Virginia Employment Firm Audit

Description

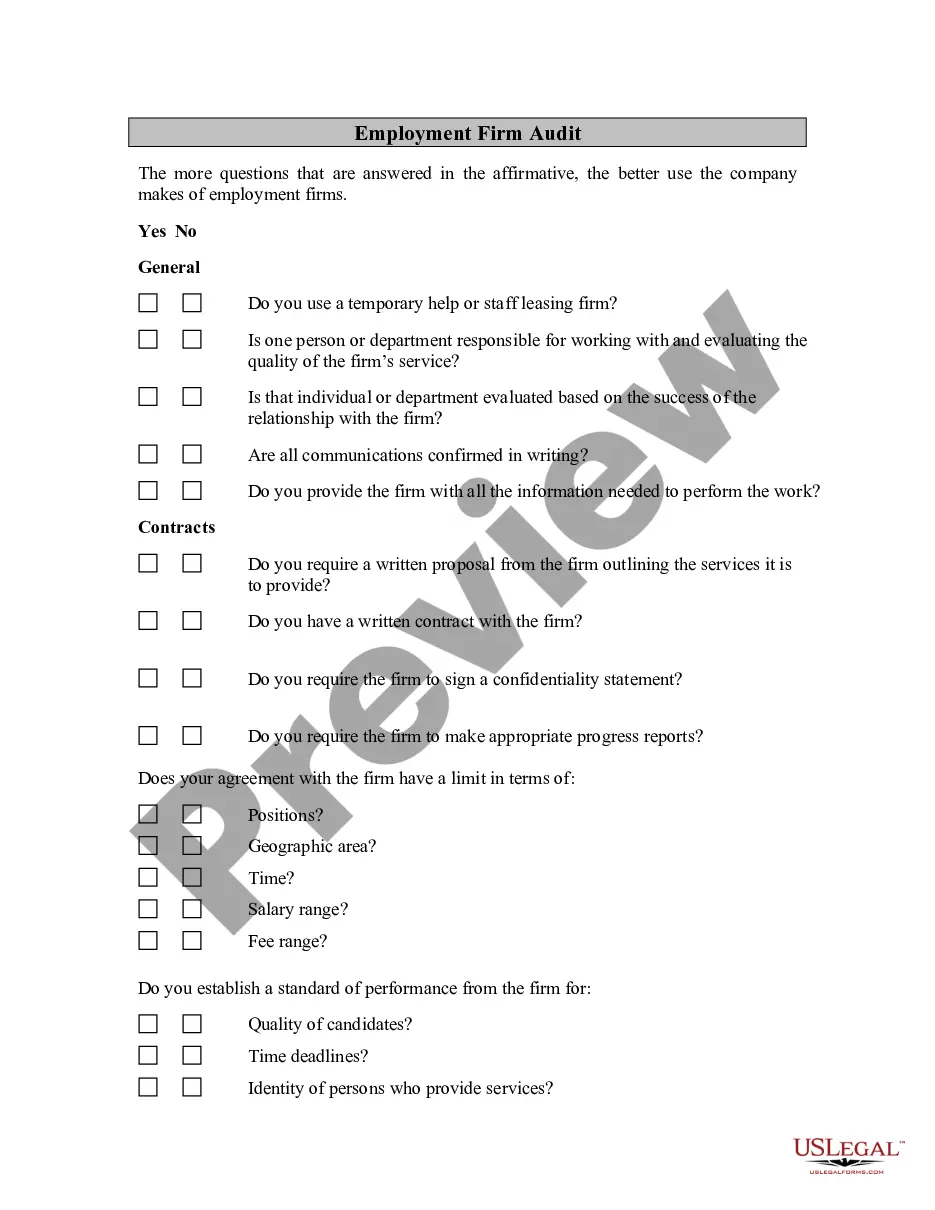

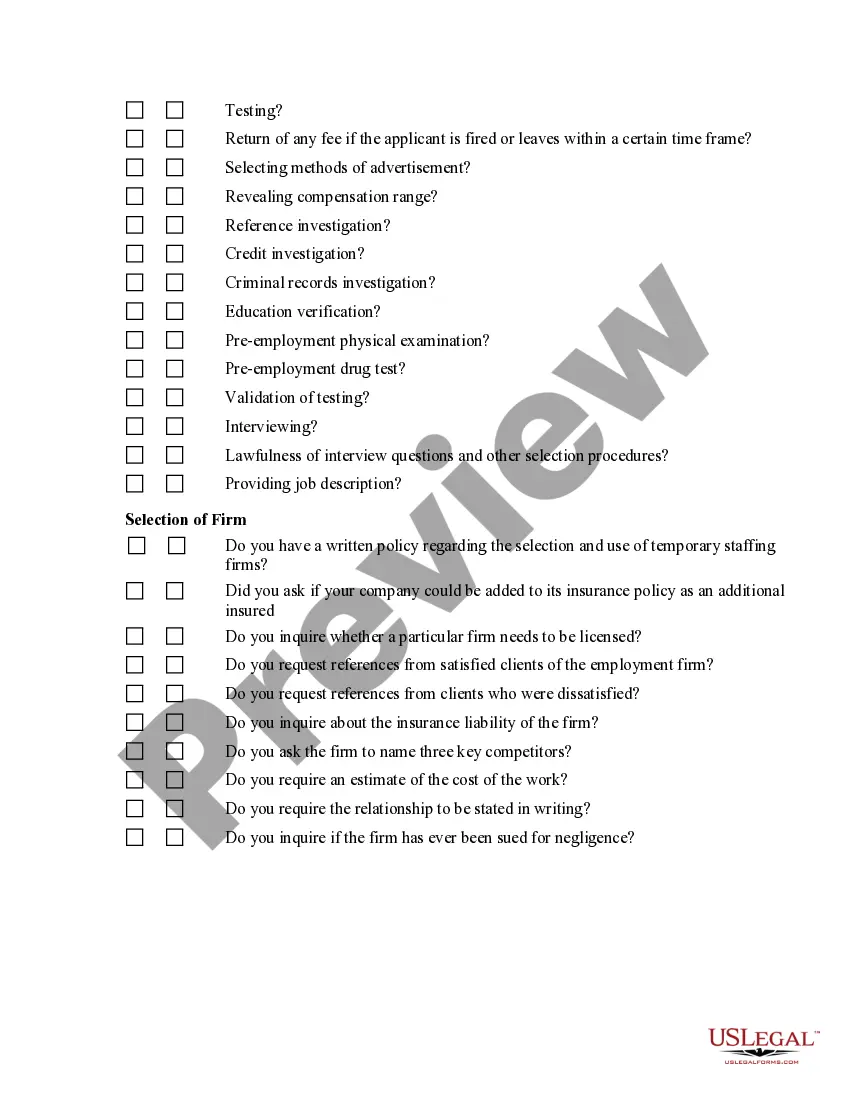

How to fill out Employment Firm Audit?

If you desire to be thorough, acquire, or generate legal document templates, utilize US Legal Forms, the largest assortment of legal forms that are accessible online.

Utilize the website’s user-friendly and convenient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and locations, or keywords.

Every legal document template you purchase is yours permanently. You have access to each template you downloaded within your account.

Visit the My documents section and select a form to print or download again. Complete and obtain, and print the Virginia Employment Agency Audit with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the Virginia Employment Agency Audit within just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click on the Download button to acquire the Virginia Employment Agency Audit.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Make sure you have selected the form for the correct city/state.

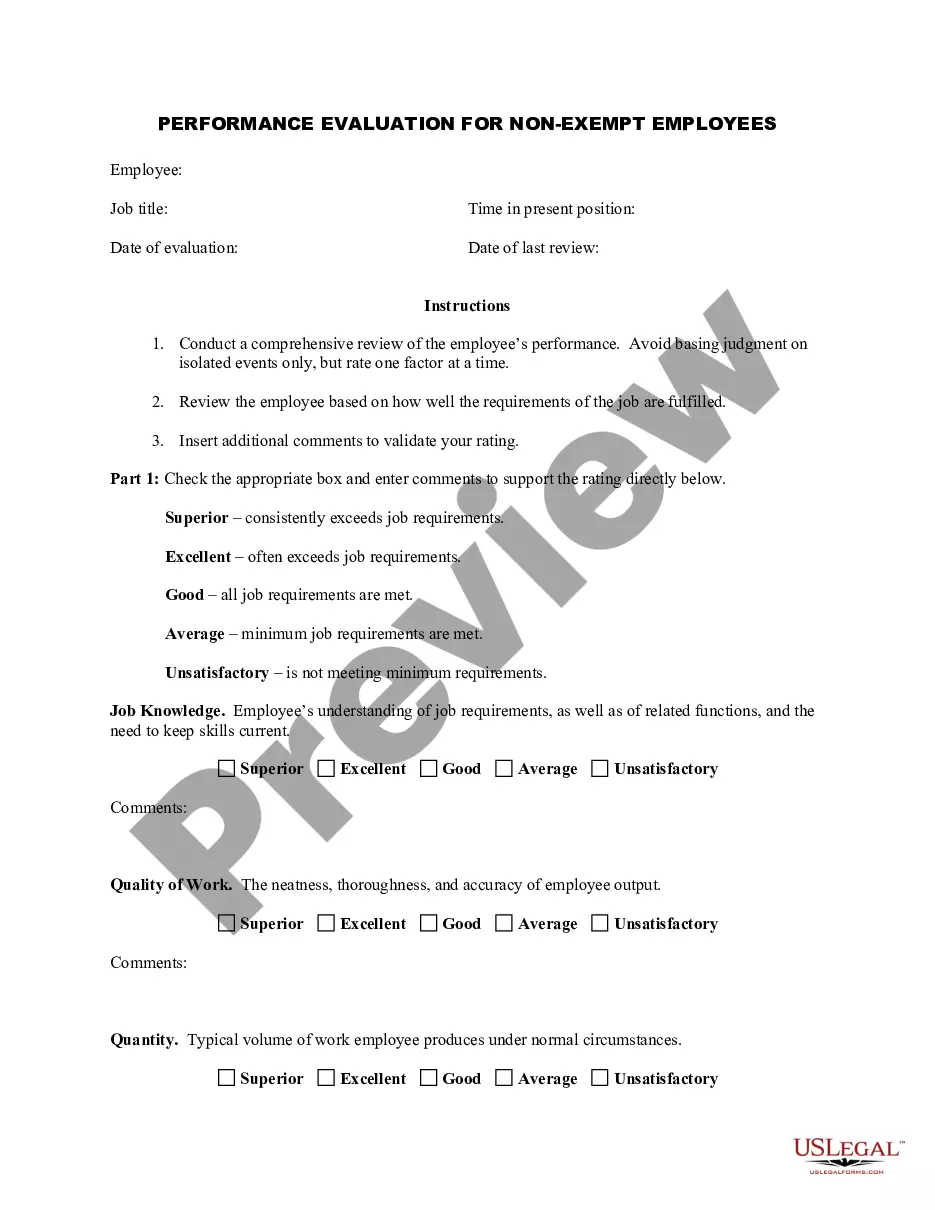

- Step 2. Use the Review feature to inspect the document’s content. Remember to check the information.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form format.

- Step 4. Once you have found the necessary form, click on the Buy now button. Choose your preferred payment plan and enter your details to create an account.

- Step 5. Proceed to make the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it onto your system.

- Step 7. Fill out, edit, and print or sign the Virginia Employment Agency Audit.

Form popularity

FAQ

The VEC serves as Virginia's dedicated resource for managing unemployment insurance, workforce training, and job placements. Its mission is to foster a robust labor market by assisting both job seekers and employers. Engaging with the VEC enhances the effectiveness of the Virginia Employment Firm Audit, ensuring compliance and better employment practices.

The VEC operates by processing unemployment claims, providing job placement services, and offering workforce training programs. It collaborates with various stakeholders, such as employers and educational institutions, to align workforce needs with training initiatives. Understanding how the VEC functions is key for a smooth Virginia Employment Firm Audit and for utilizing its services effectively.

In Virginia, an employee is guilty of misconduct connected with her work sufficient to disqualify her from receiving unemployment benefits when she deliberately violates a company rule reasonably designed to protect the legitimate business interests of her employer, or when his acts or omissions are of such a nature

You may receive what's known as a VEC audit in the event that your records do not match up with what is in the system, namely if workers file for unemployment and the numbers don't match. Over 3,700 VEC audits are conducted every year with the state's auditors conducting periodic reviews of registered employers.

The Virginia Employment Commission (VEC) oversees unemployment benefits in Virginia. An employee that was fired, terminated, or released from an employer is not automatically entitled to unemployment benefits.

If your address has been changed on your unemployment claim after 12-30-21 and you have not received the original mailed copy by 2-14-22, please call 866-832-2363 to request a copy be mailed to your newly updated address.

To register and immediately receive a VEC Account Number, go to iReg, our new online registration process. You can also contact a VEC Local Office or download the form VEC-FC-27 from the Employer Services page on this website.

Effective September 30, 2020 a program at the Virginia Employment Commission allows smaller employers to file their Quarterly Reports (Forms FC20/21) electronically in a quick and easy manner. This program is called . Key Features of at the VEC: No Sign Up required.

The VA Unemployment Compensation Act does not allow claimants who are receiving unemployment benefits to refuse jobs without good reason. If you refuse a job, or Workforce Center referral to a potential job, you must report the refusal on your weekly request for payment of benefits.

Form FC-20 / FC-21 - Employer's Quarterly Tax and Payroll Report.