Virginia Checklist for Proving Entertainment Expenses

Description

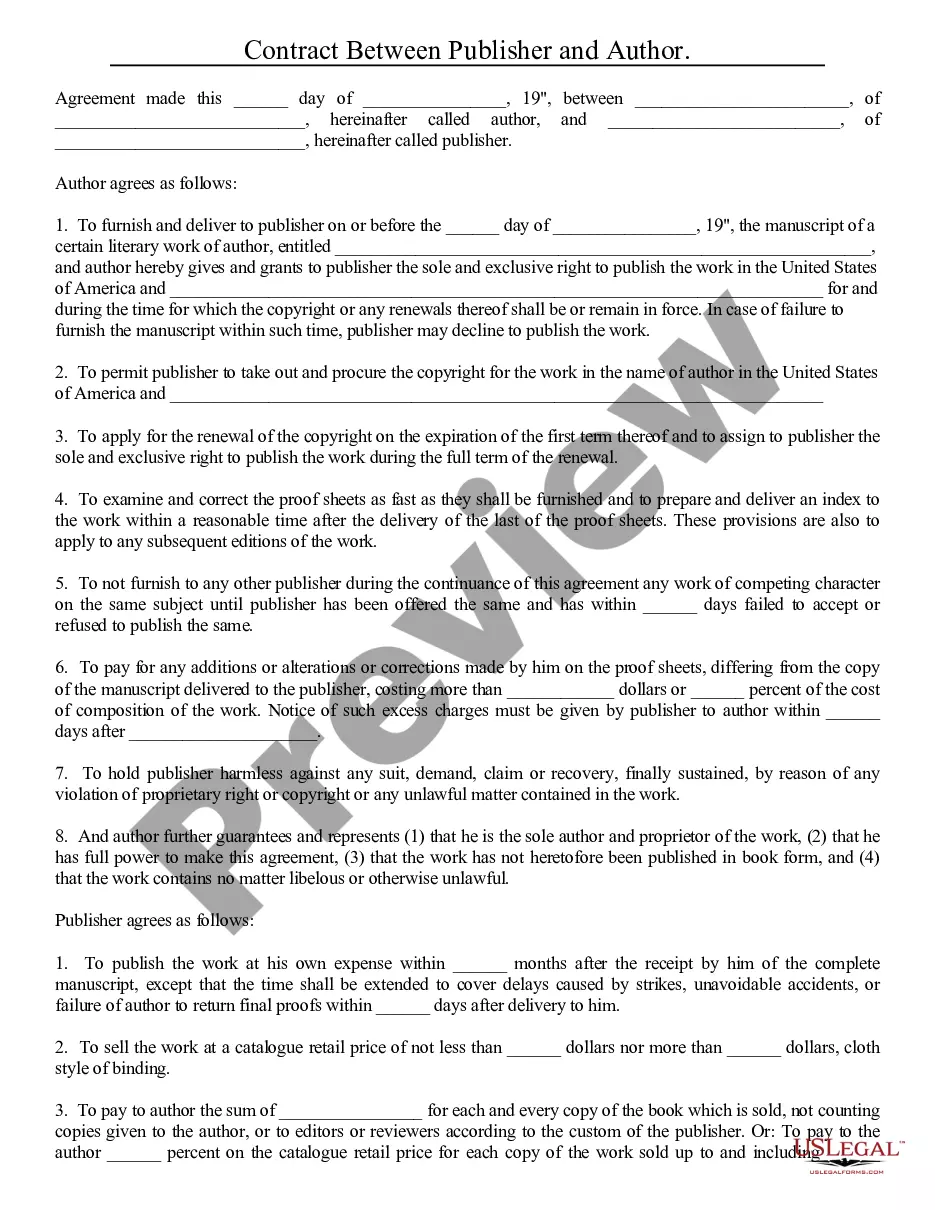

How to fill out Checklist For Proving Entertainment Expenses?

If you want to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site’s straightforward and user-friendly search function to find the documents you require.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 3. If you are dissatisfied with the form, utilize the Search bar at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Utilize US Legal Forms to acquire the Virginia Checklist for Proving Entertainment Expenses in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Virginia Checklist for Proving Entertainment Expenses.

- You can also access forms you previously saved from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure that you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the form's content. Don't forget to read the summary.

Form popularity

FAQ

Entertainment expenses, like a sporting event or tickets to a show, are still non-deductible. However, team-building activities for employees are deductible.

This temporary 100% deduction was designed to help restaurants, many of which have been hard-hit by the COVID-19 pandemic. Entertainment expenses, like a sporting event or tickets to a show, are still non-deductible. However, team-building activities for employees are deductible.

Providing entertainment means: providing entertainment by way of food, drink or recreation....What is tax-exempt body entertainment?the cost of meals provided to employees in a staff cafeteria (not including social functions)the cost of meals at certain business seminars.meals on business travel overnight.

2022 Meals And Entertainment Deductions ListBusiness meals with clients (50%)Office snacks and other food items (50%)The cost of meals while traveling for work (50%)Meals at a conference that go above the ticket price (50%)Lunch out with less than half of company employees (50%)More items...?

Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. Entertaining clients (concert tickets, golf games, etc.) Wondering how this breaks down? If you're dining out with a client at a restaurant, you can consider that meal 100% tax-deductible.

Section 1.274-2(b)(1)(i) of the Income Tax Regulations provides that the term entertainment means any activity which is of a type generally considered to constitute entertainment, amusement, or recreation, such as entertaining at night clubs, cocktail lounges, theaters, country clubs, golf and athletic clubs,

Businesses will be permitted to fully deduct business meals that would normally be 50% deductible. Although this change will not affect your 2020 tax return, the savings will offer a 100% deduction in 2021 and 2022 for food and beverages provided by a restaurant.

Tax relief for staff entertainingStaff entertaining is generally considered to be an allowable business expense and is therefore tax deductible. Allowable costs in this context include food, drink, entertainment, venue hire, transport and overnight accommodation.

Entertainment expenses include the cost of entertaining customers or employees at social and sports events, restaurant meals and theater tickets, among other things. You may deduct business entertainment expenses subject to certain conditions.

Generally, the answer is that you can deduct ordinary and necessary expenses to entertain a customer or client if:Your expenses are of a type that qualifies as meals or entertainment.Your expenses bear the necessary relationship to your business activities.You keep adequate records and can substantiate the expenses.