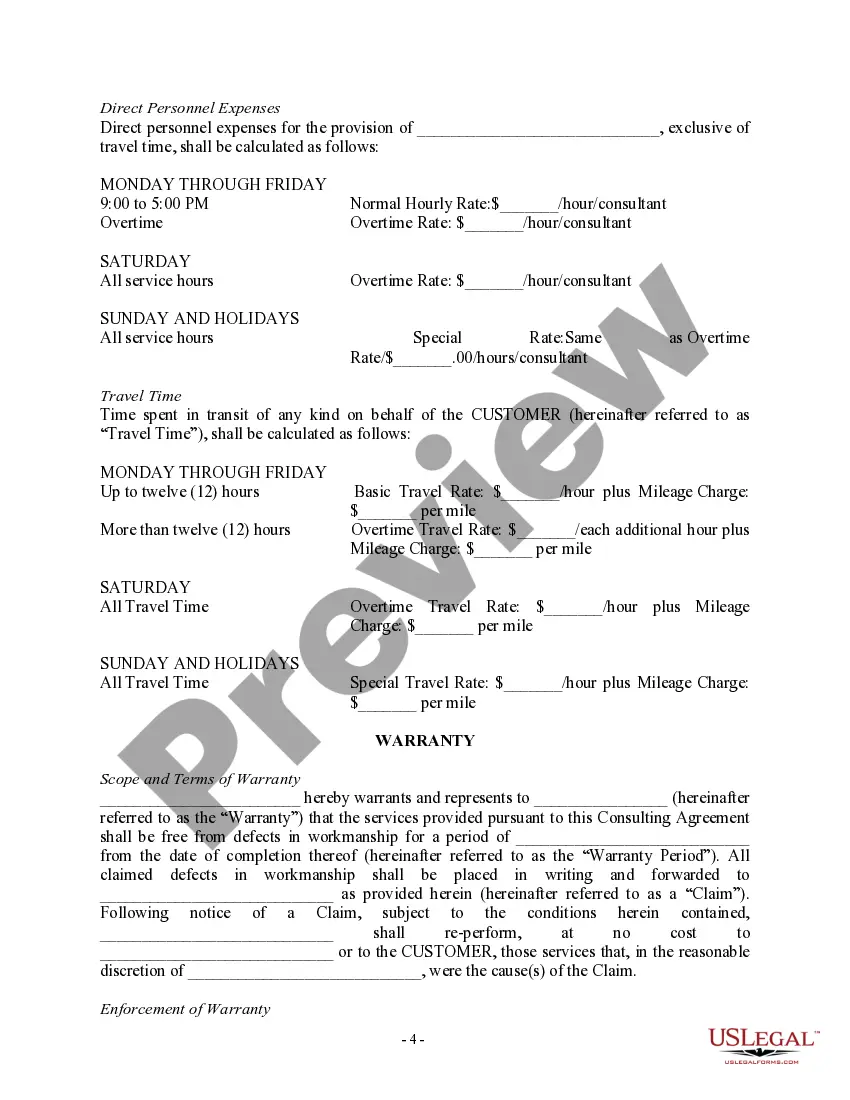

A Virginia Self-Employed Independent Contractor Consulting Agreement is a legally binding contract that outlines the terms and conditions between a self-employed individual or independent contractor and a client for consulting services. This agreement forms a solid foundation for a professional relationship between the parties involved. Key elements typically included in a detailed Virginia Self-Employed Independent Contractor Consulting Agreement include: 1. Parties Involved: The names and contact information of both the self-employed individual (referred to as the "Contractor") and the client (referred to as the "Client") are clearly stated at the beginning of the agreement. 2. Scope of Work: A detailed description of the consulting services to be provided by the Contractor is included, outlining specific tasks, deliverables, and project timelines. This section ensures that both parties have a clear understanding of the project's scope. 3. Payment Terms: This section outlines the payment structure, including the payment amount, method, and schedule. It also specifies if any additional expenses or reimbursable costs will be covered by the Client. 4. Independent Contractor Status: It is important to define the Contractor's status as an independent contractor and not an employee of the Client. This section clarifies that the Contractor will be responsible for their own taxes, insurance, and any other legal obligations. 5. Confidentiality and Non-Disclosure: This section ensures that both parties agree to keep any sensitive or proprietary information confidential and not disclose it to any third parties unless required by law. 6. Intellectual Property Rights: This clause addresses the ownership and usage rights of any intellectual property created by the Contractor during the engagement. It defines whether the Contractor retains ownership or transfers it to the Client. 7. Termination Clause: This section outlines the conditions under which either party can terminate the agreement. It may include provisions for termination by mutual agreement, breach of contract, or non-performance. Different types of Virginia Self-Employed Independent Contractor Consulting Agreements may include variations in terms and specific provisions to cater to various industries or services. For example: 1. IT Consulting Agreement: Tailored specifically for individuals providing consulting services related to information technology, software development, or technical support. 2. Marketing Consulting Agreement: Specifically designed for marketing professionals providing consulting services, such as market research, brand development, advertising strategies, or social media campaigns. 3. Financial Consulting Agreement: Suitable for self-employed individuals offering consulting services in financial planning, investment advice, accounting, or tax planning. 4. Legal Consulting Agreement: Specifically crafted for self-employed legal professionals providing consulting services, such as legal advice, contract drafting, or intellectual property guidance. These are just a few examples, as Virginia Self-Employed Independent Contractor Consulting Agreements can be customized to meet the specific needs of various industries and consulting services. It is crucial to consult with legal professionals to ensure all necessary provisions are included based on the unique circumstances of the engagement.

Virginia Self-Employed Independent Contractor Consulting Agreement - Detailed

Description

How to fill out Virginia Self-Employed Independent Contractor Consulting Agreement - Detailed?

You can commit hrs on the Internet trying to find the authorized papers design that meets the federal and state needs you want. US Legal Forms provides a huge number of authorized types that are evaluated by experts. It is simple to obtain or produce the Virginia Self-Employed Independent Contractor Consulting Agreement - Detailed from your services.

If you have a US Legal Forms bank account, it is possible to log in and then click the Down load button. Afterward, it is possible to full, edit, produce, or indication the Virginia Self-Employed Independent Contractor Consulting Agreement - Detailed. Each authorized papers design you acquire is yours for a long time. To acquire yet another duplicate of any acquired type, proceed to the My Forms tab and then click the related button.

If you work with the US Legal Forms internet site for the first time, adhere to the basic instructions listed below:

- Initially, ensure that you have selected the right papers design to the area/town of your choice. Look at the type description to ensure you have picked the proper type. If available, make use of the Preview button to check through the papers design also.

- If you would like locate yet another edition of the type, make use of the Lookup area to discover the design that meets your requirements and needs.

- Upon having located the design you want, click on Get now to carry on.

- Find the prices strategy you want, enter your accreditations, and sign up for an account on US Legal Forms.

- Total the financial transaction. You may use your charge card or PayPal bank account to pay for the authorized type.

- Find the structure of the papers and obtain it in your gadget.

- Make modifications in your papers if needed. You can full, edit and indication and produce Virginia Self-Employed Independent Contractor Consulting Agreement - Detailed.

Down load and produce a huge number of papers themes utilizing the US Legal Forms website, which provides the largest variety of authorized types. Use professional and condition-particular themes to take on your company or personal demands.

Form popularity

FAQ

The independent contractor provision states that the relationship between the parties is that of an independent contractor, that the agreement does not create an employment relationship, and that under no circumstances is the independent contractor an agent of the company for which they provide services.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.