Virginia Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement

Description

How to fill out Hawaii Registration For Offer Sale Of Franchise Or Supplemental Report To Registration Statement?

It is possible to invest hrs on the Internet attempting to find the legitimate document template that meets the state and federal requirements you need. US Legal Forms supplies a large number of legitimate kinds that happen to be evaluated by pros. You can actually obtain or produce the Virginia Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement from the service.

If you currently have a US Legal Forms account, it is possible to log in and then click the Download option. After that, it is possible to total, edit, produce, or signal the Virginia Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement. Every single legitimate document template you purchase is your own property eternally. To acquire one more backup for any bought form, go to the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms internet site for the first time, stick to the basic directions beneath:

- First, make sure that you have selected the best document template to the area/metropolis of your choice. Browse the form outline to make sure you have chosen the right form. If available, make use of the Review option to look throughout the document template too.

- In order to get one more edition in the form, make use of the Search area to discover the template that meets your requirements and requirements.

- Upon having found the template you want, just click Purchase now to move forward.

- Select the rates prepare you want, type in your references, and sign up for a free account on US Legal Forms.

- Full the deal. You should use your credit card or PayPal account to fund the legitimate form.

- Select the file format in the document and obtain it for your device.

- Make alterations for your document if necessary. It is possible to total, edit and signal and produce Virginia Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement.

Download and produce a large number of document templates while using US Legal Forms website, that offers the biggest assortment of legitimate kinds. Use skilled and state-specific templates to tackle your company or personal requires.

Form popularity

FAQ

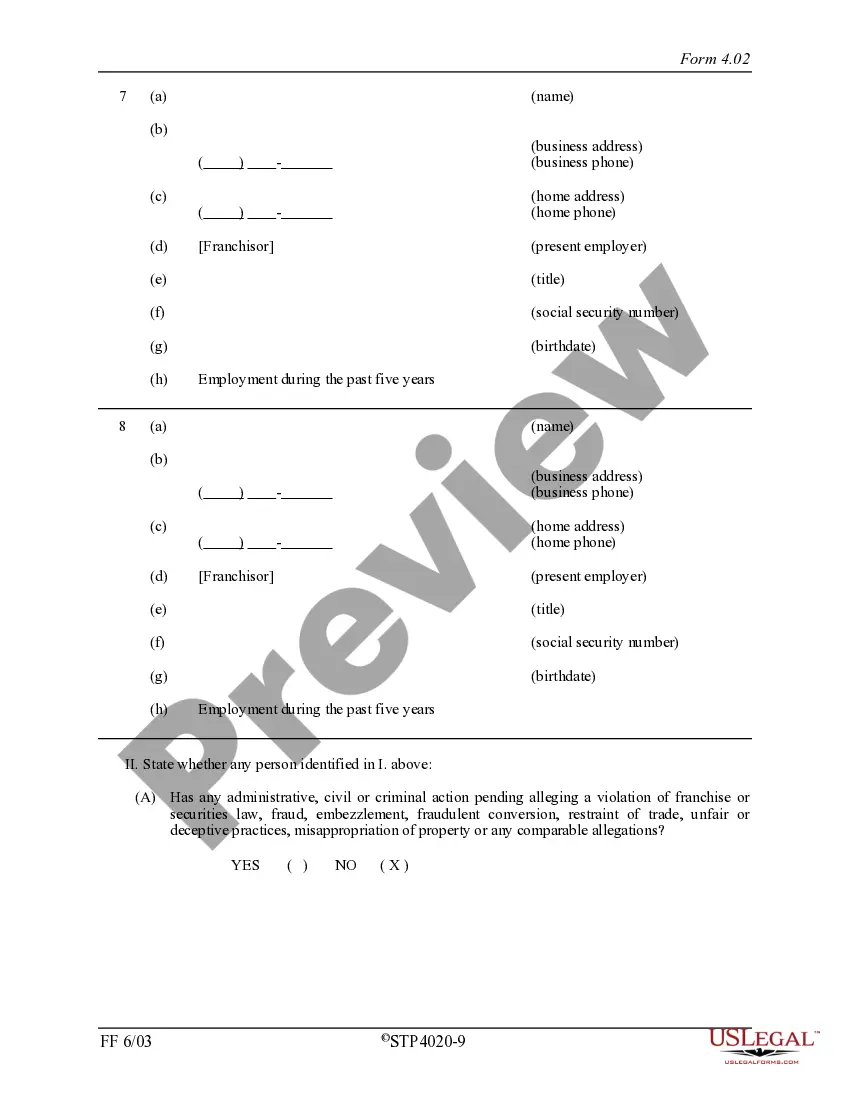

Registration statements have two principal parts. In the prospectus, your company must clearly describe important information about its business operations, financial condition, results of operations, risk factors, and management. The prospectus must also include audited financial statements.

Hear this out loud PauseA registration statement is a document providing qualitative and quantitative information to investors that issuers must file with the Securities and Exchange Commission (SEC) in order to publicly offer securities.

1934 Act Registration. The 1934 Act requires companies with a widely traded class of equity securities to register those securities with the SEC. Registration under the 1934 Act is a one-time registration of an entire class of securities.

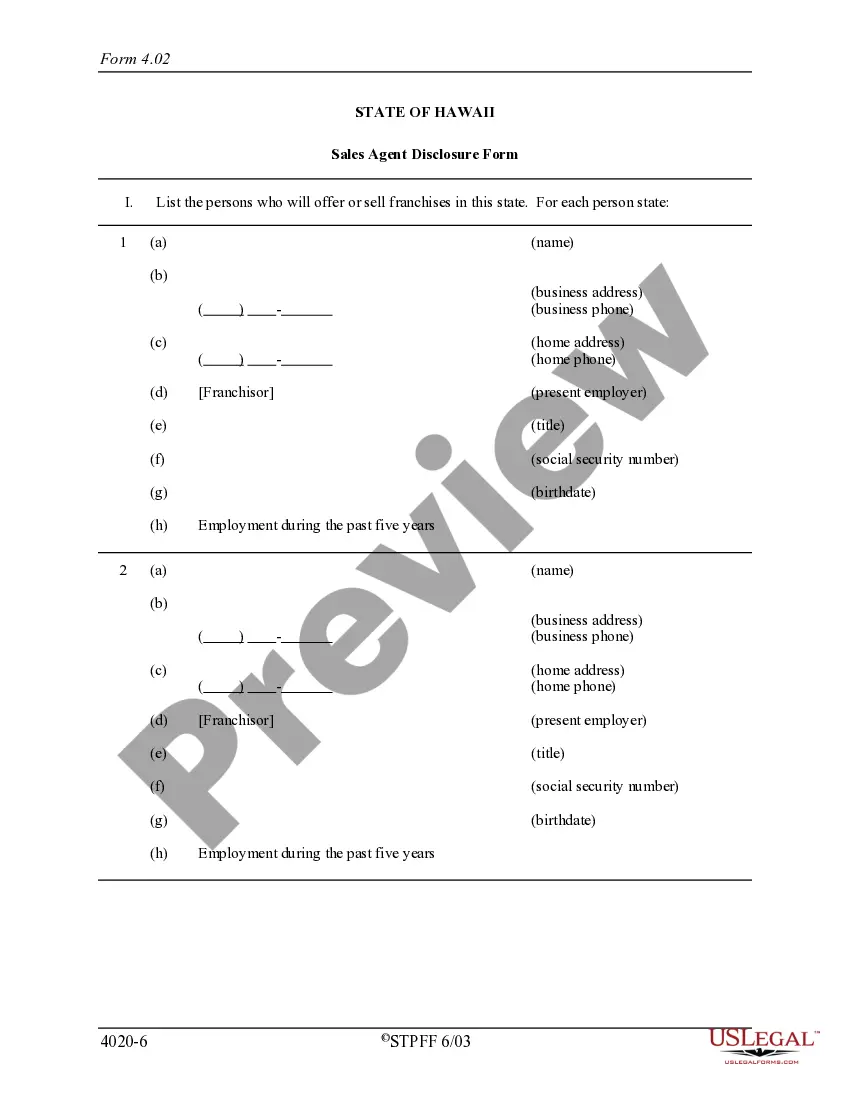

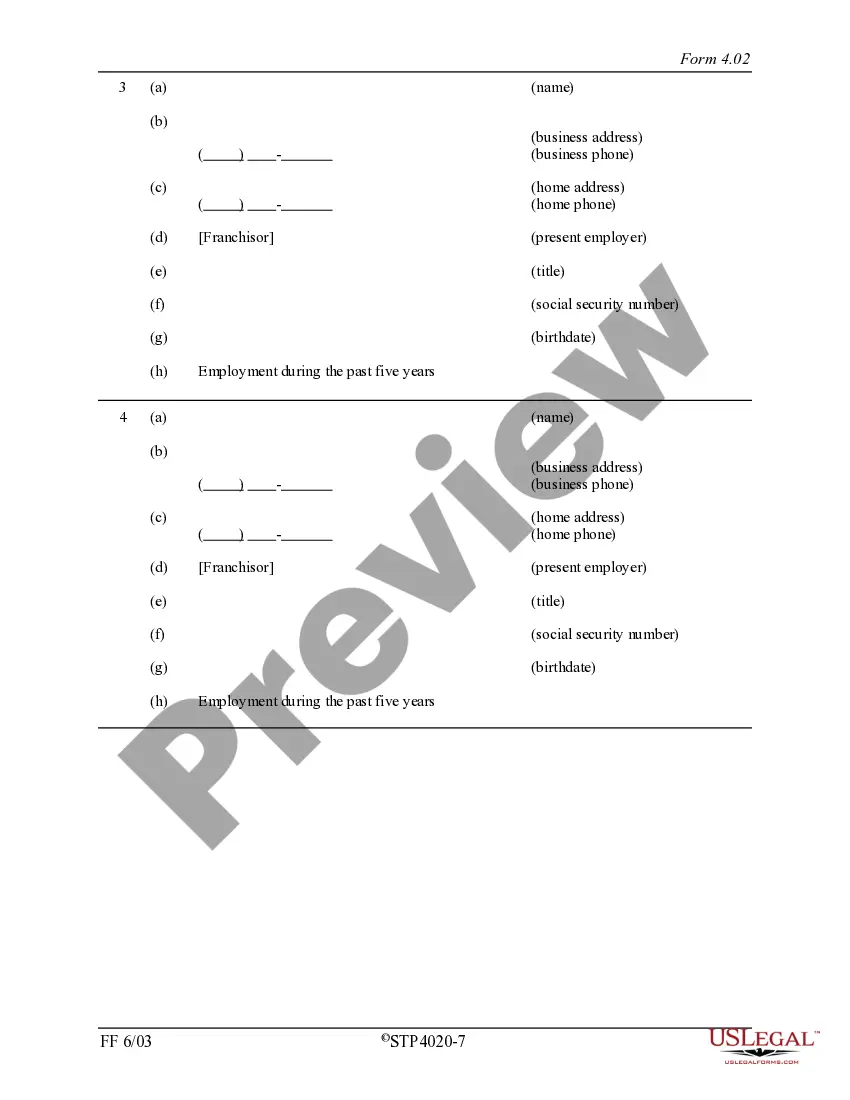

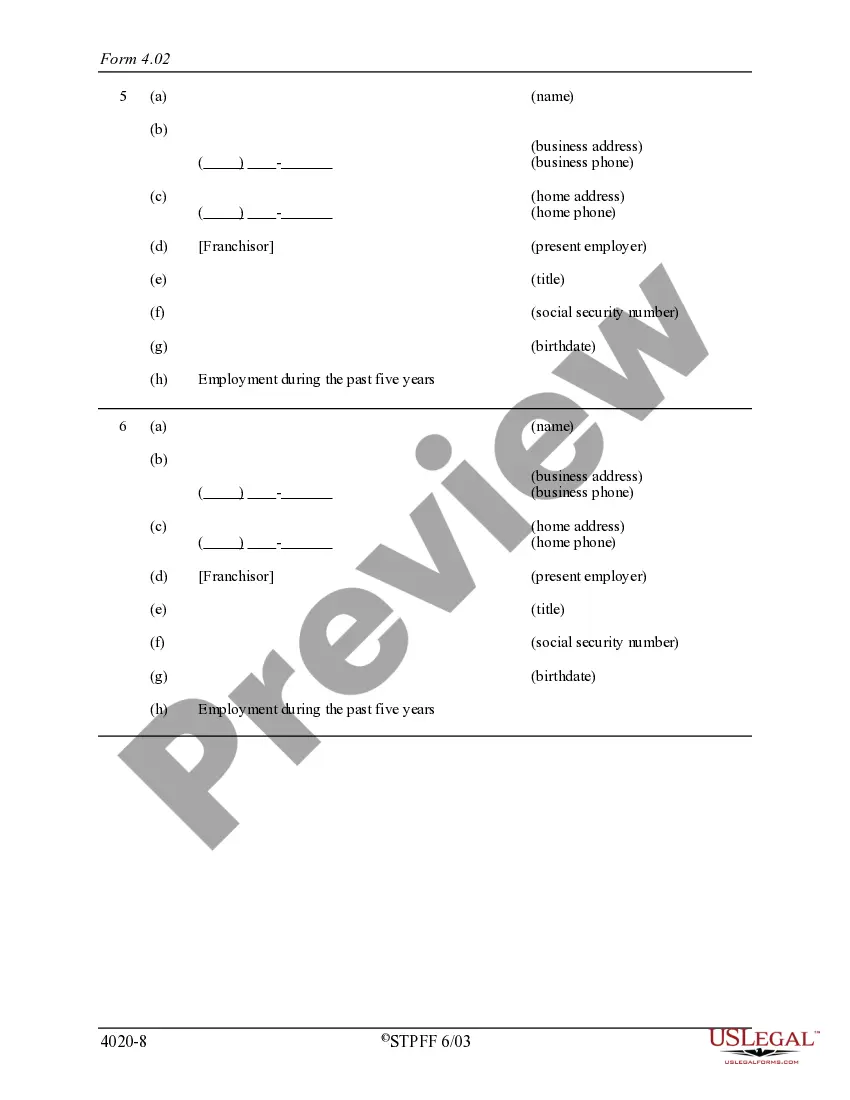

Hear this out loud PauseHawaii is a franchise registration state. Before you offer or sell a franchise in Hawaii you must register your Franchise Disclosure Document (FDD) with the Business Registration Division of the Hawaii State Dept. of Commerce and Consumer Affairs.

Registration statement. a document that an issuer of securities files with the SEC that contains required information about the issuer, the securities to be issued, and other relevant information.

Statement of the Register is a document about a fact of registration. Certificate of Incorporation is a document about a fact of creation of a company.

Hear this out loud PauseArkansas is not a franchise registration state nor a franchise filing state, so you may offer or sell your franchise without registering or filing your Franchise Disclosure Document (?FDD?) with the state, provided that you are compliant with the Federal Franchise Rule.

Hear this out loud PauseVirginia is a franchise registration state. Before offering or selling a franchise in Virginia franchisors must register and file their FDD with the Virginia State Corporation Commission. Virginia's franchise law, known as the Virginia Retail Franchising Act, Section 13.1-557, et. seq.