A Virginia Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a Two-Person Partnership with Each Partner Owning 50% of the Partnership is a legally binding document that outlines the procedures and terms for the transfer of ownership in the event of a partner's death. This type of agreement is crucial in ensuring a smooth transition of the deceased partner's share of the partnership to the surviving partner. The purpose of this agreement is to establish the value of the partnership and ensure a fair and predetermined price for the buyout. It safeguards the interests of both partners and the partnership itself, eliminating any potential conflicts or uncertainties that may arise from a partner's untimely death. Here are the key components of this type of agreement: 1. Fixed Value: The agreement must determine the fixed value or method of valuation for the partnership. This can be based on the current market value, a pre-agreed formula, or an appraisal conducted by a professional evaluator. By fixing the value in advance, it eliminates any future disagreements and sets a fair purchase price. 2. Requiring Sale: The agreement mandates that the estate of the deceased partner must sell their share of the partnership to the surviving partner. This requirement ensures a smooth transfer of ownership and prevents the estate from retaining an interest in the partnership. 3. Survivor's Obligations: The agreement outlines the obligations of the surviving partner, including the payment terms and schedule for acquiring the deceased partner's share. It may also include provisions for the surviving partner to secure funding for the buyout, such as obtaining a loan or utilizing partnership assets. 4. Estate's Obligations: The agreement specifies the obligations of the deceased partner's estate, such as timely transfer of ownership documents and providing necessary financial information to facilitate the buyout process. It may also address any restrictions on selling the partnership interest to a third party rather than the surviving partner. 5. Dissolution of Partnership: In some cases, the death of a partner may result in the dissolution of the partnership. The agreement can include provisions for either the continuation or termination of the partnership following the buyout. It is important to note that while the main purpose of this agreement is to address the transfer of ownership in a two-person partnership with each partner owning 50%, there may be variations and additional provisions based on the specific needs and circumstances of the partnership. Each partnership agreement should be tailored to the partnership's unique aspects, and it is recommended to consult with legal professionals experienced in Virginia partnership law to ensure compliance and a comprehensive arrangement.

Virginia Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership

Description

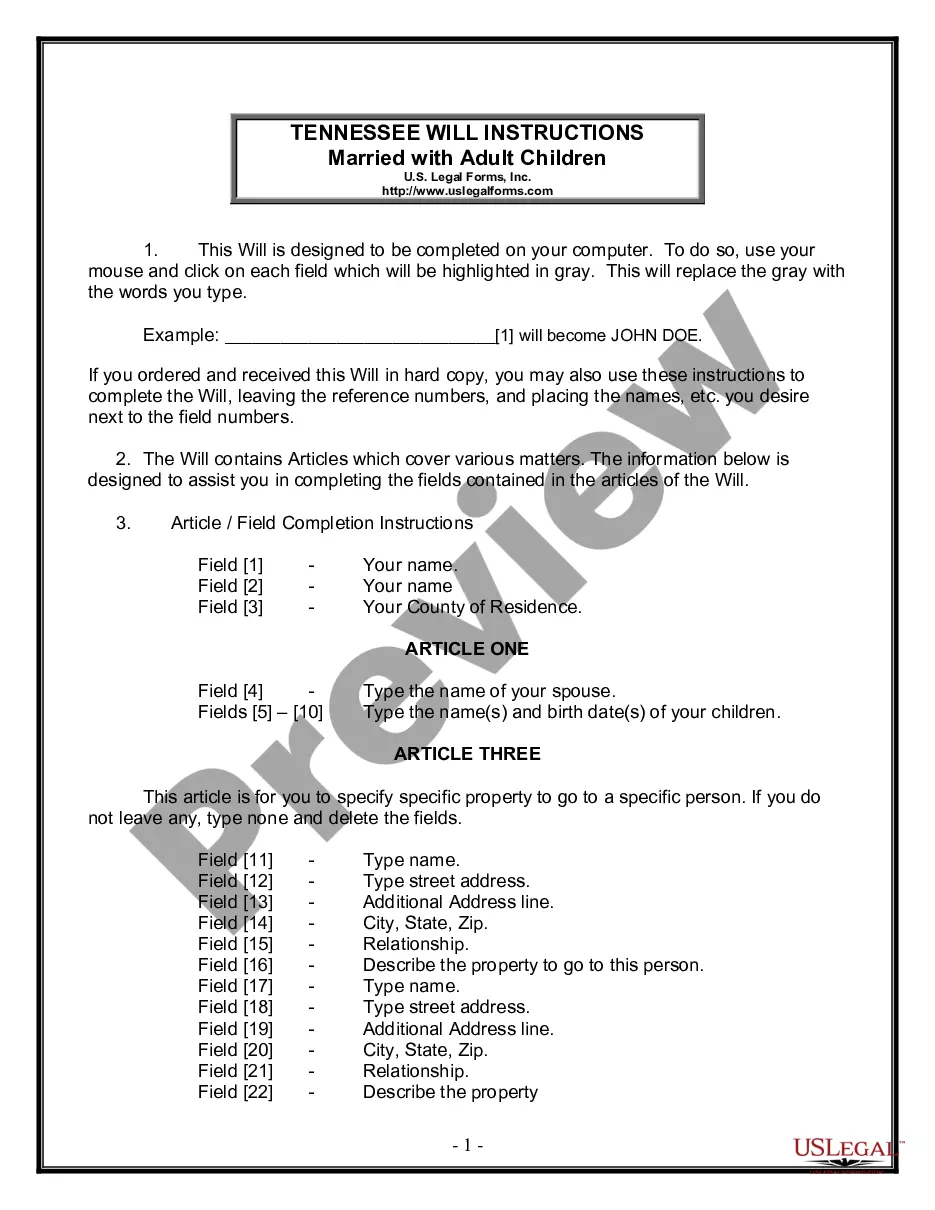

How to fill out Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor In Two Person Partnership With Each Partner Owning 50% Of Partnership?

Discovering the right legitimate file template could be a have difficulties. Of course, there are a variety of themes available on the Internet, but how do you obtain the legitimate form you will need? Use the US Legal Forms internet site. The service delivers 1000s of themes, for example the Virginia Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership, that you can use for organization and private requirements. All of the kinds are checked out by experts and satisfy state and federal needs.

Should you be currently authorized, log in to your bank account and then click the Download switch to find the Virginia Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership. Use your bank account to look throughout the legitimate kinds you might have bought earlier. Visit the My Forms tab of your bank account and get yet another copy of your file you will need.

Should you be a fresh customer of US Legal Forms, listed below are basic recommendations for you to stick to:

- Initially, ensure you have selected the correct form for your city/state. You can look through the shape making use of the Review switch and read the shape description to make certain it will be the right one for you.

- If the form is not going to satisfy your needs, take advantage of the Seach industry to discover the right form.

- Once you are sure that the shape is acceptable, click on the Get now switch to find the form.

- Pick the rates program you want and enter the necessary information. Make your bank account and buy an order with your PayPal bank account or credit card.

- Opt for the submit formatting and download the legitimate file template to your device.

- Full, modify and printing and sign the obtained Virginia Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership.

US Legal Forms will be the greatest collection of legitimate kinds for which you can find various file themes. Use the company to download expertly-made papers that stick to express needs.

Form popularity

FAQ

Right to access books and accounts: Each partner can inspect and copy books of accounts of the business. This right is applicable equally to active and dormant partners. Right to share profits: Partners generally describe in their deed the proportion in which they will share profits of the firm.

Certain transfers of the partnership interest after death may cause the partnership to terminate, however. For example, if a partner's interest in a partnership is transferred to the decedent's heirs to satisfy a pecuniary bequest, this may cause the partnership to technically terminate because, under Sec.

Keeping it successful is even harder, and coping with the death of a partner may be the hardest situation of all. When that happens, your deceased partner's share in the business usually passes to a surviving spouse, either by terms of a will or simply by default as the primary heir.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

After the Death of a Business PartnerThe deceased's estate takes over their share of the partnership. A transfer happens of the other partner's share to you on a payment to the estate. You buy the share of the partnership using a financial formula.

purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires.

Most legislation states that the partnership will end upon the death or bankruptcy of any partner. If your partner dies, you will then owe your partner's estate their share of the partnership that accrues at the date of their death.

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec. 708(b)(1)(A)). If this occurs, the partnership's tax year closes on the partner's date of death.

Business partnership agreement. A properly arranged and funded agreement is a legally binding contract that spells out exactly what is to happen if one of the business's owners dies. It generally calls for the survivors to buy the deceased owner's share in the business from his or her heirs.