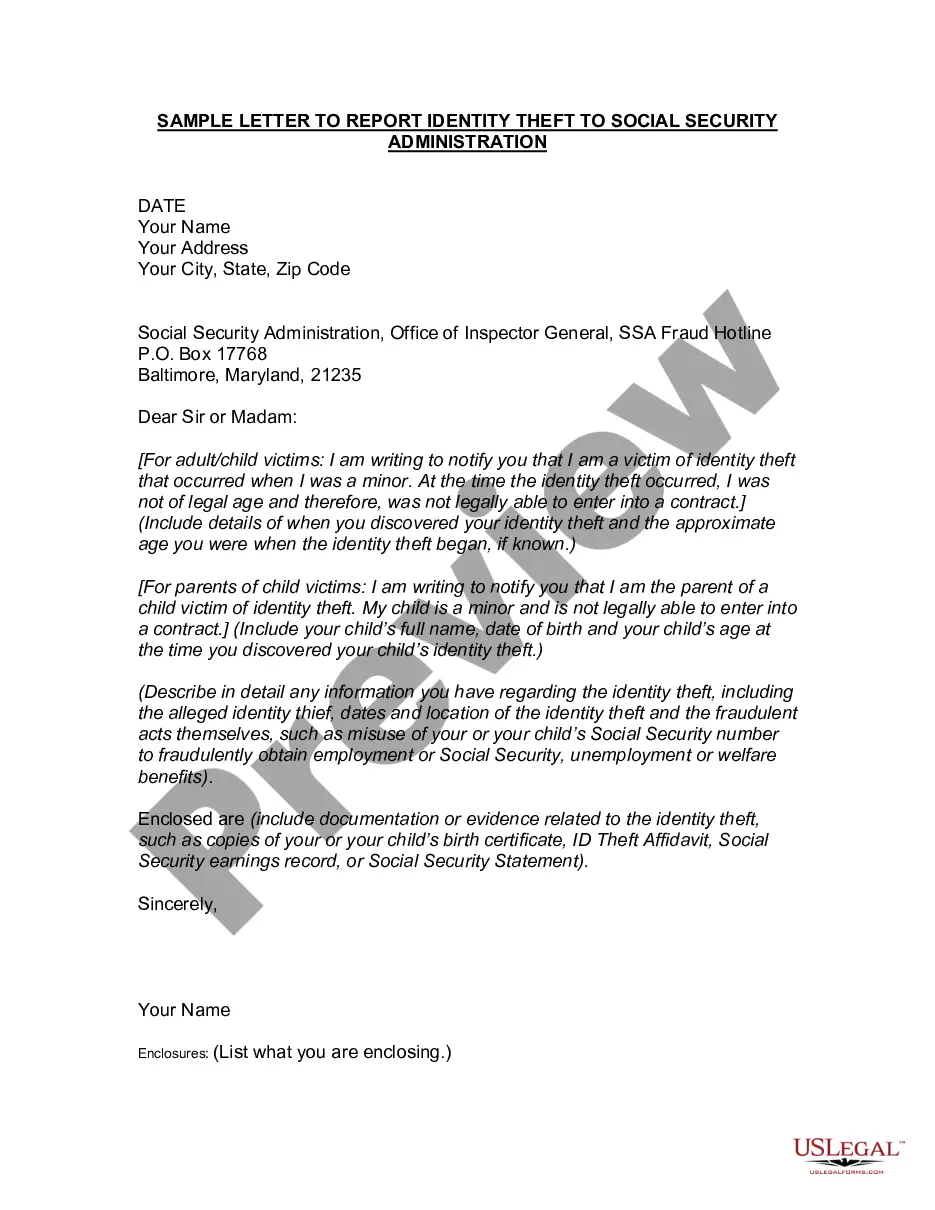

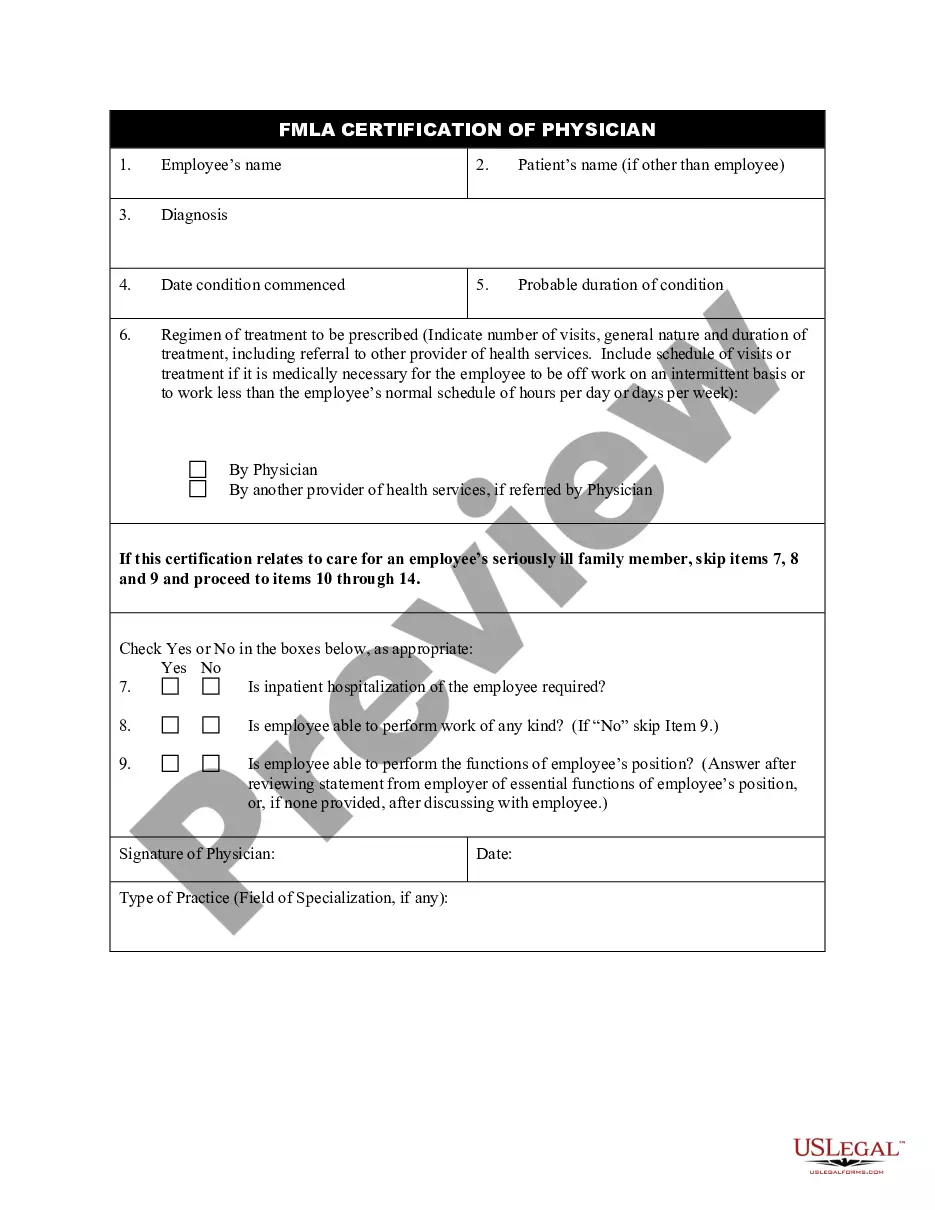

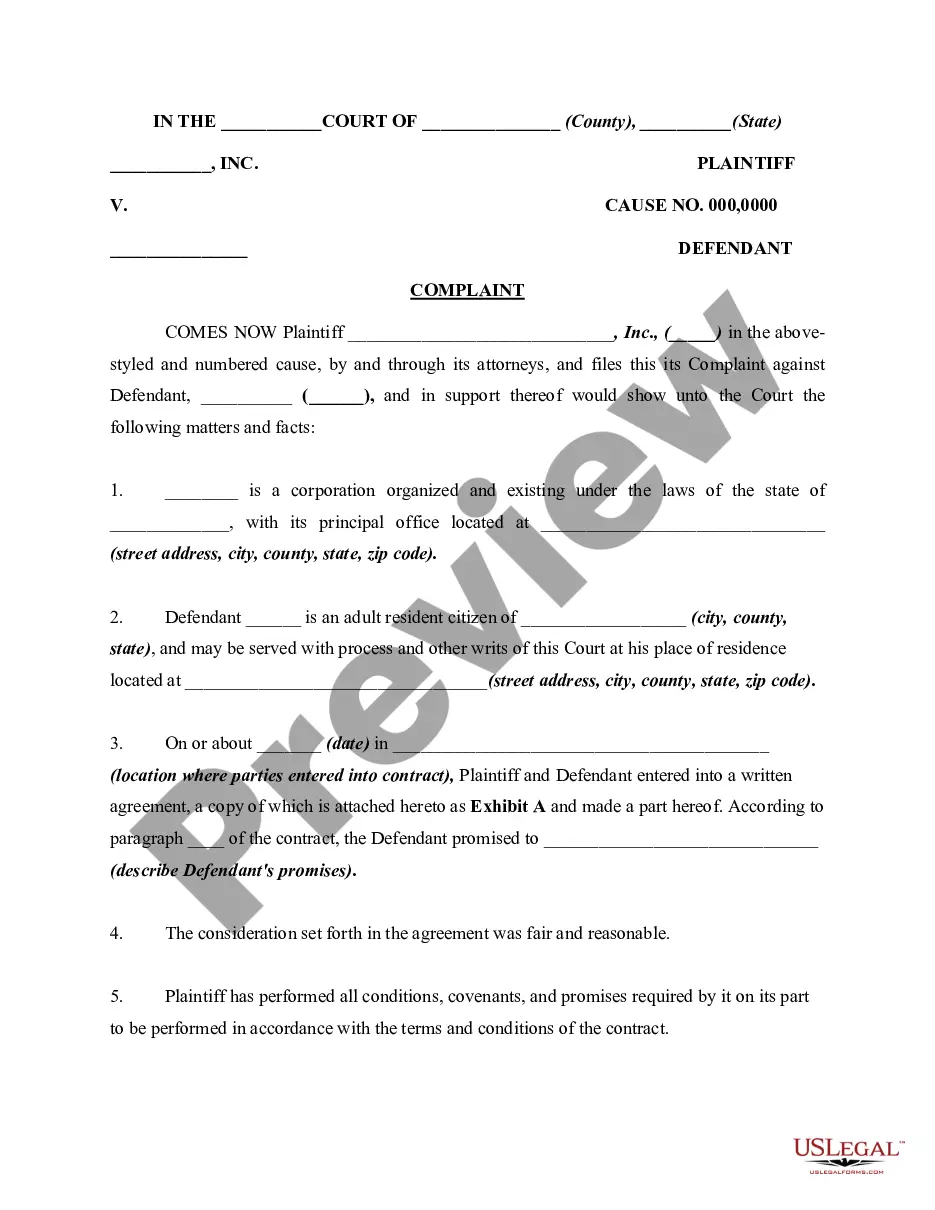

If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Virginia Private Client General Asset Management Agreement.

- Every legal document template you acquire belongs to you permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for your chosen state/region.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

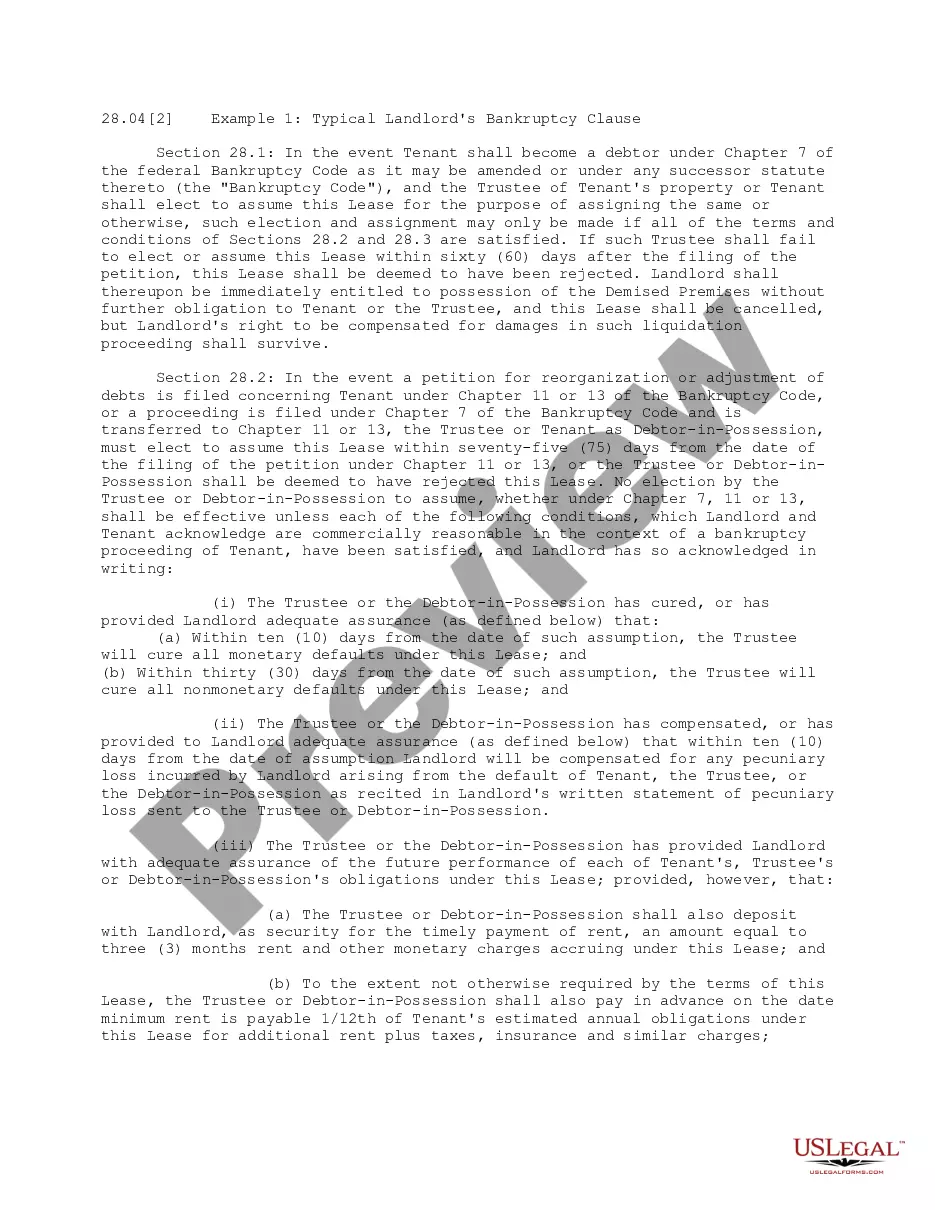

The purpose of an investment management agreement is to clarify the relationship between the client and the investment manager. It details the services to be provided, expectations, and how the client's assets will be managed over time. By using the Virginia Private Client General Asset Management Agreement, clients have a structured approach to asset management, designed to meet their unique financial goals and enhance overall investment performance.

Discretionary investment management service allows an investment manager to make decisions on behalf of the client regarding asset allocation and investment selection. This service is designed to align with the client’s investment goals, risk tolerance, and timelines. When you choose the Virginia Private Client General Asset Management Agreement, you can benefit from professional expertise while enjoying the peace of mind that comes from delegated investment decisions.

An Investment Management Agreement (IMA) agreement is essentially the same as the IMA document; it is the foundational contract between a client and their investment manager. This agreement lays out the client’s investment objectives, how the manager will strategize investments, and what fees will be incurred. Utilizing the Virginia Private Client General Asset Management Agreement gives you confidence that your assets are managed according to your wishes.

A Separately Managed Account (SMA) is a personalized investment account that allows for individual asset management, while an Investment Management Agreement (IMA) governs the overall management services provided. The IMA sets the framework within which the SMA operates, detailing how assets are managed and aligned with your financial goals. Engaging with the Virginia Private Client General Asset Management Agreement ensures a clear understanding of these distinctions.

The Investment Management Agreement (IMA) contract is a formal document establishing the relationship between a client and an investment manager. It outlines the terms of investment management services, including fees, duties, and responsibilities. When you use the Virginia Private Client General Asset Management Agreement, it clarifies how your assets will be managed according to your specific needs and preferences.

Property management agreements require several essentials to ensure effective management of assets. These include clear definitions of duties, management fees, and terms regarding tenant acquisition and property maintenance. In forming a Virginia Private Client General Asset Management Agreement, it is vital to outline these components to avoid conflicts and ensure a smooth operation. Understanding these requirements can help you streamline your property management effectively.

The Investment Management Agreement (IMA) is a critical document in the realm of asset management. It outlines the terms and conditions between the client and the asset manager, including the scope of services, fees, and responsibilities. A well-structured IMA is essential for ensuring clarity and alignment in managing investments, particularly in a Virginia Private Client General Asset Management Agreement. This agreement fosters a strong partnership between clients and managers, maximizing benefits.

The purpose of a management agreement is to establish clear guidelines for the management of your assets. This agreement protects both the client and the asset manager, ensuring that expectations are met and responsibilities are understood. By securing a Virginia Private Client General Asset Management Agreement, you can focus on your investment goals while professionals manage your portfolio effectively.

You can file Virginia Form 502 with the Virginia Department of Taxation. It is important to submit this form accurately and on time to avoid any penalties. If you need assistance, the uslegalforms platform offers resources that can guide you through the filing process, ensuring compliance with your Virginia Private Client General Asset Management Agreement.

An asset management agreement specifically details the terms under which an asset manager operates on behalf of a client. This agreement typically covers investment strategies, fees, and reporting obligations. Through a Virginia Private Client General Asset Management Agreement, you can have confidence that your assets are being managed with transparency and accountability.