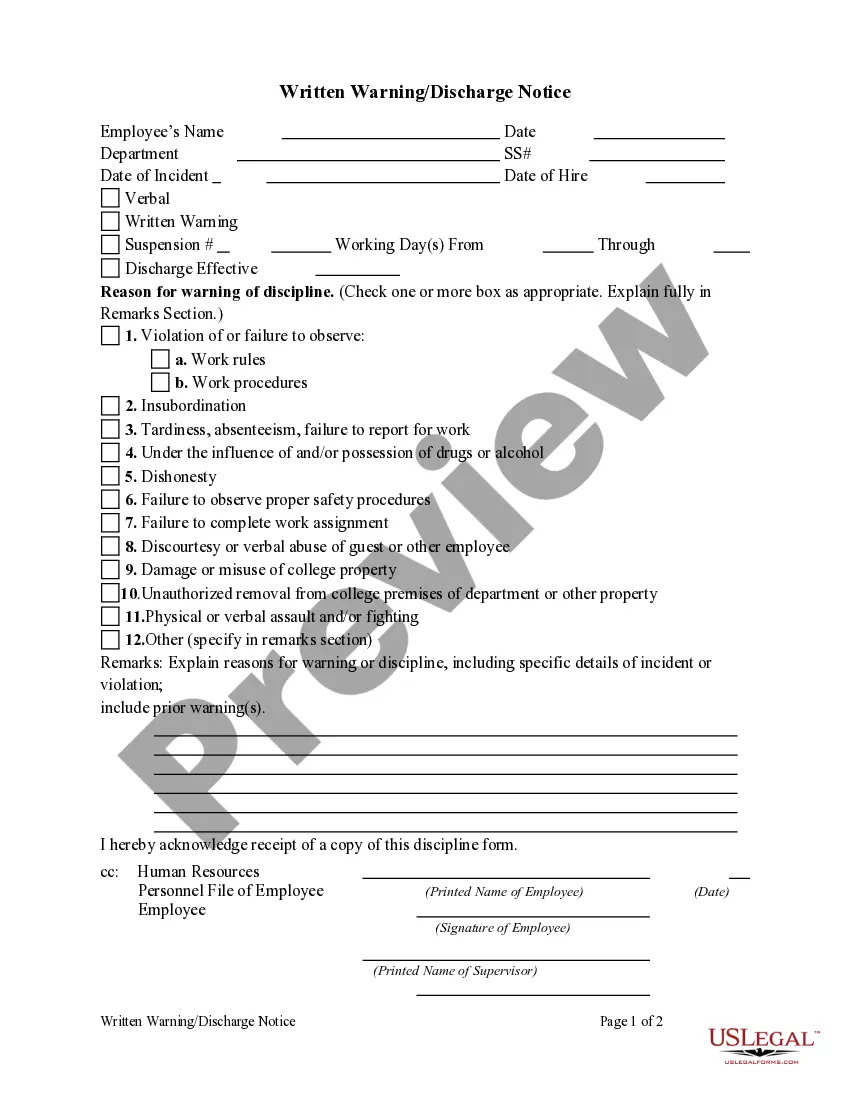

Virginia Employee Notice to Correct IRCA Compliance

Description

How to fill out Employee Notice To Correct IRCA Compliance?

It is feasible to spend hours on the Internet searching for the legal document template that fits the federal and state requirements you need.

US Legal Forms provides thousands of legal forms that can be reviewed by professionals.

You can easily download or print the Virginia Employee Notice to Correct IRCA Compliance from the service.

If available, utilize the Preview button to look through the document template as well.

- If you currently possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Virginia Employee Notice to Correct IRCA Compliance.

- Every legal document template you purchase is yours to keep permanently.

- To obtain an additional copy of the purchased form, navigate to the My documents tab and click on the appropriate button.

- If you’re using the US Legal Forms site for the first time, follow the basic instructions below.

- First, ensure that you have selected the correct document template for the area/region you choose.

- Review the form summary to ensure you have selected the correct form.

Form popularity

FAQ

IRCA requires all employers to have all employees hired after 1986 complete I-9 verification paperwork. Workers who are not hired do not need to complete I-9 Forms and employers who selectively choose who will and will not complete I-9s could face penalties under anti-discrimination rules.

What Happens If You Don't Give 2 Weeks' Notice? You could break the provisions of your contract, and that could have legal repercussions. If you have no choice, then notifying your employer and giving as much notice as possible (or perhaps even working out a new deal) can potentially make the fallout less serious.

The Immigration Reform and Control Act (IRCA) of 1986 requires all U.S. employers, regardless of size, to complete a Form I-9 upon hiring a new employee to work in the United States.

Employers must: Have a completed Form I-9 on file for each person on their payroll who is required to complete the form; Retain and store Forms I-9 for three years after the date of hire, or for one year after employment is terminated, whichever is later; and.

In 2016, the Virginia Supreme Court held that employers and employees need not provide advance notice before terminating an at will employment relationship. No child under the age of 16 can be employed except under such hours and conditions as the Department of Labor and Industry may set.

Which I-9 Documents Need to Be Reverified?Temporary Evidence of Lawful Permanent Residence in the form of I-551 Stamp in a Foreign Passport.Temporary Evidence of Lawful Permanent Residence in the form of a machine-readable Immigrant Visa with a I-551 Notation.Employment Authorization Document Form I-776.More items...?

In 2016, the Virginia Supreme Court held that employers and employees need not provide advance notice before terminating an at will employment relationship. No child under the age of 16 can be employed except under such hours and conditions as the Department of Labor and Industry may set.

The Immigration Reform and Control Act (IRCA) of 1986 requires all U.S. employers, regardless of size, to complete a Form I-9 upon hiring a new employee to work in the United States.

The Immigration Reform and Compliance Act of 1986 (IRCA) prohibits the employment of unauthorized aliens and requires all employers to: (1) not knowingly hire or continue to employ any person not authorized to work in the United States, (2) verify the employment eligibility of every new employee (whether the employee