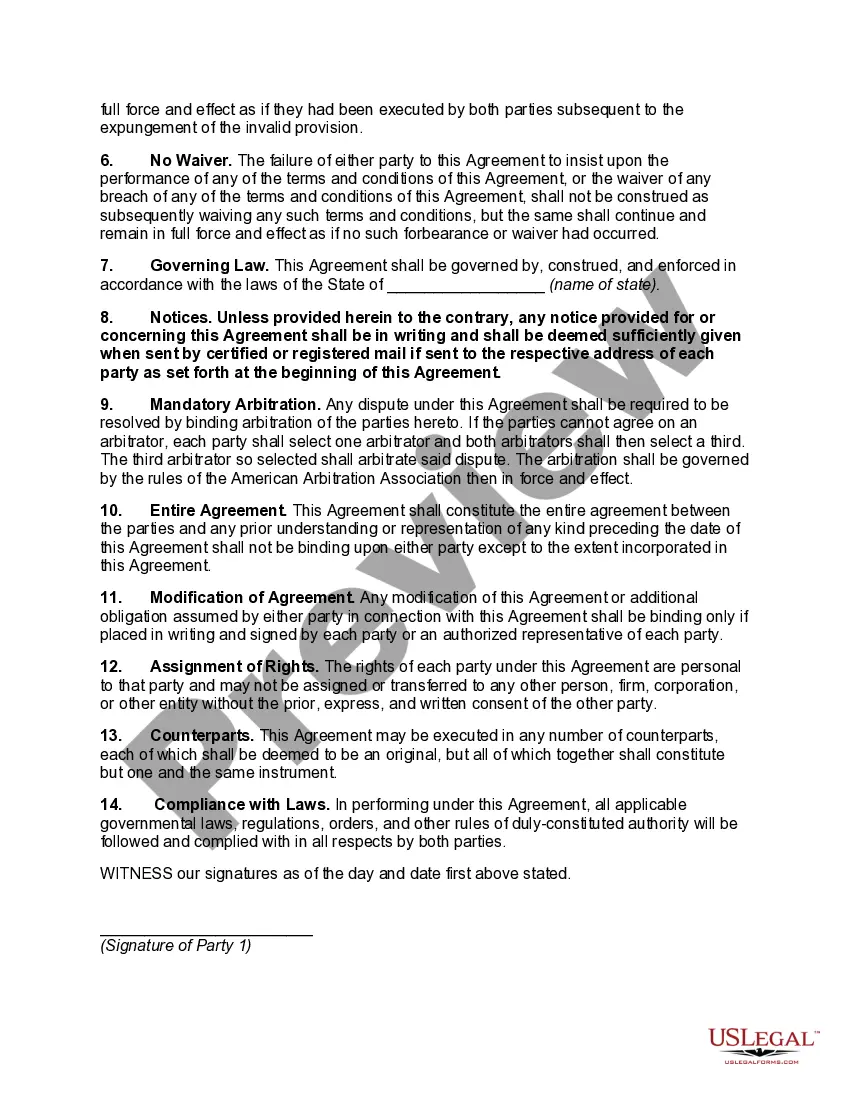

The Virginia Agreement to Establish Committee to Wind Up Partnership is a legal document that outlines the procedures and responsibilities for winding up a partnership in the state of Virginia. This agreement is typically used when partners decide to dissolve their partnership and need to formalize the process of distributing assets, settling liabilities, and concluding any remaining business affairs. The agreement begins with a statement identifying the partnership and its legal status. It includes the names and addresses of all partners involved in the dissolution, as well as the effective date of the agreement. This ensures clarity and transparency throughout the winding up process. The agreement then establishes the formation of a committee responsible for managing the partnership's wind-up. The committee is typically composed of one or more partners, who are tasked with overseeing the distribution of assets, payment of debts, and other necessary actions to close the partnership. In addition to establishing the committee, the agreement outlines the powers and duties of committee members. It specifies that members should act in the best interest of the partnership and in accordance with relevant Virginia partnership laws. The agreement may also include provisions regarding the appointment of a committee chair or leader to facilitate decision-making. Another important aspect of the agreement is the distribution of partnership assets. It provides guidance on how the assets should be valued, sold, or transferred between partners. Additionally, it may outline the process for settling outstanding debts, including payment to creditors and resolution of any outstanding legal disputes. Different types of Virginia Agreement to Establish Committee to Wind Up Partnership may include variations based on specific circumstances or requirements. For instance, there may be agreements that are tailored to partnerships with complex financial structures, multiple locations, or specific industry-related regulations. However, these variations would still generally serve the purpose of efficiently concluding the partnership's affairs. In summary, the Virginia Agreement to Establish Committee to Wind Up Partnership is a crucial legal document that sets forth the guidelines for dissolving and winding up a partnership in Virginia. It ensures a systematic and organized approach to distributing assets, settling debts, and closing the partnership's operations, while following the relevant laws and regulations in the state.

Virginia Agreement to Establish Committee to Wind Up Partnership

Description

How to fill out Virginia Agreement To Establish Committee To Wind Up Partnership?

Are you currently in a placement the place you will need paperwork for sometimes enterprise or person reasons nearly every working day? There are a variety of legal file templates available on the Internet, but getting ones you can rely on isn`t straightforward. US Legal Forms offers 1000s of kind templates, just like the Virginia Agreement to Establish Committee to Wind Up Partnership, which are written to fulfill state and federal specifications.

Should you be presently informed about US Legal Forms website and have an account, just log in. Following that, you are able to acquire the Virginia Agreement to Establish Committee to Wind Up Partnership format.

If you do not come with an accounts and need to start using US Legal Forms, follow these steps:

- Get the kind you require and ensure it is for your proper town/state.

- Utilize the Preview switch to check the form.

- Read the explanation to ensure that you have chosen the right kind.

- When the kind isn`t what you`re searching for, utilize the Look for discipline to find the kind that fits your needs and specifications.

- Whenever you find the proper kind, simply click Acquire now.

- Choose the rates plan you desire, complete the desired details to generate your account, and pay money for an order utilizing your PayPal or bank card.

- Pick a hassle-free file structure and acquire your version.

Discover every one of the file templates you have bought in the My Forms food list. You can obtain a more version of Virginia Agreement to Establish Committee to Wind Up Partnership whenever, if required. Just click on the required kind to acquire or printing the file format.

Use US Legal Forms, one of the most substantial variety of legal forms, to conserve efforts and steer clear of faults. The services offers expertly produced legal file templates which you can use for an array of reasons. Produce an account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

Under a general partnership, if there is no partnership agreement a partner cannot retire or leave the partnership; the partnership has to be dissolved. One partner can dissolve the partnership simply by giving notice to the other partners.

Here are five steps you'll want to take. Review your partnership agreement. ... Approach your partner to discuss the current business situation. ... Prepare dissolution papers. ... Close all joint accounts and resolve the finances. ... Communicate the change to clients.

There are different ways to dissolve a business partnership: the partnership term as stated in the formal partnership agreement expires. one partner gives written notice to the other partners to exit the partnership. one or more partners can no longer legally own a business.

The process of dissolving your partnership Discuss terms and issues. ... Draft a dissolution agreement. ... Double-check the terms. ... Check your state's business laws. ... File a statement of dissolution with your state. ... Notify all of your customers, clients and suppliers directly. ... Divide remaining assets.

5 steps to dissolve a partnership. Dissolving a partnership includes reviewing your agreement, discussing the situation with your partner, preparing dissolution papers, closing accounts, and then communicating the change to relevant parties.

Review Your Partnership Agreement. ... Take a Vote or Action to Dissolve. ... Pay Debts and Distribute Assets (Wind Up) ... File a Form With the State. ... Notify Creditors, Customers, Clients, and Suppliers. ... Final Tax Issues. ... Out-of-State Registrations.

§ 50-73.88. Except as otherwise provided in subsection B, the association of two or more persons to carry on as co-owners a business for profit forms a partnership, whether or not the persons intend to form a partnership.

Winding up a partnership business involves: Collecting any remaining business assets; Settling any remaining debts that are owed to non-partner creditors; and. Distributing the remaining assets to the remaining partners.