Virginia Check Requisition Worksheet

Description

How to fill out Check Requisition Worksheet?

Are you currently in a situation where you require documents for either business or personal purposes on a daily basis.

There are numerous legal document templates accessible on the Internet, but finding ones you can rely on is not easy.

US Legal Forms offers thousands of document templates, including the Virginia Check Requisition Worksheet, that are designed to comply with federal and state regulations.

Select the pricing plan you prefer, provide the necessary information to create your account, and pay for the order using PayPal or a credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can download another copy of the Virginia Check Requisition Worksheet at any time, if needed. Click on the appropriate document to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Virginia Check Requisition Worksheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/state.

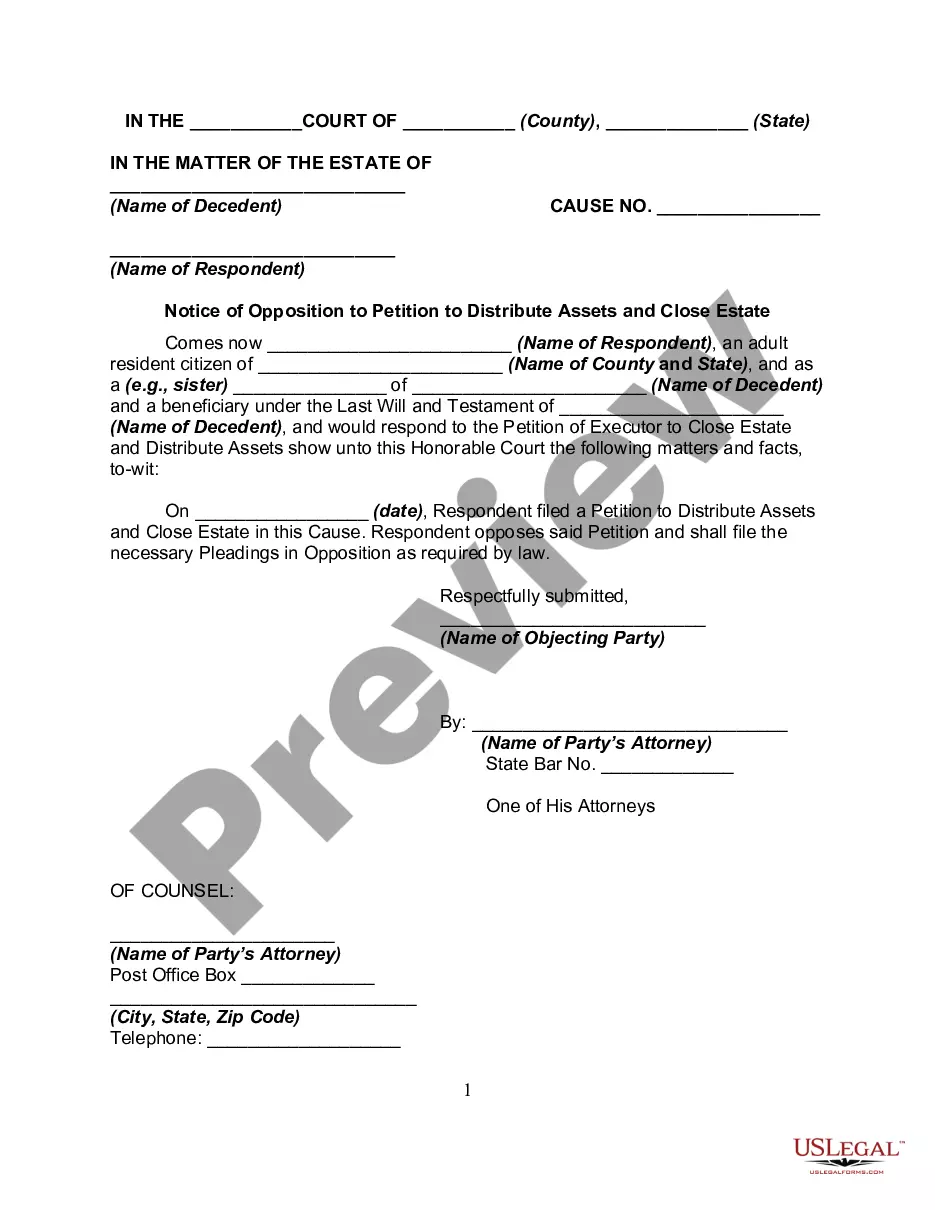

- Utilize the Preview button to review the form.

- Read the description to make sure you have selected the right document.

- If the document isn’t what you’re looking for, use the Search field to find the template that meets your needs and specifications.

- When you locate the appropriate document, click Download now.

Form popularity

FAQ

A planning worksheet focuses on budgeting and outlining future expenses, while a requisition worksheet is specifically designed for requesting approval for immediate purchases. The Virginia Check Requisition Worksheet falls under the latter category, allowing users to specify their needs and receive timely approval for transactions. Understanding this distinction helps users efficiently manage both budgeting and requisitioning processes.

Attach check or money order payable to Virginia Department of Taxation. Include your Social Security number and the tax period for the payment on the check. If your financial institution does not honor your payment to us, we may impose a $35 fee (Code of Virginia § 2.2-614.1).

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

When completing the Commonwealth of Virginia Form VA-4: Line 1 On Line 1(c), please write in the number 0 or 1 (NRAs can only select a maximum of 1 as their total number of allowances Line 2 skip. Line 3 skip (NRAs cannot check this box) Line 4 (not on older form) skip.

You may not claim more personal exemptions on form VA-4 than you are allowed to claim on your income tax return unless you have received written permission to do so from the Department of Taxation. Line1. You may claim an exemption for yourself.

When completing the Commonwealth of Virginia Form VA-4: Line 1 On Line 1(c), please write in the number 0 or 1 (NRAs can only select a maximum of 1 as their total number of allowances Line 2 skip. Line 3 skip (NRAs cannot check this box) Line 4 (not on older form) skip.

You may not claim more personal exemptions on form VA-4 than you are allowed to claim on your income tax return unless you have received written permission to do so from the Department of Taxation. Line1. You may claim an exemption for yourself.

Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.

Use this form to notify your employer whether you are subject to Virginia income tax withholding and how many exemptions you are allowed to claim. You must file this form with your employer when your employment begins.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.