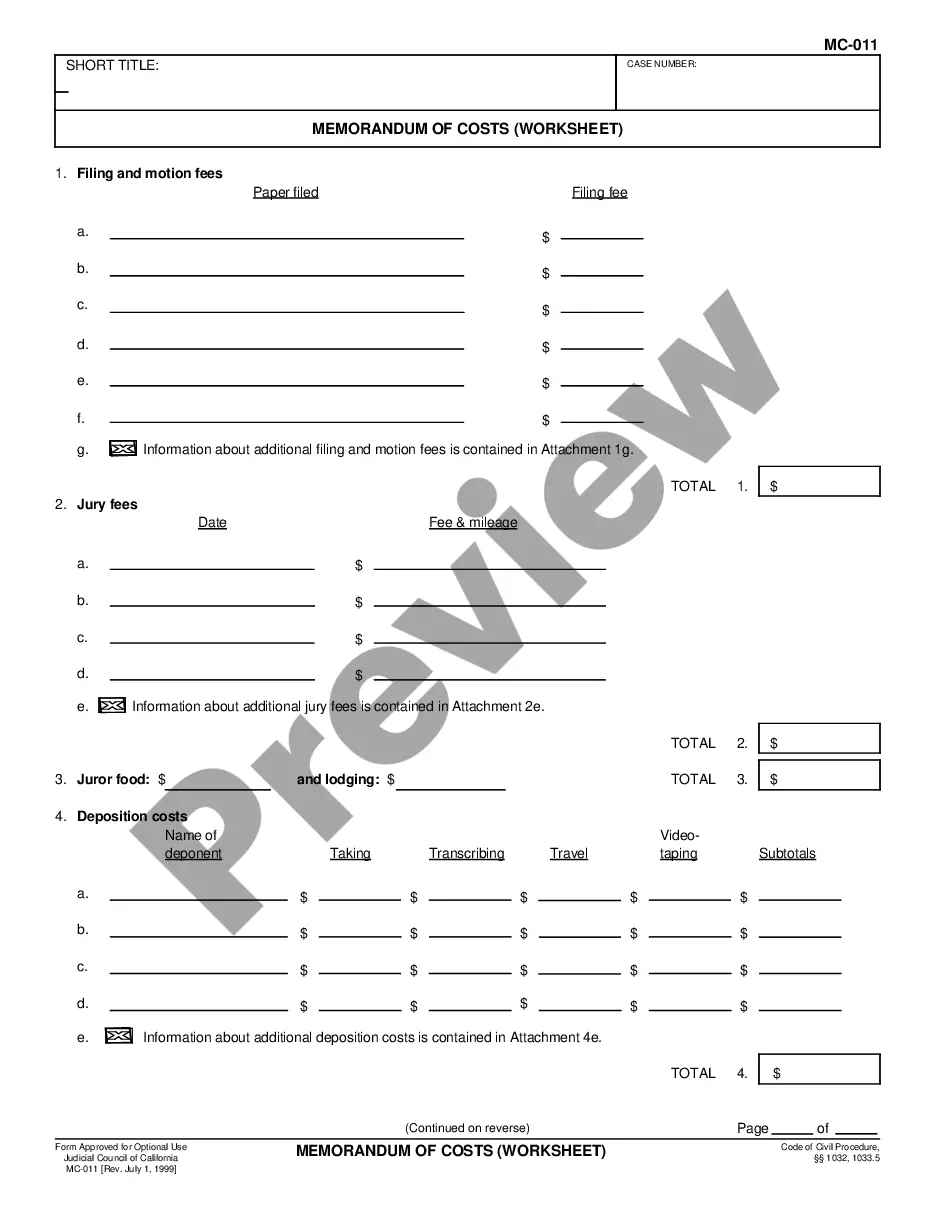

Virginia Cash Disbursements and Receipts refer to the financial transactions involving the inflow and outflow of funds within the state of Virginia. These transactions could occur in a variety of contexts such as governmental organizations, businesses, non-profit organizations, and individuals. Understanding the nature of cash disbursements and receipts is crucial for maintaining accurate financial records, preparing budgets, and assessing the overall financial health of an entity. In the realm of government finances, Virginia Cash Disbursements and Receipts play a vital role in ensuring effective governance and public service delivery. Various types of cash disbursements are encountered in government operations, including payments to vendors for goods and services, salaries and wages to government employees, social benefits, grants, subsidies, and debt repayments. These disbursements are recorded as expenses for the government entity and entail the outflow of cash from its coffers. Conversely, cash receipts in the governmental context encompass revenue generated through taxes, fines, fees, licenses, permits, and intergovernmental transfers. Additionally, other sources of receipts may comprise proceeds from investments, loans, donations, and the sale of assets. Governmental entities track these receipts to ensure the availability of funds for supporting public programs, infrastructure development, and citizen services. In the business sphere, similar principles apply to cash disbursements and receipts. Cash disbursements mainly encompass payments made by companies to suppliers, employees, and creditors. Other disbursements may include expenses related to overhead costs, utilities, rent, material purchases, insurance premiums, and loan repayments. These transactions represent the outflow of funds from a company's accounts. On the other hand, cash receipts for businesses consist of revenue generated from sales of products or services. Additionally, funds can be received through investments, loans, interest income, and other business activities. Tracking and managing cash receipts are essential for businesses in order to assess their profitability, liquidity, and financial stability. In Virginia, specific types of cash disbursements and receipts may vary depending on the sector or industry. For example, in the public sector, there may be disbursements and receipts specific to education, healthcare, transportation, or public safety. Similarly, businesses operating in sectors like manufacturing, retail, or technology will have unique cash disbursements and receipts related to their respective activities. To ensure accurate financial reporting and transparency, governmental organizations and businesses in Virginia should maintain meticulous records of cash disbursements and receipts. These records, supported by relevant documentation, play a crucial role during audits, financial analysis, and budgeting processes. Modern accounting software and systems are often utilized to streamline these processes and minimize the risk of errors or fraudulent activities. In conclusion, Virginia Cash Disbursements and Receipts encompass the various financial transactions involving the inflow and outflow of funds within the state. Understanding these transactions and accurately recording them is vital for maintaining financial health, transparency, and effective governance in both governmental and business settings. By closely managing cash disbursements and receipts, entities in Virginia can ensure financial stability, meet their obligations, and sustain their operations.

Virginia Cash Disbursements and Receipts

Description

How to fill out Cash Disbursements And Receipts?

If you have to total, download, or print out legal record web templates, use US Legal Forms, the biggest selection of legal varieties, which can be found on the web. Take advantage of the site`s simple and easy practical search to discover the documents you will need. Various web templates for company and specific purposes are sorted by types and says, or keywords and phrases. Use US Legal Forms to discover the Virginia Cash Disbursements and Receipts with a handful of click throughs.

If you are previously a US Legal Forms consumer, log in in your account and click on the Acquire key to get the Virginia Cash Disbursements and Receipts. You can even accessibility varieties you formerly acquired in the My Forms tab of the account.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for that appropriate town/region.

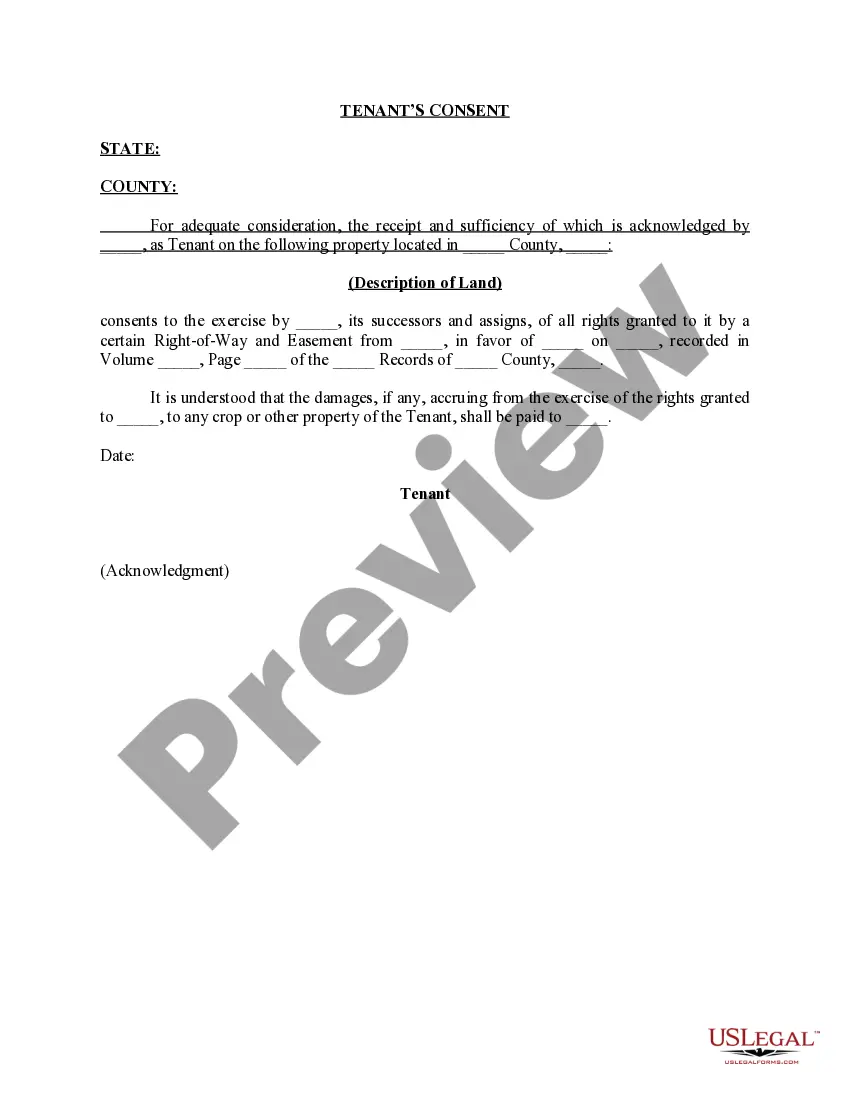

- Step 2. Take advantage of the Preview solution to look over the form`s articles. Never neglect to read through the explanation.

- Step 3. If you are unhappy using the type, take advantage of the Research discipline towards the top of the display screen to find other types from the legal type design.

- Step 4. Upon having located the shape you will need, click the Acquire now key. Pick the rates prepare you like and include your references to register on an account.

- Step 5. Approach the purchase. You may use your bank card or PayPal account to finish the purchase.

- Step 6. Choose the structure from the legal type and download it in your gadget.

- Step 7. Full, modify and print out or signal the Virginia Cash Disbursements and Receipts.

Every single legal record design you acquire is your own for a long time. You might have acces to each type you acquired within your acccount. Go through the My Forms segment and pick a type to print out or download once again.

Contend and download, and print out the Virginia Cash Disbursements and Receipts with US Legal Forms. There are thousands of expert and status-certain varieties you can use to your company or specific requires.