The Virginia Agreement for Sale of Assets of Corporation is a legally binding document that outlines the terms and conditions of the sale or transfer of assets from one corporation to another. It serves as a crucial agreement that ensures the protection of both parties involved in the transaction. A typical Virginia Agreement for Sale of Assets of Corporation includes essential details such as the names and addresses of the buyer and seller, the purchase price, effective date, and closing date. Furthermore, it specifies the assets being sold, which may consist of tangible assets like equipment, inventory, and real estate, as well as intangible assets such as patents, trademarks, and customer contracts. This agreement establishes the warranties and representations made by both parties regarding the assets being sold. It clarifies whether the assets are being sold on an "as-is" basis or if there are any conditions or guarantees associated with their quality, condition, or legality. Additionally, it may outline any restrictions on future competition by the seller and provisions to protect the buyer from assuming any hidden liabilities or lawsuits. There are various types of Virginia Agreements for Sale of Assets of Corporation, each tailored to specific circumstances: 1. Asset Purchase Agreement: This is the most common type of agreement, covering the purchase or sale of a wide range of assets, including equipment, real estate, inventory, and intellectual property. 2. Stock Purchase Agreement: Conversely, this agreement focuses on the transfer of stock or ownership interests in a corporation. It involves the purchase of the corporation itself, along with all its assets and liabilities. 3. Merger Agreement: This agreement pertains to the consolidation of two or more corporations, where one entity absorbs the other(s) through the transfer of assets and liabilities. It outlines the terms and conditions of the merger, including the exchange ratio of stock and governance structure of the newly formed entity. 4. Bulk Sale Agreement: This agreement is specific to the sale of assets in bulk, often in the context of businesses like retail stores or restaurants. It typically involves the transfer of inventory and other assets involved in the daily operations of the business. In summary, the Virginia Agreement for Sale of Assets of Corporation is an essential legal document that facilitates the smooth transfer of assets from one corporation to another. It provides detailed provisions to safeguard the interests of both parties and ensures transparency throughout the sale process. By understanding the various types of agreements available, corporations can choose the most appropriate one based on their specific asset transfer requirements.

Virginia Agreement for Sale of Assets of Corporation

Description

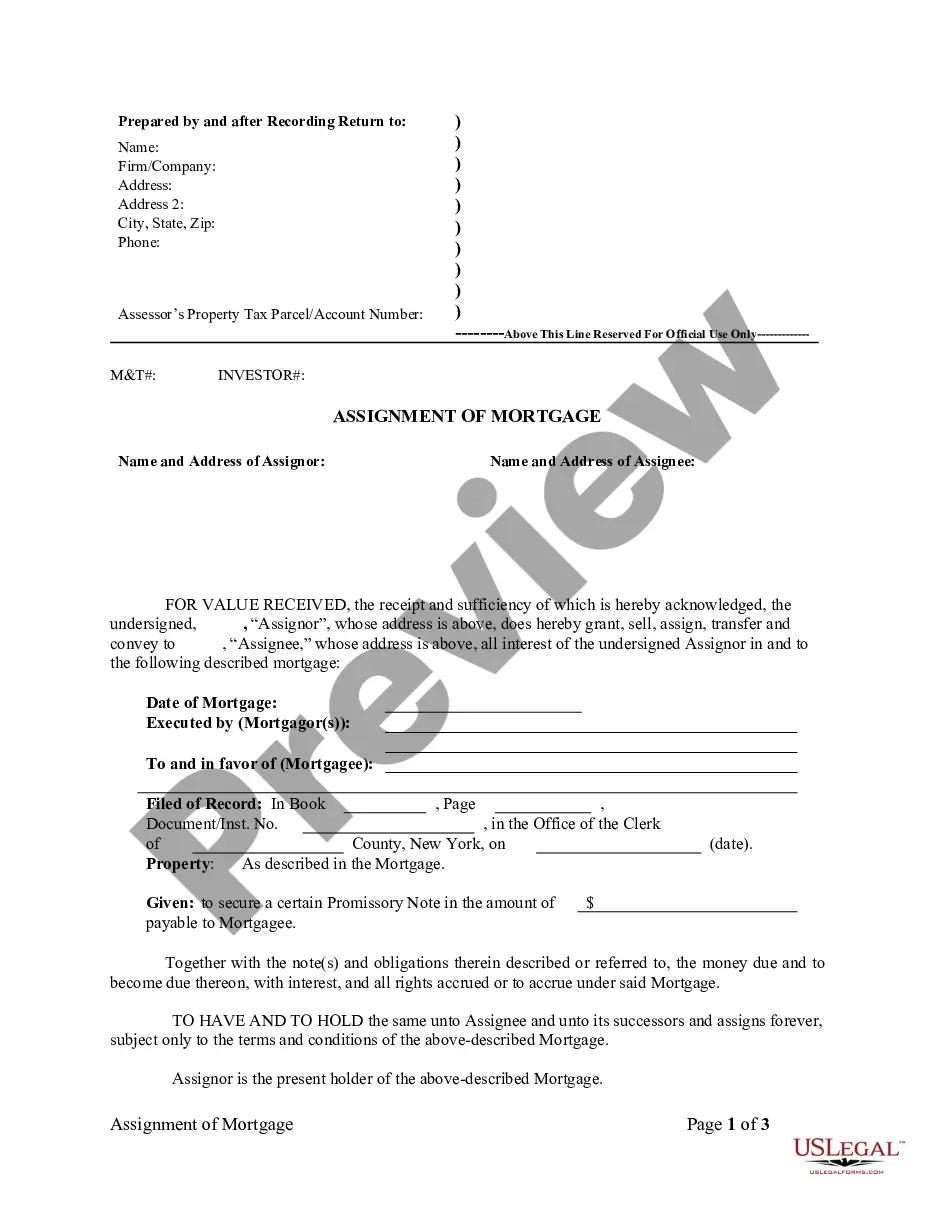

How to fill out Virginia Agreement For Sale Of Assets Of Corporation?

You might spend hours online looking for the legal template that meets the state and federal requirements you need.

US Legal Forms offers numerous legal documents that have been reviewed by experts.

You can conveniently download or print the Virginia Agreement for Sale of Assets of Corporation from my services.

If available, use the Review button to preview the template as well. If you wish to find another version of the form, use the Search field to locate the template that fits your needs.

- If you already possess a US Legal Forms account, you may sign in and click on the Download button.

- After that, you can complete, modify, print, or sign the Virginia Agreement for Sale of Assets of Corporation.

- Every legal template you purchase is yours forever.

- To obtain an additional copy of a purchased form, visit the My documents section and click on the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, verify that you have selected the correct template for your state/town.

- Review the form description to ensure you have selected the right document.

Form popularity

FAQ

Approval for selling all the assets of a corporation typically requires consent from the board of directors and may also involve shareholder approval. This process is crucial to ensure that the interests of all parties are considered and upheld. The Virginia Agreement for Sale of Assets of Corporation provides a structured approach for obtaining necessary approvals and ensuring the sale meets legal standards.

Legally, 'substantially all' refers to a level of asset transfer that significantly alters the business operations and structure. While there isn’t a precise percentage that defines it, it generally means the majority of assets owned by the corporation. When engaging in any transaction involving the Virginia Agreement for Sale of Assets of Corporation, understanding this term is vital to ensure proper classification of the sale.

The substantially all requirement pertains to the legal threshold necessary to classify a sale as one that includes nearly all of a corporation's assets. This requirement helps ensure that stakeholders and regulatory bodies recognize the gravity of the transaction. Adhering to the Virginia Agreement for Sale of Assets of Corporation is key in meeting this criterion and preventing disputes post-sale.

Acquiring substantially all of the assets means purchasing nearly all of the properties and rights of a corporation, which effectively transfers control of the business. This type of transaction often requires an understanding of the Virginia Agreement for Sale of Assets of Corporation, as it involves detailed legal and financial evaluations. Such acquisitions can lead to significant changes in company operations and market presence.

VA Code 13.1 900 outlines the legal framework for asset transactions in Virginia. It specifies the conditions under which a corporation can sell its assets and the necessary approvals required for such transactions. Understanding this code is essential for any corporation considering a Virginia Agreement for Sale of Assets of Corporation, ensuring compliance with state laws.

A substantial sale of assets involves transferring a significant portion of a corporation's assets in a single transaction. This type of sale typically impacts the company’s operations and financial health. Under the Virginia Agreement for Sale of Assets of Corporation, defining what constitutes 'substantial' is crucial to ensure that all legal requirements are met.

The sale of substantially all assets refers to a transaction where a corporation sells almost all of its resources and properties. This can include equipment, inventory, intellectual properties, and real estate. Such sales often require careful consideration under the Virginia Agreement for Sale of Assets of Corporation to ensure legal compliance and protect the interests of stakeholders.

Yes, selling a company usually requires shareholder approval. This is especially true if the sale involves transferring the majority of assets or if the company’s governing documents stipulate such a process. Engaging with a reliable platform like uslegalforms can help you create an effective Virginia Agreement for Sale of Assets of Corporation, ensuring that all legal requirements and approvals are thoroughly addressed.

In many cases, you will require shareholder approval to sell corporate assets. This requirement arises particularly when the sale involves a substantial portion of assets or would impact shareholder rights. Utilizing a well-structured Virginia Agreement for Sale of Assets of Corporation can streamline this process and clarify the necessary approvals.

When a corporation intends to sell a significant portion of its assets, the board of directors typically must approve the transaction. Additionally, under Virginia law, the shareholders may need to provide their consent, especially if the sale substantially affects their ownership interest. It is crucial to draft an effective Virginia Agreement for Sale of Assets of Corporation to ensure compliance and protect all parties involved.

Interesting Questions

More info

1-300.