Title: Understanding Virginia Liquidation of Partnership with Sale of Assets and Assumption of Liabilities Introduction: Virginia Liquidation of Partnership with Sale of Assets and Assumption of Liabilities is a legal process through which a partnership decides to dissolve its operations and distribute its assets and liabilities among the partners. This detailed description will shed light on the key aspects, legal proceedings, and different types of liquidation that exist in Virginia. Keywords: Virginia liquidation of partnership, sale of assets, assumption of liabilities, legal process, dissolution, distribution, partners Types of Virginia Liquidation of Partnership with Sale of Assets and Assumption of Liabilities: 1. Voluntary Liquidation: In voluntary liquidation, the partners collectively decide to dissolve the partnership and dispose of its assets. This process can occur when the partners reach a unanimous decision or when specified conditions mentioned in the partnership agreement are met. 2. Involuntary Liquidation: Involuntary liquidation arises when a partnership is compelled by external factors, such as bankruptcy, court order, or violation of contractual obligations, leading to the dissolution of partnership and sale of assets. Key Aspects of Virginia Liquidation of Partnership with Sale of Assets and Assumption of Liabilities: 1. Dissolution Process: The first step in liquidation involves the formal dissolution of the partnership. This process typically requires unanimous consent from the partners or in accordance with the terms stated in the partnership agreement. 2. Valuation and Sale of Assets: Once the partnership is dissolved, the assets are appraised and valued. Based on the valuation, the partners determine a strategy to sell the assets, either individually or as a whole. The proceeds are then used to settle the liabilities and distribute the remaining funds among the partners. 3. Assumption of Liabilities: During liquidation, the partnership's outstanding debts and liabilities are evaluated. The partners must determine how these obligations will be fulfilled and allocate each partner's responsibility accordingly. 4. Asset Distribution: After the sale of assets and settlement of liabilities, the remaining funds are distributed among the partners based on their respective ownership interests in the partnership. The distribution is typically based on the partnership agreement or agreed-upon terms during the liquidation process. 5. Legal Compliance: Virginia Liquidation of Partnership with Sale of Assets and Assumption of Liabilities requires adherence to specific legal requirements. Seeking professional legal advice is crucial to ensure compliance with state laws, tax regulations, and any other relevant legal obligations. Conclusion: Virginia Liquidation of Partnership with Sale of Assets and Assumption of Liabilities is a complex legal process that involves the dissolution of a partnership, sale of its assets, assumption of liabilities, and fair distribution of remaining funds among the partners. Understanding the key aspects and types of liquidation is essential for a smooth and legally compliant process. Consulting an attorney experienced in partnership law is highly recommended navigating the intricate legal requirements and protect the rights and interests of all parties involved.

Virginia Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Virginia Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

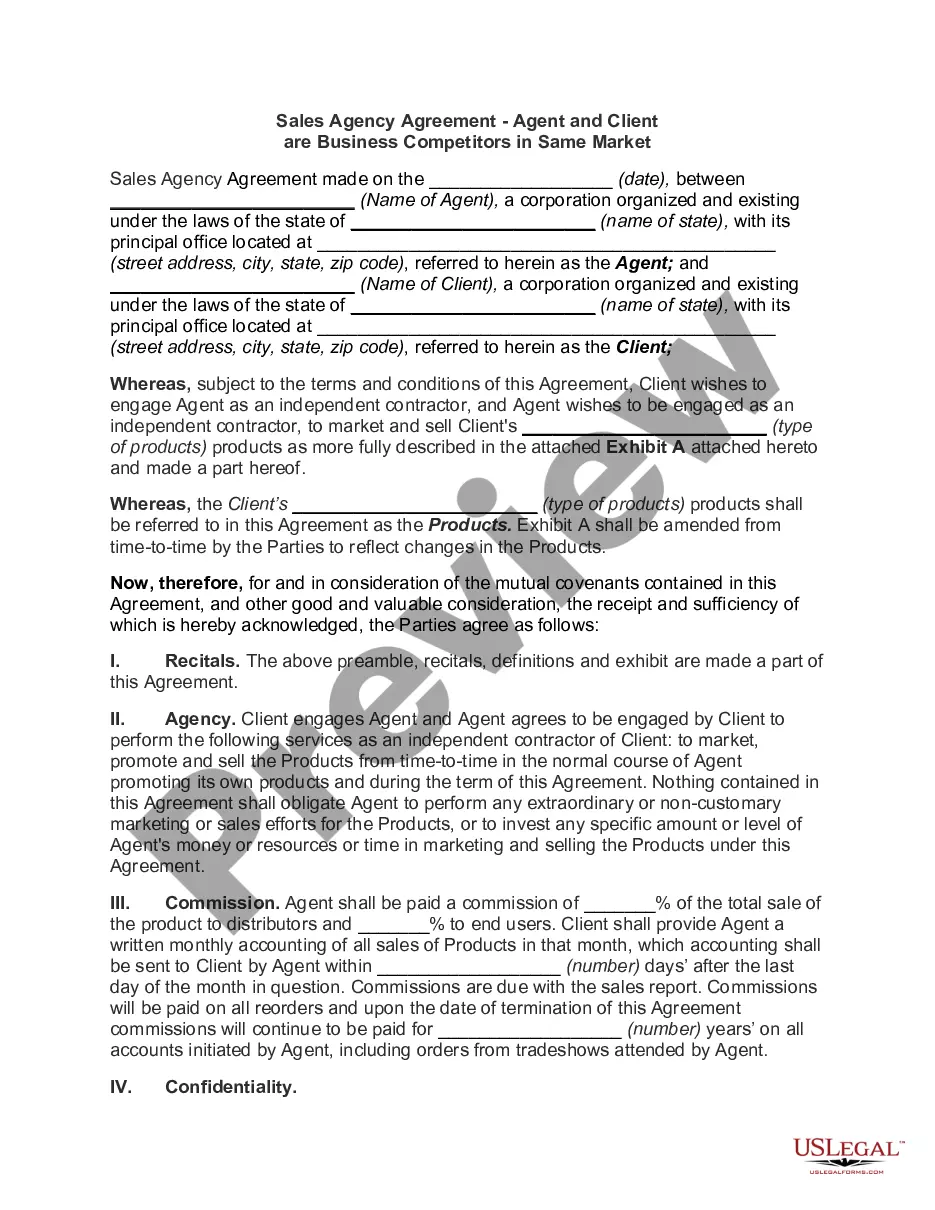

Are you currently in a position where you will need documents for both enterprise or individual uses just about every working day? There are plenty of legitimate record themes accessible on the Internet, but discovering ones you can rely on isn`t easy. US Legal Forms gives a large number of form themes, like the Virginia Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, which can be created in order to meet federal and state demands.

If you are already acquainted with US Legal Forms site and have your account, basically log in. After that, it is possible to acquire the Virginia Liquidation of Partnership with Sale of Assets and Assumption of Liabilities web template.

Should you not come with an accounts and want to begin using US Legal Forms, abide by these steps:

- Obtain the form you want and ensure it is for the appropriate area/region.

- Make use of the Preview switch to examine the shape.

- See the outline to ensure that you have chosen the right form.

- In the event the form isn`t what you are looking for, make use of the Look for discipline to get the form that meets your requirements and demands.

- When you obtain the appropriate form, just click Acquire now.

- Choose the costs strategy you want, submit the desired info to create your money, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file file format and acquire your duplicate.

Find all of the record themes you possess purchased in the My Forms menus. You can obtain a additional duplicate of Virginia Liquidation of Partnership with Sale of Assets and Assumption of Liabilities any time, if possible. Just click the essential form to acquire or produce the record web template.

Use US Legal Forms, the most extensive selection of legitimate types, to save time as well as stay away from faults. The service gives appropriately created legitimate record themes which you can use for a selection of uses. Create your account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

Definition: Partnership liquidation is the process of closing the partnership and distributing its assets. Many times partners choose to dissolve and liquidate their partnerships to start new ventures. Other times, partnerships go bankrupt and are forced to liquidate in order to pay off their creditors.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

What Role Does Basis Play In A Partnership Liquidation? basis equal to the amount of money on hand plus the level at which any business-related assets will be contributed, ie, what they will cost.

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

What is the partner's basis in property received in liquidation of his interest? When a partnership distributes property in a liquidating distribution, the recipient partner's outside basis reduced by any amount of cash included in the distribution is allocated to the distributed property.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

Upon the winding up of a limited partnership, the assets shall be distributed as follows: (1) To creditors, including partners who are creditors, to the extent permitted by law, in satisfaction of liabilities of the limited partnership other than liabilities for distributions to partners under section 34-20d or 34-27d;

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

Cases. A dividend may be referred to as liquidating dividend when a company: Goes out of business and the net assets of the company (after all liabilities have been paid) are distributed to shareholders, or. Sells a portion of its business for cash and the proceeds are distributed to shareholders.

The basis of property (other than money) distributed by a partnership to a partner in liquidation of the partner's interest shall be an amount equal to the adjusted basis of such partner's interest in the partnership reduced by any money distributed in the same transaction.