A Virginia Software Product Sales Agreement is a legally binding contract between a software vendor and a customer in the state of Virginia. It outlines the terms and conditions under which the vendor agrees to sell and the customer agrees to purchase software products. This agreement serves as a crucial document that governs the sale and licensing of software products in Virginia. It provides clarity on the rights, responsibilities, and obligations of both parties involved. It helps avoid any misunderstandings or disputes during the sale and use of software products by clearly defining the terms of the transaction. The Virginia Software Product Sales Agreement typically includes the following key elements: 1. Parties involved: It identifies the software vendor (usually referred to as the "Licensor") and the customer (referred to as the "Licensee"). 2. Product description: It provides detailed information about the software product being sold, such as its name, version, features, and specifications. 3. License grant: It states the type and scope of the license being granted to the customer. This can include a non-exclusive or exclusive license, perpetual or limited-term license, and any usage restrictions. 4. Use restrictions: It defines the limitations on the customer's use of the software product, such as prohibiting reverse engineering, making copies, or sharing with third parties. 5. Payment terms: It outlines the price, payment methods, and any applicable taxes or additional fees associated with the purchase of the software product. 6. Delivery: It specifies how the software product will be delivered to the customer, whether it's through digital download, physical media, or online access. 7. Support and maintenance: It outlines the vendor's commitment to providing technical support or software updates and whether these services are included in the purchase price or require additional fees. 8. Intellectual property rights: It clarifies the ownership and intellectual property rights of the software product, ensuring that the customer acknowledges and respects the vendor's ownership rights. 9. Warranty and liability: It addresses any warranties or disclaimers relating to the software product's performance, compatibility, or fitness for a particular purpose. It also outlines any limitations on the vendor's liability for damages or losses. 10. Termination: It specifies the conditions under which either party may terminate the agreement, such as breach of contract, non-payment, or non-compliance with the terms. Different types of software product sales agreements in Virginia can vary depending on factors such as the complexity of the software being sold, the licensing model (perpetual or subscription-based), and the specific needs or preferences of the parties involved. Some common variations may include enterprise license agreements, volume license agreements, software as a service (SaaS) agreements, or end-user license agreements (EULA).

Virginia Software Product Sales Agreement

Description

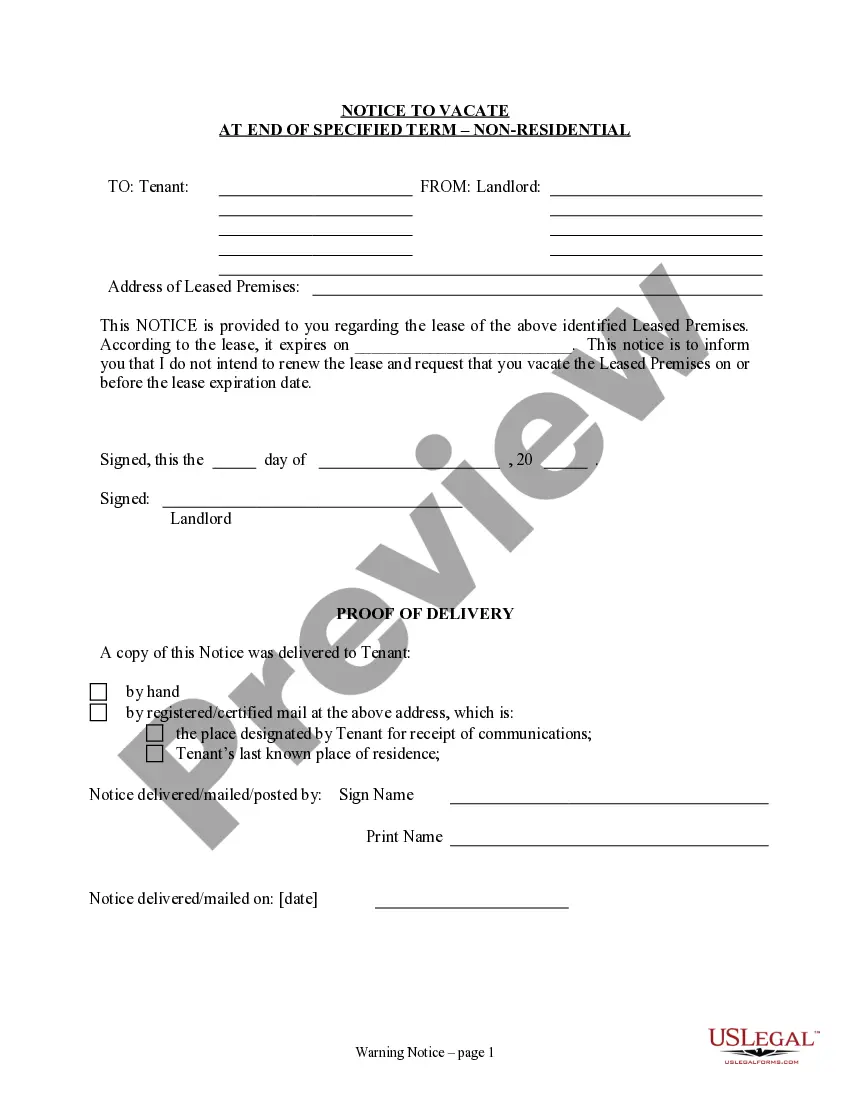

How to fill out Virginia Software Product Sales Agreement?

If you have to full, obtain, or printing lawful document web templates, use US Legal Forms, the biggest assortment of lawful kinds, that can be found online. Make use of the site`s easy and hassle-free research to discover the files you require. A variety of web templates for company and person functions are categorized by groups and states, or keywords and phrases. Use US Legal Forms to discover the Virginia Software Product Sales Agreement in just a few click throughs.

When you are currently a US Legal Forms buyer, log in for your bank account and then click the Download switch to find the Virginia Software Product Sales Agreement. You may also accessibility kinds you earlier saved in the My Forms tab of the bank account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape to the correct metropolis/nation.

- Step 2. Take advantage of the Preview solution to look over the form`s information. Never neglect to read the explanation.

- Step 3. When you are not happy using the type, make use of the Search field near the top of the screen to discover other versions of the lawful type template.

- Step 4. Once you have found the shape you require, click the Get now switch. Choose the rates prepare you prefer and include your qualifications to sign up for the bank account.

- Step 5. Approach the transaction. You can use your credit card or PayPal bank account to finish the transaction.

- Step 6. Choose the file format of the lawful type and obtain it on the system.

- Step 7. Total, modify and printing or indication the Virginia Software Product Sales Agreement.

Every single lawful document template you purchase is your own property forever. You might have acces to every type you saved in your acccount. Click on the My Forms segment and choose a type to printing or obtain yet again.

Contend and obtain, and printing the Virginia Software Product Sales Agreement with US Legal Forms. There are many skilled and condition-specific kinds you may use for the company or person needs.

Form popularity

FAQ

There is typically no transfer or provision of tangible personal provided to customers of cloud-computing services. Therefore, the Taxpayer incurs no taxable use in downloading from the Developer's servers in Virginia.

Sales of digital products are exempt from the sales tax in Virginia.

Charges for services generally are exempt from the retail sales and use tax. However, services provided in connection with sales of tangible personal property are taxable.

In other words, Software-as-a-Service as a cloud-computing program that is only accessed remotely without delivery of a tangible media and does not include the user taking possession of the program is not subject to sales or use tax.

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax. Several states have ping-ponged on their decisions, the most recent being Michigan, who ultimately decided to exempt it.

The Virginia Department of Revenue has maintained a long-standing policy, which is referenced in Virginia Public Document Ruling No. 05-44 , that sales of software delivered electronically do not constitute the sale of tangible personal property and are not subject to sales tax.

The Taxpayer is correct that the sale of software delivered electronically to customers does not constitute the sale of tangible personal property and is generally not subject to Virginia sales and use taxation.

In the state of Virginia, any maintenance contracts that provide only repair labor are considered to be exempt. Any contracts that provide both parts and labor are definitely subject to tax on one-half the total charge for the contract. Contracts which provide only parts are considered to be taxable.

The Taxpayer is correct that the sale of software delivered electronically to customers does not constitute the sale of tangible personal property and is generally not subject to Virginia sales and use taxation.