Virginia Charity Subscription Agreement

Instant download

Description

A subscription agreement is a legal obligation to make a payment in money or its equivalent in furtherance of a charitable, business or other undertaking, A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization that is exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. For example, 501(c)(3) tax-exemptions apply to entities that are organized and operated exclusively for religious, charitable, scientific, literary, or educational purposes.

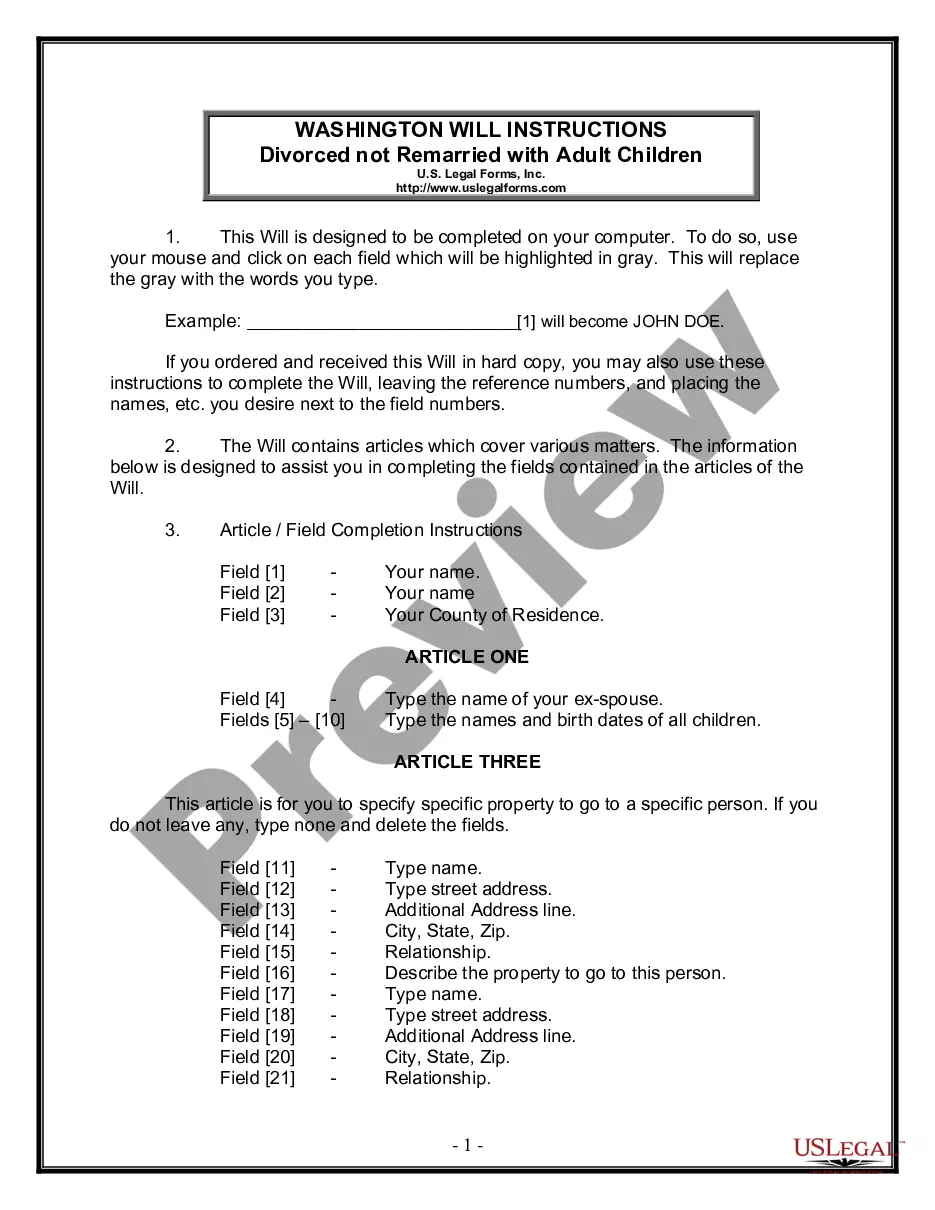

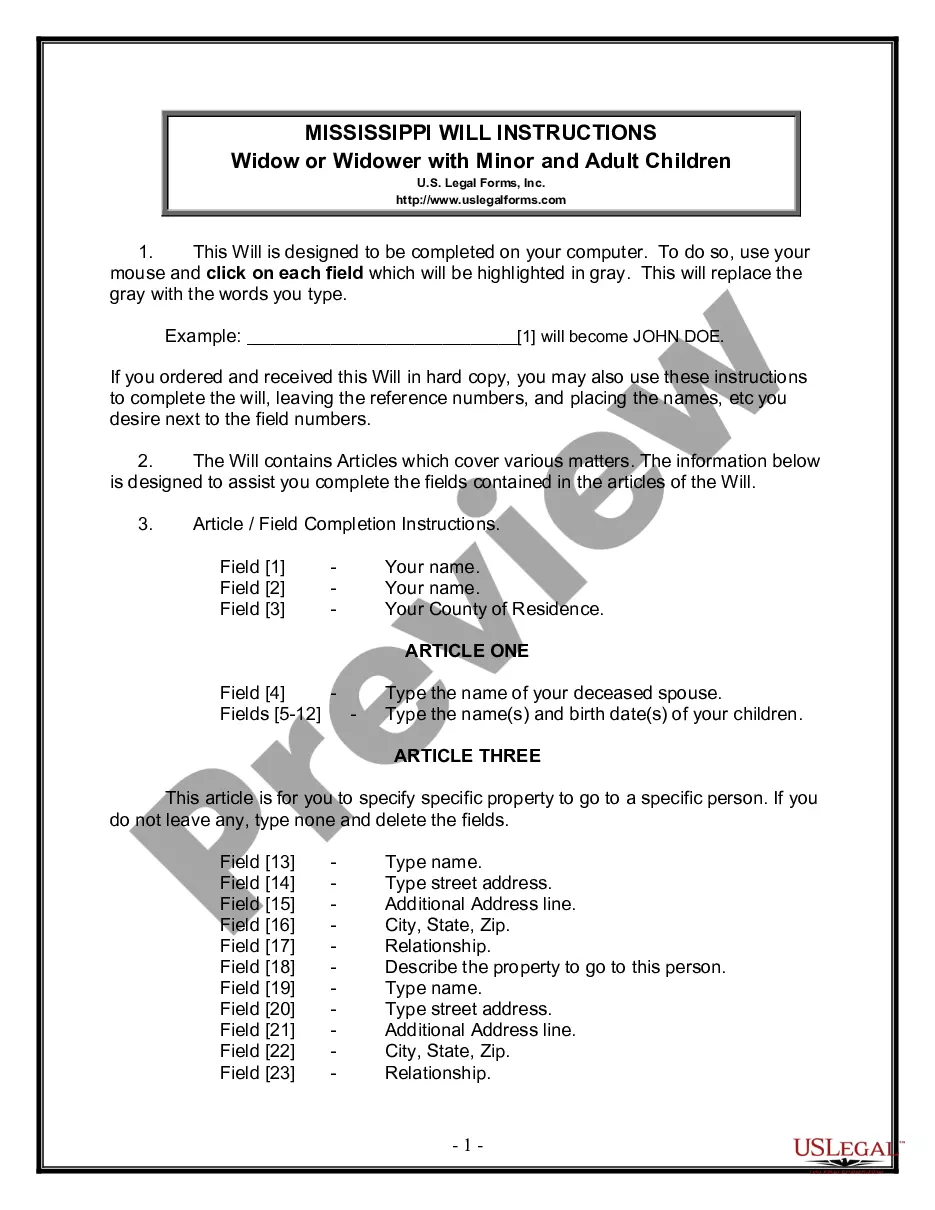

How to fill out Charity Subscription Agreement?

Finding the appropriate official document template can be challenging.

Indeed, there are numerous templates available online, but how do you identify the correct format you require.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Virginia Charity Subscription Agreement, suitable for both commercial and personal needs.

If the form does not meet your needs, utilize the Search field to locate the correct form.

- All documents are reviewed by professionals and comply with federal and state guidelines.

- If you are already registered, Log Into your account and then click the Download button to retrieve the Virginia Charity Subscription Agreement.

- Use your account to access the legal forms you have previously obtained.

- Navigate to the My documents section of your account to get an additional copy of the document you need.

- For new users of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your region/state. You can preview the document using the Review button and read the document description to confirm it is suitable for you.