Virginia Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

How to fill out Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

Have you been within a place that you require papers for possibly organization or individual functions virtually every day time? There are a variety of authorized document layouts accessible on the Internet, but finding kinds you can rely isn`t straightforward. US Legal Forms gives thousands of form layouts, such as the Virginia Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss, which are composed to fulfill federal and state requirements.

When you are presently knowledgeable about US Legal Forms website and get a free account, merely log in. After that, you may down load the Virginia Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss template.

If you do not provide an account and want to begin to use US Legal Forms, follow these steps:

- Discover the form you require and make sure it is for your appropriate city/county.

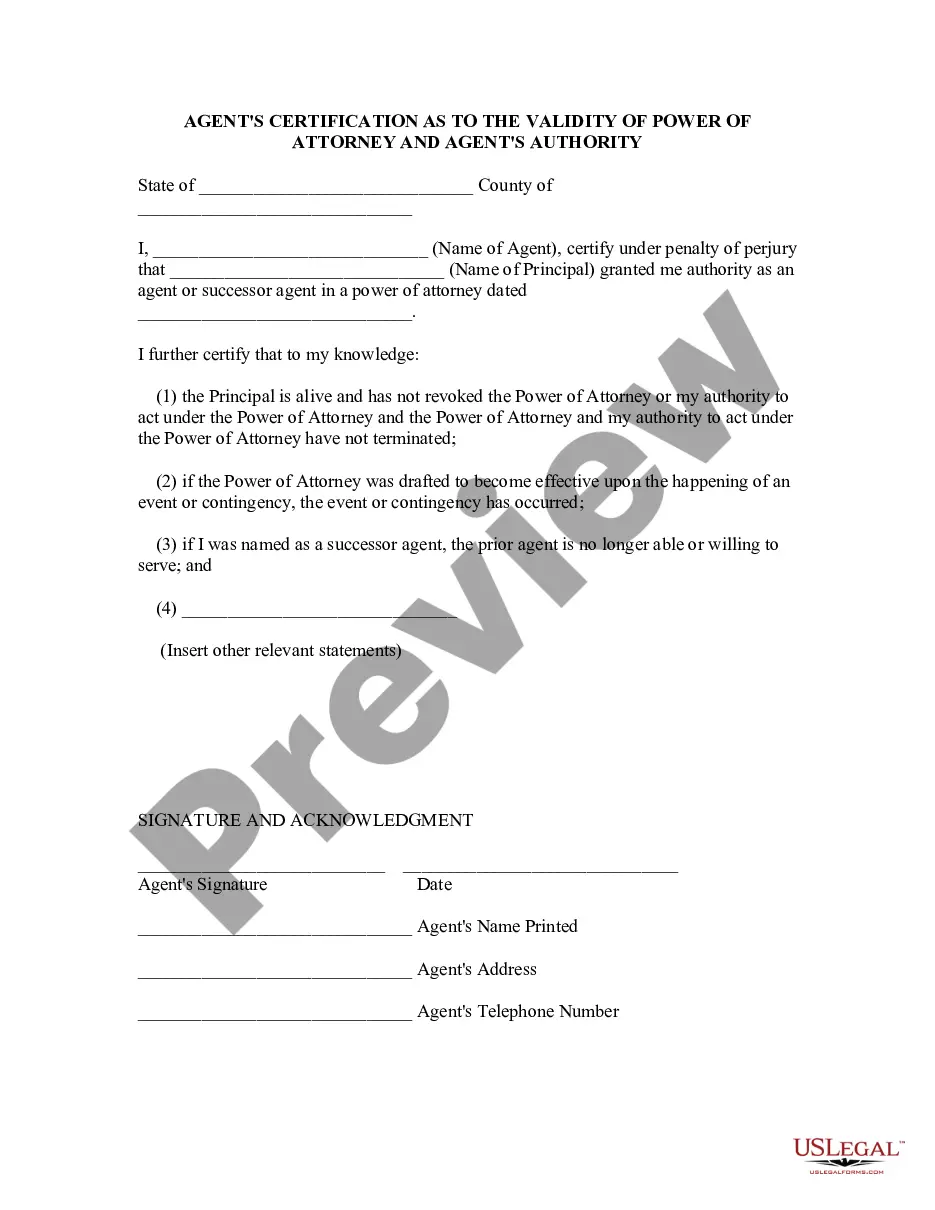

- Take advantage of the Preview button to check the form.

- Browse the information to actually have chosen the appropriate form.

- If the form isn`t what you are trying to find, make use of the Research area to get the form that meets your requirements and requirements.

- If you discover the appropriate form, simply click Buy now.

- Choose the prices program you need, fill in the necessary information and facts to produce your account, and purchase your order using your PayPal or charge card.

- Select a hassle-free document format and down load your duplicate.

Locate all the document layouts you might have purchased in the My Forms menus. You can get a more duplicate of Virginia Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss any time, if needed. Just click the necessary form to down load or produce the document template.

Use US Legal Forms, probably the most comprehensive selection of authorized types, in order to save time as well as avoid faults. The support gives skillfully created authorized document layouts that can be used for a variety of functions. Generate a free account on US Legal Forms and commence generating your way of life a little easier.