Title: Understanding Virginia Challenge crediting Reports: Experian, TransUnion, and Equifax Introduction: In Virginia, consumers have the right to challenge the accuracy, completeness, or inclusion of erroneous information in their credit reports held by major credit reporting agencies like Experian, TransUnion, and Equifax. This article provides a detailed description of Virginia's challenge process and highlights key aspects related to these credit bureaus. 1. Virginia Challenge crediting Report: An Overview — When individuals in Virginia discover errors or inaccuracies in their credit reports, they can initiate a challenge to rectify the information. — The process involves filing a dispute directly with the credit reporting agencies, such as Experian, TransUnion, and Equifax. 2. Common Types of Challenges — Virginia residents can challenge various types of discrepancies in their credit reports, including: a. Incorrect Personal Information: Address, name, Social Security number, etc. b. Potential Fraudulent Activities: Accounts that the consumer did not open or suspicious transactions. c. Inaccurate Account Details: Incorrect balances, late payments, collections, etc. d. Outdated Information: Accounts or negative records that exceed the reporting time limit. 3. Initiating a Credit Report Challenge in Virginia — Individuals must send a written dispute to the credit reporting agencies with the following information: a. Complete identification details: Full name, address, contact information, and SSN. b. Explanation of the error(s) identified: Clearly state what information is incorrect and provide supporting evidence. c. Supporting documents: Enclose copies of relevant documents such as bank statements, payment receipts, or court documents. d. Request for correction or removal: Specify the desired action for each disputed item. 4. Credit Reporting Agencies' Responsibilities — Once a dispute is received, the credit reporting agencies are obliged to: a. Conduct an investigation: Within 30 days, the agencies must investigate the disputed items and verify the accuracy using available records. b. Communicate with data furnishes: The agencies will contact the creditors or entities that furnished the information to gather necessary details and evidence. c. Rectify errors or remove inaccuracies: If the information is found to be incorrect, incomplete, or unverifiable, the credit reporting agencies must update or delete the disputed items from the credit report. 5. Virginia Credit Report Challenge Rights — Virginia residents have additional rights when it comes to challenging their credit reports, such as: a. Free annual credit report: Individuals are entitled to request one free credit report from each bureau per year. b. Notifications of changes and updates: Credit bureaus must inform consumers about any changes made to their reports within 30 days. Conclusion: Understanding the Virginia challenge crediting reports is crucial for individuals seeking to correct errors or inaccuracies in their Experian, TransUnion, and/or Equifax reports. By knowing the process and their rights, consumers can take proactive steps to ensure their credit reports accurately reflect their financial history.

Virginia Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

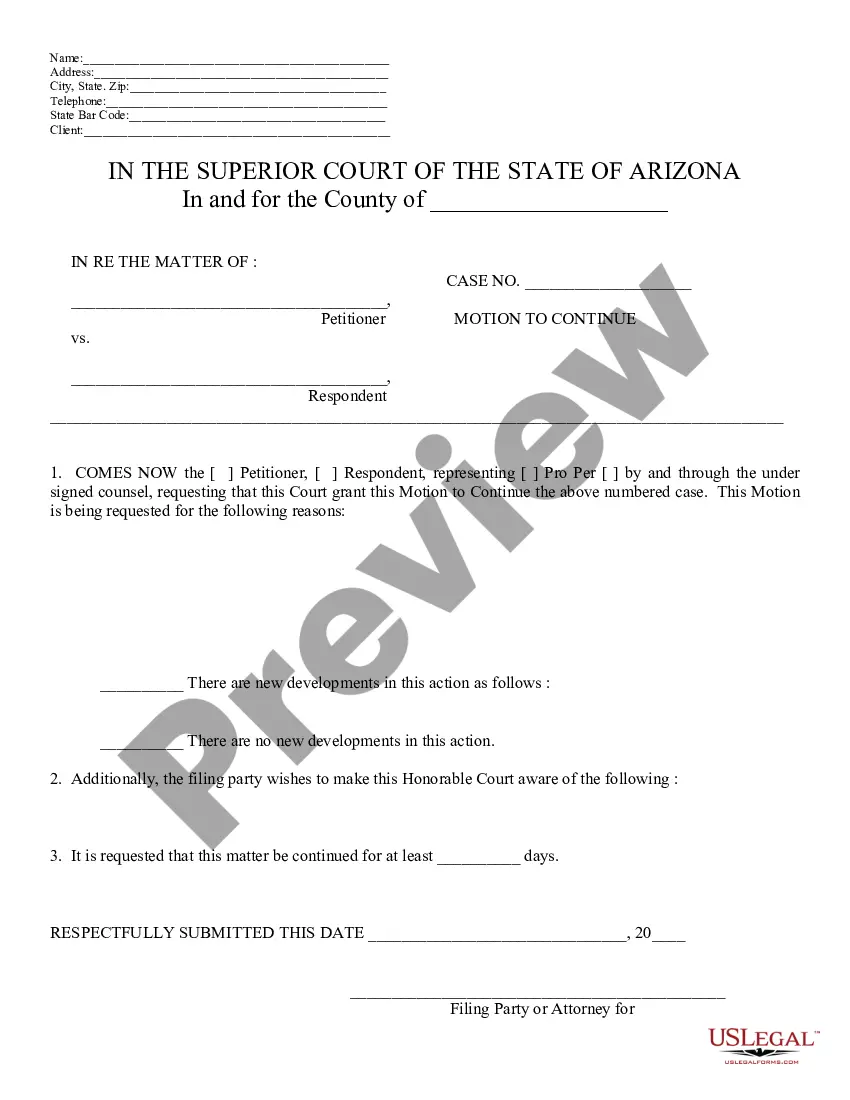

How to fill out Virginia Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Finding the right lawful papers web template might be a have difficulties. Needless to say, there are a variety of layouts available on the Internet, but how can you discover the lawful type you will need? Use the US Legal Forms site. The service offers thousands of layouts, such as the Virginia Challenge to Credit Report of Experian, TransUnion, and/or Equifax, that can be used for enterprise and private requirements. All of the types are examined by professionals and fulfill federal and state demands.

Should you be presently signed up, log in in your accounts and click the Download button to get the Virginia Challenge to Credit Report of Experian, TransUnion, and/or Equifax. Utilize your accounts to check with the lawful types you have bought previously. Proceed to the My Forms tab of your respective accounts and obtain one more backup of your papers you will need.

Should you be a fresh customer of US Legal Forms, allow me to share easy instructions that you should adhere to:

- Initial, be sure you have selected the right type for your personal metropolis/region. You may look through the form while using Preview button and look at the form information to make sure it will be the best for you.

- When the type does not fulfill your needs, use the Seach industry to discover the proper type.

- Once you are certain the form is proper, select the Purchase now button to get the type.

- Opt for the costs prepare you want and enter the required info. Make your accounts and pay money for the order with your PayPal accounts or bank card.

- Choose the data file structure and download the lawful papers web template in your device.

- Comprehensive, revise and printing and signal the received Virginia Challenge to Credit Report of Experian, TransUnion, and/or Equifax.

US Legal Forms may be the largest catalogue of lawful types that you can discover numerous papers layouts. Use the company to download skillfully-created files that adhere to state demands.

Form popularity

FAQ

A freeze can give you a false sense of security ? you may still be susceptible to credit fraud or other fraud involving your Social Security number.

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.

To freeze your credit, you have to contact each of the three credit bureaus individually. Placing a credit freeze is free for you and your children, as is lifting it when applying for new credit.

To dispute information in your Experian credit report, you can easily submit a dispute online: Go to the Dispute Center to start a new dispute. Choose a reason for the disputes you're submitting. Review your request before hitting submit. Upload relevant documents that confirm the inaccuracy.

The Bottom Line You are entitled by law to freeze your credit reports anytime, for free. To do so, you must request a security freeze at each of the national credit bureaus individually. Freezing your credit limits criminals' ability to open loans and credit card accounts in your name.

Dispute mistakes with the credit bureaus. You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureau's dispute form (if they have one), copies of documents that support your dispute, and keep records of everything you send.

Freezing your credit is free, and you'll need to do it with all three credit bureaus to lock down each of your credit reports. And again, the freeze will stay in place until you lift it.

If you want to freeze your credit, you need to do it at each of the three major credit bureaus: Equifax (1-800-349-9960) TransUnion (1-888-909-8872) Experian (1-888-397-3742) .