Virginia Personnel Status Change Worksheet

Description

How to fill out Personnel Status Change Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates you can download or create.

By utilizing the website, you can access thousands of forms for business and personal uses, categorized by types, states, or keywords. You can find the latest versions of forms such as the Virginia Employee Status Change Worksheet within moments.

If you already possess a subscription, Log In to obtain the Virginia Employee Status Change Worksheet from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Every form you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Access the Virginia Employee Status Change Worksheet with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Ensure you have selected the appropriate form for your region/area. Click the Preview button to review the form's content. Check the form details to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button. Then, select your preferred payment option and provide your details to register for an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

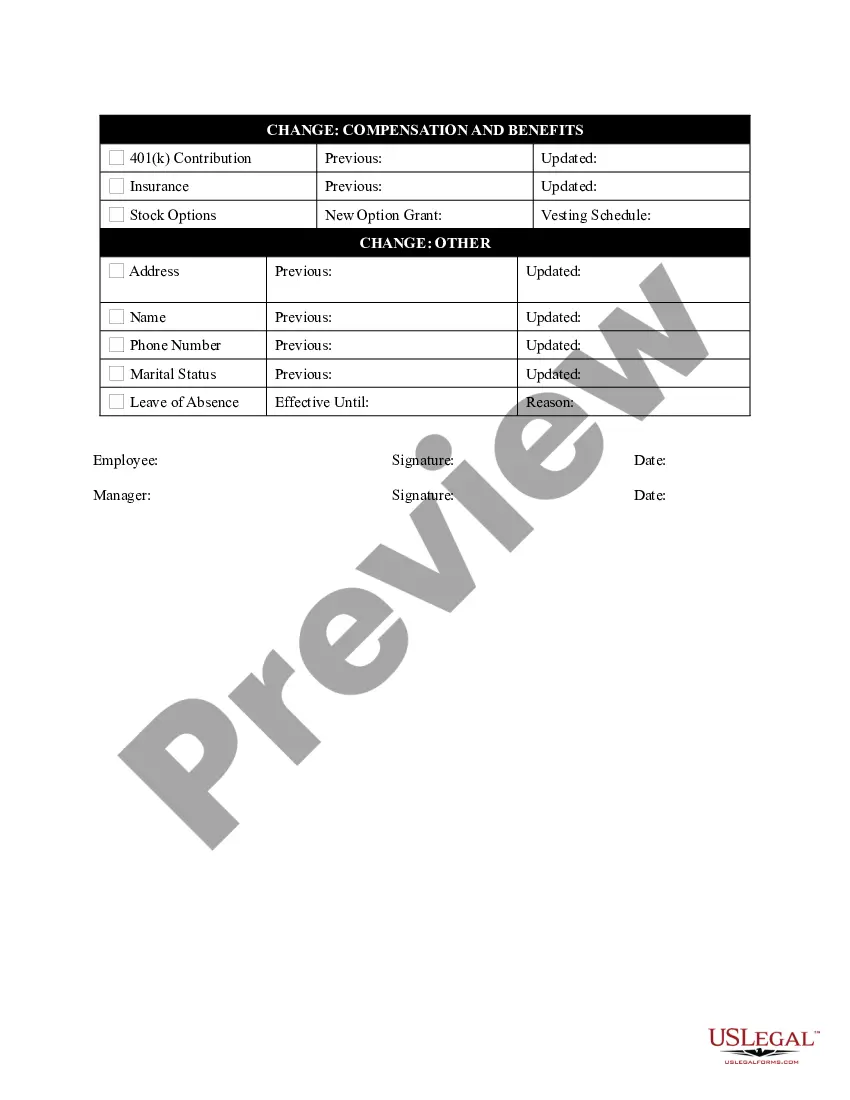

- Make modifications. Fill in, edit, and print and sign the downloaded Virginia Employee Status Change Worksheet.

Form popularity

FAQ

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

You may not claim more personal exemptions on form VA-4 than you are allowed to claim on your income tax return unless you have received written permission to do so from the Department of Taxation. Line1. You may claim an exemption for yourself.

Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. You can also claim one tax exemption for each person who qualifies as your dependent, your spouse is never considered your dependent.

Personal Exemptions: The Basics A personal exemption was a specific amount of money that you could deduct for yourself and for each of your dependents. Regardless of your filing status is, you qualify for the same exemption. For tax year 2017 (the taxes you filed in 2018), the personal exemption was $4,050 per person.

If you do not agree to withhold additional tax, the employee may need to make estimated tax payments. An employee is exempt from Virginia withholding if he or she meets any of the conditions listed on Form VA-4 or VA-4P. The employee must file a new certificate each year to certify the exemption.

Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.

You can claim a personal exemption for yourself unless someone else can claim you as a dependent. Note that's if they can claim you, not whether they actually do. If you qualify as someone else's dependent, you can't claim the personal exemption even if they don't actually claim you on their return.

When completing the Commonwealth of Virginia Form VA-4: Line 1 On Line 1(c), please write in the number 0 or 1 (NRAs can only select a maximum of 1 as their total number of allowances Line 2 skip. Line 3 skip (NRAs cannot check this box) Line 4 (not on older form) skip.

First, what you claim on the W-4 does not have to match what you eventually claim on your actual tax return. If you want the maximum take home pay claim yourself on the W-4. If you want a refund at tax time, claim 0 exemptions. You mother will have no access to your refund.