A Virginia Firm Offer is a legally binding commitment made by a merchant to sell their goods or services at a specified price, which cannot be revoked for a certain period of time. This offer is protected under the Uniform Commercial Code (UCC) Section 2-205, also known as the Firm Offer Rule. When a Virginia merchant makes a firm offer, they are obligated to hold the offer open for the agreed-upon time, and the offer cannot be withdrawn or altered during that period. The Virginia Firm Offer serves as a valuable tool in the business arena, providing certainty and stability to both buyers and sellers. It allows buyers to secure their desired products or services, ensuring protection against price changes or product unavailability during the specified period. For sellers, a firm offer guarantees a committed customer, increasing the likelihood of closing the deal. In Virginia, there are two main types of firm offers recognized: 1. Firm Offer for the Sale of Goods: This type of firm offer applies specifically to the sale of goods, governed by the UCC. Under this rule, Virginia merchants typically make firm offers in writing, outlining the terms of the offer, including price, quantity, and expiration date. Once the offer is properly communicated and accepted by the buyer, a binding contract is formed, granting the buyer the right to purchase the goods at the agreed-upon price within the specified timeframe. 2. Firm Offer for Services: While the majority of firm offers revolve around the sale of goods, there can also be firm offers for services in Virginia. These can occur in various professional fields, such as consulting, legal services, or construction. A firm offer for services follows a similar principle as the sale of goods, forming a binding contract between the service provider and the customer. The key elements of a firm offer for services include a clear description of the services to be provided, the price, the duration of the offer, and any specific conditions. In conclusion, a Virginia Firm Offer is a legally binding commitment made by a merchant to sell goods or services at a specified price, which cannot be revoked within a certain timeframe. This offer ensures stability and security for both buyers and sellers, with two primary types being firm offers for the sale of goods and firm offers for services. Understanding the implications and benefits of a Virginia Firm Offer is crucial for businesses engaged in commerce within the state.

Virginia Firm Offer

Description

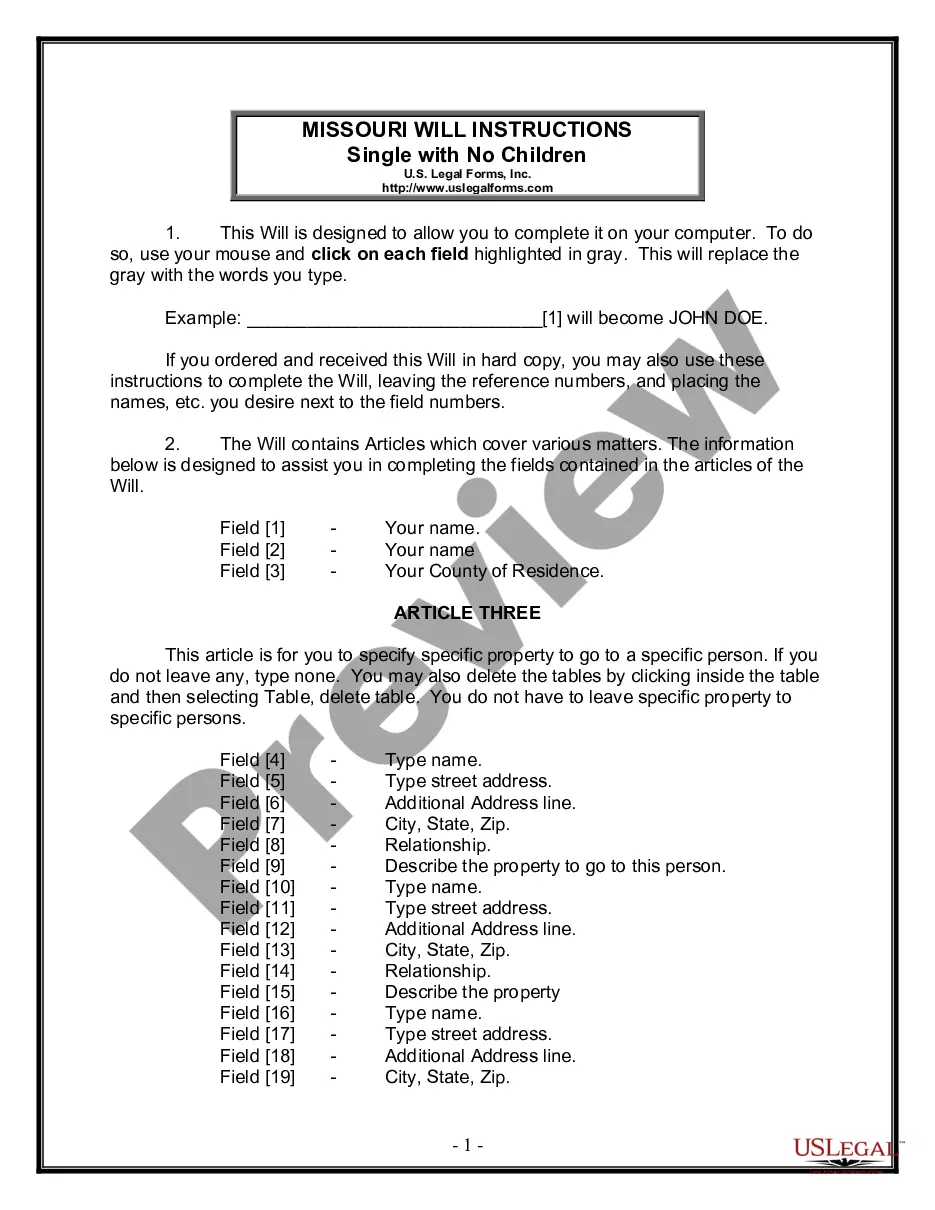

How to fill out Virginia Firm Offer?

US Legal Forms - one of the biggest libraries of lawful forms in the United States - provides a wide array of lawful record themes it is possible to acquire or print. Utilizing the website, you can find a huge number of forms for business and individual reasons, sorted by categories, states, or key phrases.You can get the most up-to-date types of forms such as the Virginia Firm Offer in seconds.

If you have a membership, log in and acquire Virginia Firm Offer in the US Legal Forms collection. The Obtain option will show up on every single kind you see. You have accessibility to all in the past downloaded forms inside the My Forms tab of your profile.

If you want to use US Legal Forms initially, listed below are straightforward guidelines to get you started off:

- Ensure you have picked out the best kind for your area/region. Select the Preview option to examine the form`s articles. Look at the kind information to ensure that you have chosen the right kind.

- In case the kind does not satisfy your needs, make use of the Lookup area towards the top of the monitor to find the one which does.

- In case you are content with the shape, affirm your option by clicking the Buy now option. Then, pick the prices prepare you favor and give your accreditations to sign up to have an profile.

- Approach the purchase. Use your Visa or Mastercard or PayPal profile to finish the purchase.

- Choose the format and acquire the shape in your product.

- Make alterations. Fill up, change and print and signal the downloaded Virginia Firm Offer.

Every single format you included with your money does not have an expiration particular date and it is your own property eternally. So, in order to acquire or print an additional version, just visit the My Forms portion and click on on the kind you require.

Get access to the Virginia Firm Offer with US Legal Forms, probably the most substantial collection of lawful record themes. Use a huge number of specialist and express-specific themes that satisfy your small business or individual needs and needs.

Form popularity

FAQ

State of Virginia Offer in CompromiseYou don't need to submit a payment with your Offer, but you can.If you owe personal tax and business tax, and would like to request a Compromise for both, you will need to complete and submit a separate OIC for each tax debt.The OIC may be used to request a Penalty Waiver.More items...

The Virginia Form VA-4, Employee's Virginia Income Tax Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

You can get an EIN immediately by applying online. International applicants must call 267-941-1099 (Not a toll-free number). If you prefer, you can fax a completed Form SS-4 to the service center for your state, and they will respond with a return fax in about one week.

FORM VA-4 INSTRUCTIONSYou must file this form with your employer when your employment begins. If you do not file this form, your employer must withhold Virginia income tax as if you had no exemptions.

You may not claim more personal exemptions on form VA-4 than you are allowed to claim on your income tax return unless you have received written permission to do so from the Department of Taxation. Line1. You may claim an exemption for yourself.

Resident Aliens (RA) may complete the W-4 and VA-4 just like a U.S. citizen. Please use the worksheet on both forms to calculate your allowances and exemptions. Non-Resident Aliens (NRA) have certain requirements for filling out tax paperwork. Please follow the directions below to correctly complete these forms.

If you don't have an SSN or ITIN, you can still get an EIN for your Virginia LLC. You just can't apply for an EIN online. You will need to mail or fax Form SS-4 to the IRS instead and you must fill the form out in a certain way.

To obtain your Tax ID (EIN) in Virginia start by choosing the legal structure of the entity you wish to get a Tax ID (EIN) for. Once you have submitted your application your EIN will be delivered to you via e-mail.

You must claim your own exemption. To determine whether you are entitled to claim any exemptions for your dependents, you must apply the federal rules for separate filing. Under federal rules, you must demonstrate that you provided at least 50% of a dependent's support in order to claim an exemption for the dependent.

Taxpayers can obtain an EIN immediately by calling the Business & Specialty Tax Line at (800) 829-4933 between a.m. p.m. local time, Monday through Friday. An assistor takes the information, assigns the EIN, and provides the number to an authorized individual over the telephone.