Virginia Exemption Statement

Description

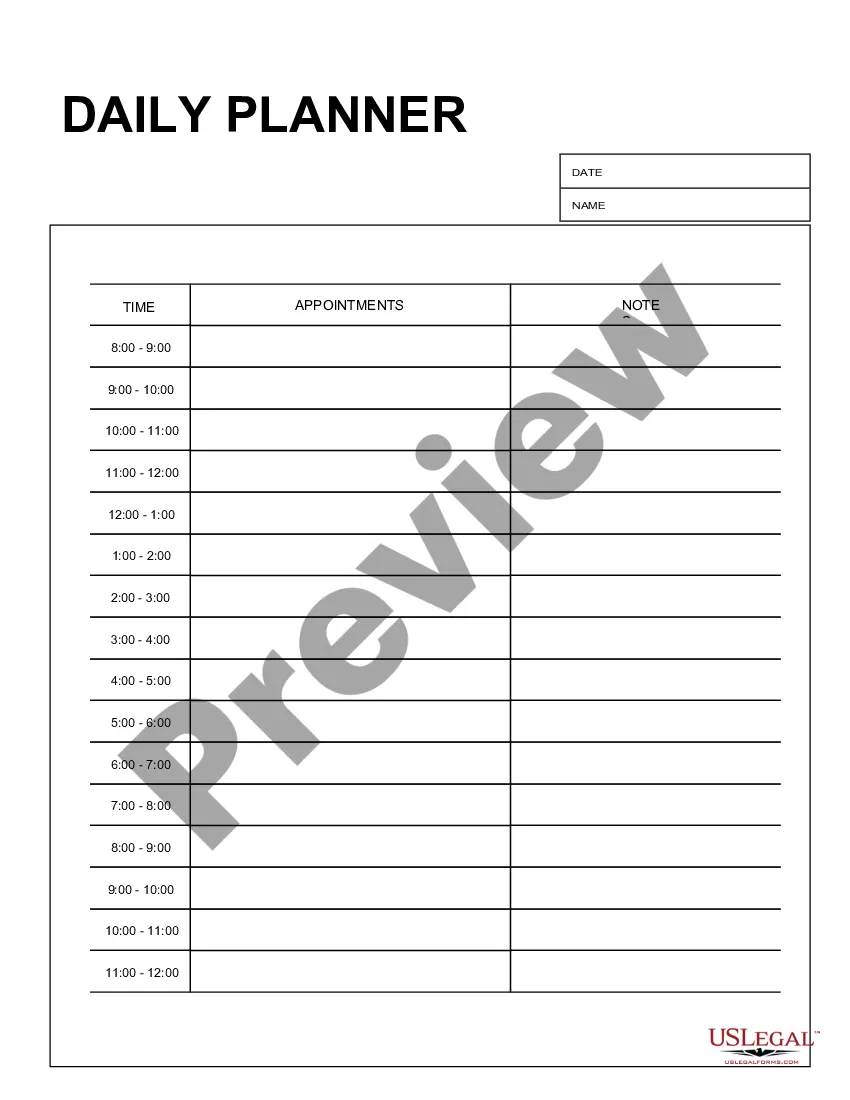

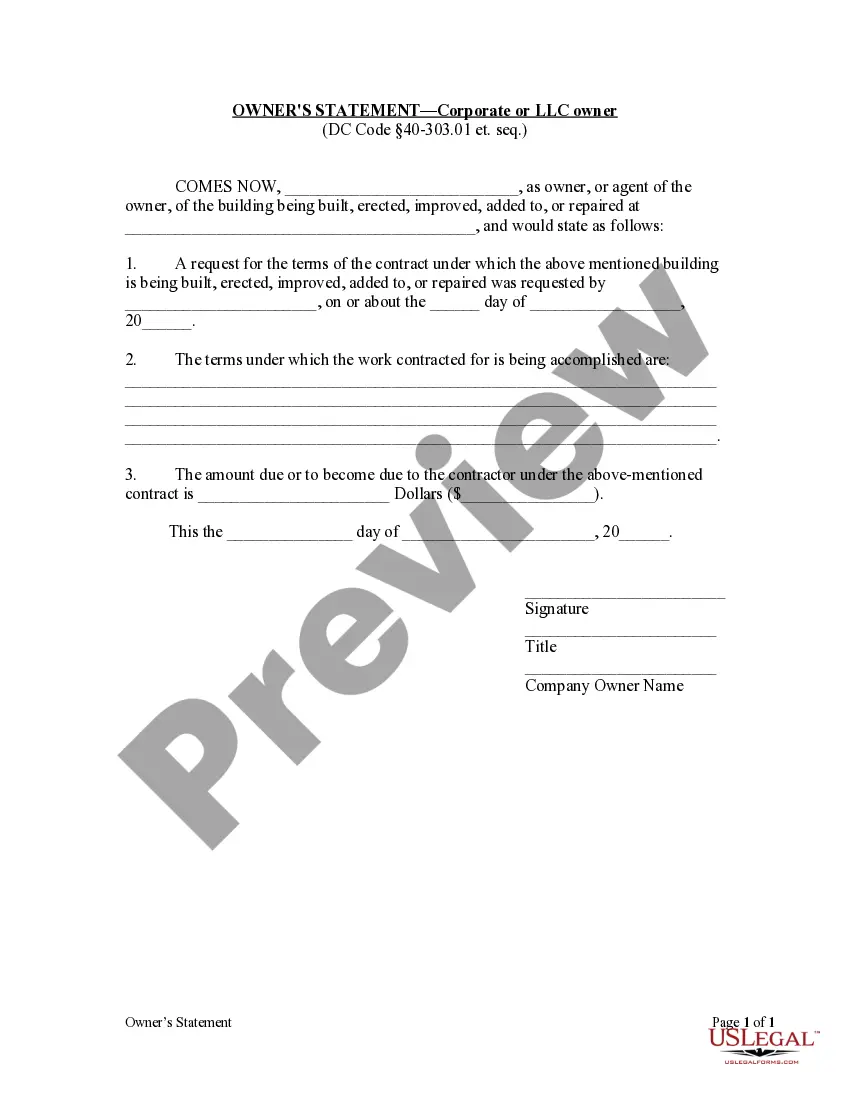

How to fill out Exemption Statement?

It is possible to devote hours on the web attempting to find the legal document format that meets the state and federal demands you require. US Legal Forms offers thousands of legal forms which can be reviewed by professionals. It is possible to down load or printing the Virginia Exemption Statement - Texas from our support.

If you currently have a US Legal Forms bank account, it is possible to log in and click on the Acquire button. Afterward, it is possible to full, edit, printing, or indicator the Virginia Exemption Statement - Texas. Every single legal document format you acquire is your own property for a long time. To obtain an additional backup of the purchased kind, go to the My Forms tab and click on the related button.

If you are using the US Legal Forms web site the first time, keep to the easy instructions listed below:

- Very first, make sure that you have chosen the proper document format for the region/area that you pick. Read the kind outline to ensure you have picked the right kind. If readily available, make use of the Review button to search from the document format too.

- In order to discover an additional version in the kind, make use of the Research field to discover the format that meets your needs and demands.

- When you have discovered the format you need, click Buy now to carry on.

- Pick the pricing plan you need, key in your qualifications, and register for a merchant account on US Legal Forms.

- Total the purchase. You can utilize your bank card or PayPal bank account to fund the legal kind.

- Pick the file format in the document and down load it to your gadget.

- Make adjustments to your document if required. It is possible to full, edit and indicator and printing Virginia Exemption Statement - Texas.

Acquire and printing thousands of document web templates utilizing the US Legal Forms Internet site, that offers the largest collection of legal forms. Use specialist and condition-specific web templates to tackle your organization or specific needs.

Form popularity

FAQ

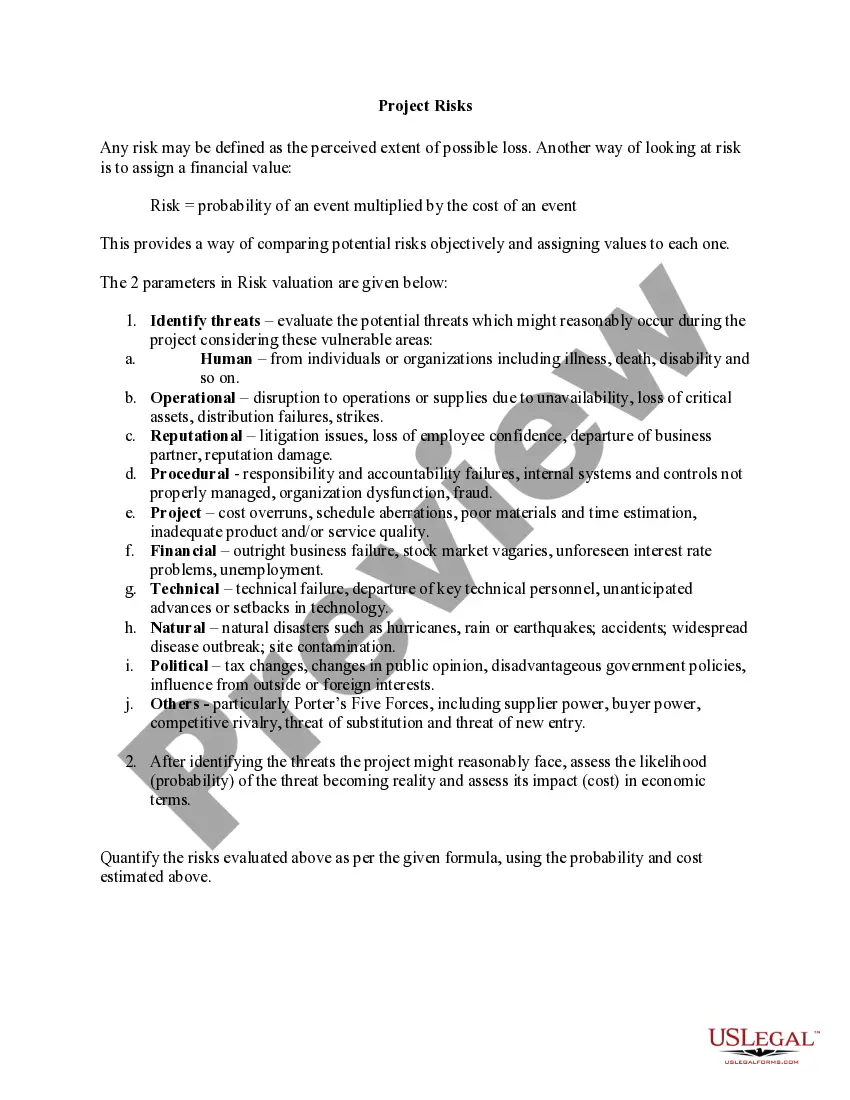

To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You must include the Ag/Timber Number on the agricultural exemption certificate (PDF) or the timber exemption certificate (PDF) when buying qualifying items. Agricultural and Timber Exemptions - Texas Comptroller texas.gov ? taxes ? ag-timber texas.gov ? taxes ? ag-timber

Common Texas sales tax exemptions include those for necessities of life, including most food and health-related items. In addition, goods for resale, such as wholesale items, are exempt from sales tax, as well as newspapers, containers, previously taxed items, and certain goods used for manufacturing.

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube Start of suggested clip End of suggested clip Address is different make sure you type in your mailing. Address here for section 3 put in the dateMoreAddress is different make sure you type in your mailing. Address here for section 3 put in the date you became the owner of the property. And then put the date you began living in the property. HECHO! How to Fill out Texas Homestead Exemption 2022 youtube.com ? watch youtube.com ? watch

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

In Texas, veterans with a disability rating of: 100% are exempt from all property taxes. 70 to 100% receive a $12,000 property tax exemption. 50 to 69% receive a $10,000 property tax exemption. Property tax breaks, disabled veterans exemptions traviscountytx.gov ? disabled-vet-exempt traviscountytx.gov ? disabled-vet-exempt

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller. Exemption Certificates - Texas Administrative Code sos.state.tx.us ? public sos.state.tx.us ? public

Applications for property tax exemptions are filed with the appraisal district in which the property is located. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether or not property qualifies for an exemption.