Virginia Sales Consulting Agreement with Independent Contractor

Description

How to fill out Sales Consulting Agreement With Independent Contractor?

Selecting the appropriate legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The platform offers a wide array of templates, including the Virginia Sales Consulting Agreement with Independent Contractor, suitable for both business and personal needs.

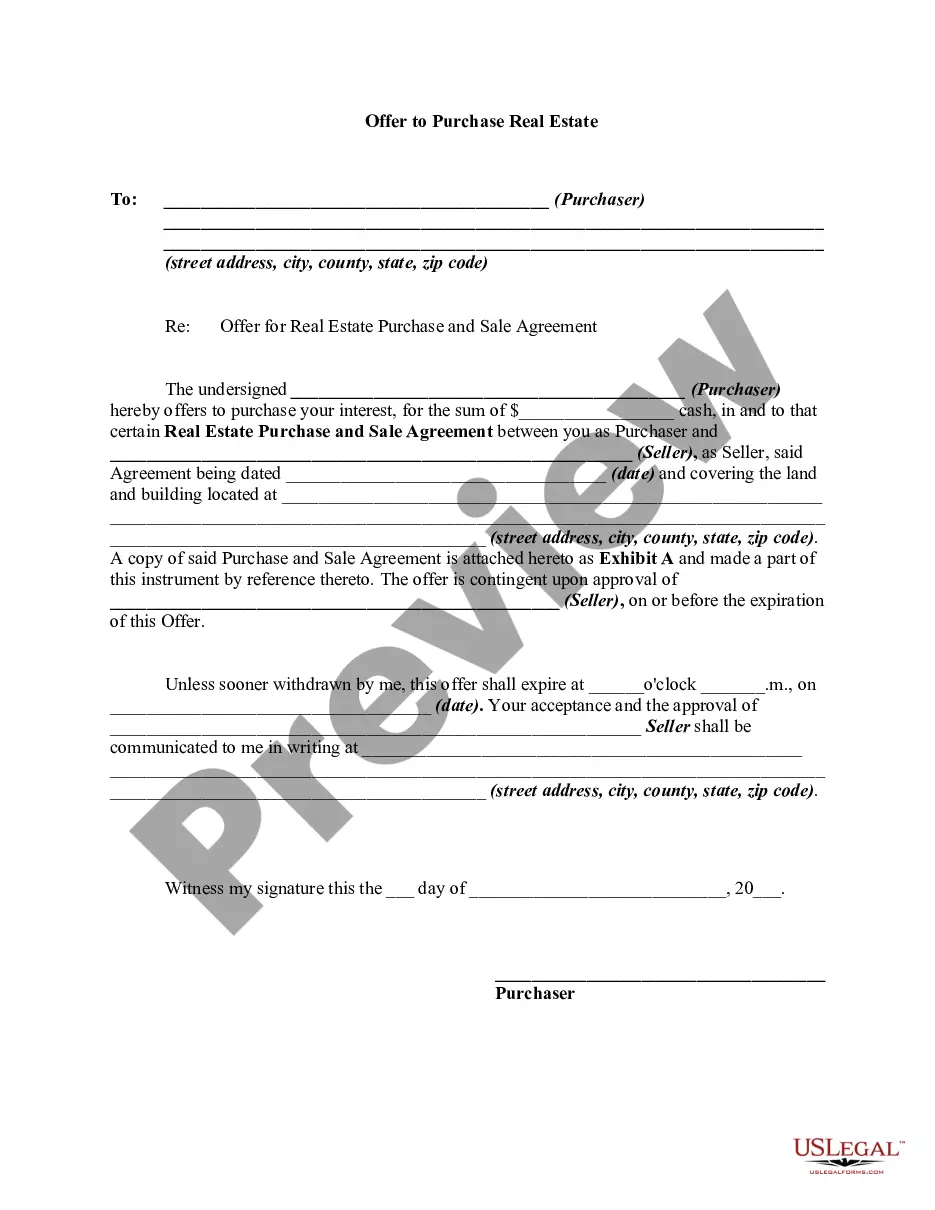

First, make sure you have selected the correct form for your city/county. You can review the form using the Preview button and read the form details to ensure it is suitable for you.

- All of the documents are reviewed by professionals and meet state and federal standards.

- If you are already registered, Log In to your account and click the Download button to access the Virginia Sales Consulting Agreement with Independent Contractor.

- Use your account to browse the legal forms you have previously purchased.

- Navigate to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple instructions.

Form popularity

FAQ

In Virginia, many business owners provide goods or services, which may require a business license. If you plan to enter into a Virginia Sales Consulting Agreement with an Independent Contractor, understanding licensing requirements is crucial. Typically, businesses generating revenue in Virginia must obtain a license to comply with state regulations. Without proper licensing, you could face penalties or restrictions on your business operations.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Pay self-employment taxAs an independent consultant you are considered self-employed, so if you earn more than $400 for the year, the IRS expects you to pay your own tax. The self-employment tax rate is 15.3% of your net earnings.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

The contractor isn't an employee of the company but works independently. The contractor provides services to the client under an Independent Contractor Agreement.