Virginia Presentation of Stock Notice

Description

How to fill out Presentation Of Stock Notice?

US Legal Forms - one of several most significant libraries of legal kinds in America - delivers an array of legal document templates you can obtain or produce. While using internet site, you may get a large number of kinds for enterprise and individual reasons, sorted by groups, says, or key phrases.You will find the most recent variations of kinds much like the Virginia Presentation of Stock Notice within minutes.

If you already possess a monthly subscription, log in and obtain Virginia Presentation of Stock Notice from your US Legal Forms library. The Down load option will appear on every kind you look at. You have access to all formerly delivered electronically kinds from the My Forms tab of your profile.

In order to use US Legal Forms initially, listed below are simple directions to help you began:

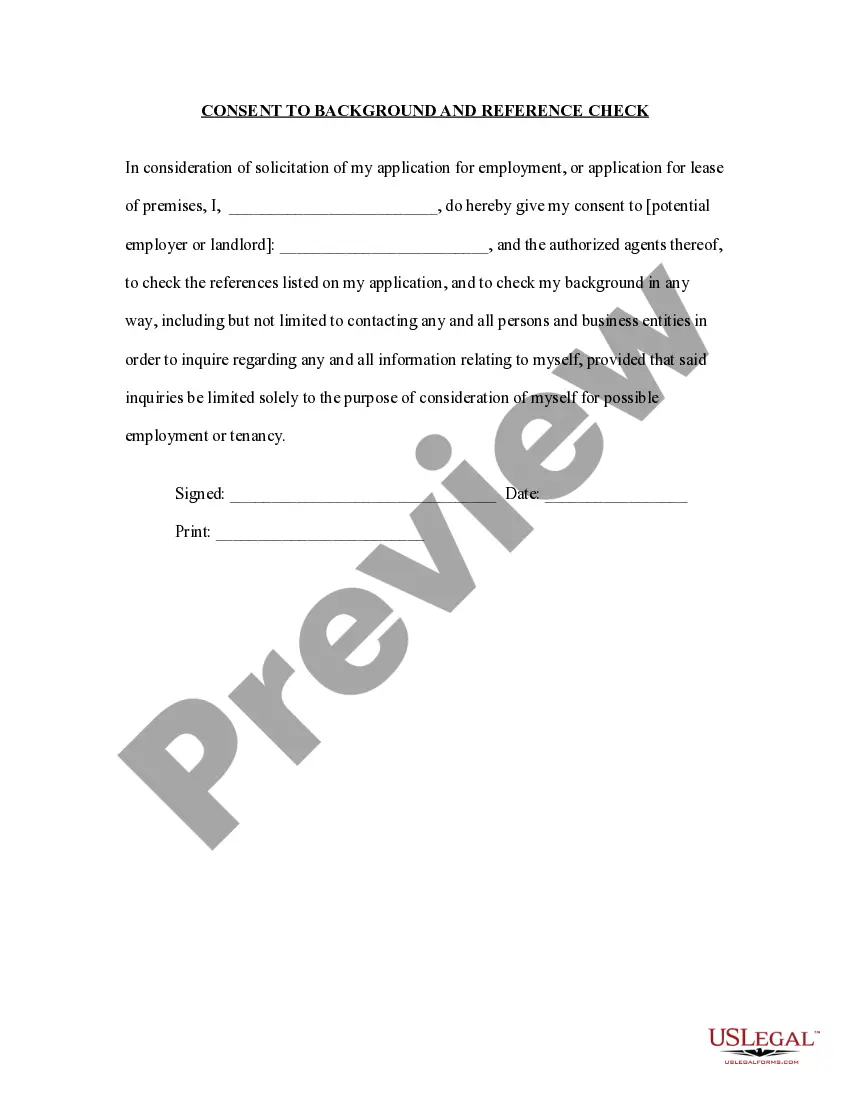

- Make sure you have selected the best kind for your town/region. Click on the Preview option to examine the form`s information. Look at the kind explanation to ensure that you have selected the proper kind.

- If the kind doesn`t suit your demands, use the Lookup discipline at the top of the display to find the one who does.

- In case you are happy with the shape, affirm your decision by simply clicking the Purchase now option. Then, pick the rates program you prefer and supply your credentials to register on an profile.

- Process the transaction. Utilize your credit card or PayPal profile to complete the transaction.

- Choose the format and obtain the shape on the system.

- Make alterations. Complete, edit and produce and indicator the delivered electronically Virginia Presentation of Stock Notice.

Each format you added to your account lacks an expiry particular date and is your own property permanently. So, if you wish to obtain or produce one more copy, just check out the My Forms section and click about the kind you need.

Obtain access to the Virginia Presentation of Stock Notice with US Legal Forms, one of the most considerable library of legal document templates. Use a large number of specialist and status-distinct templates that satisfy your company or individual needs and demands.