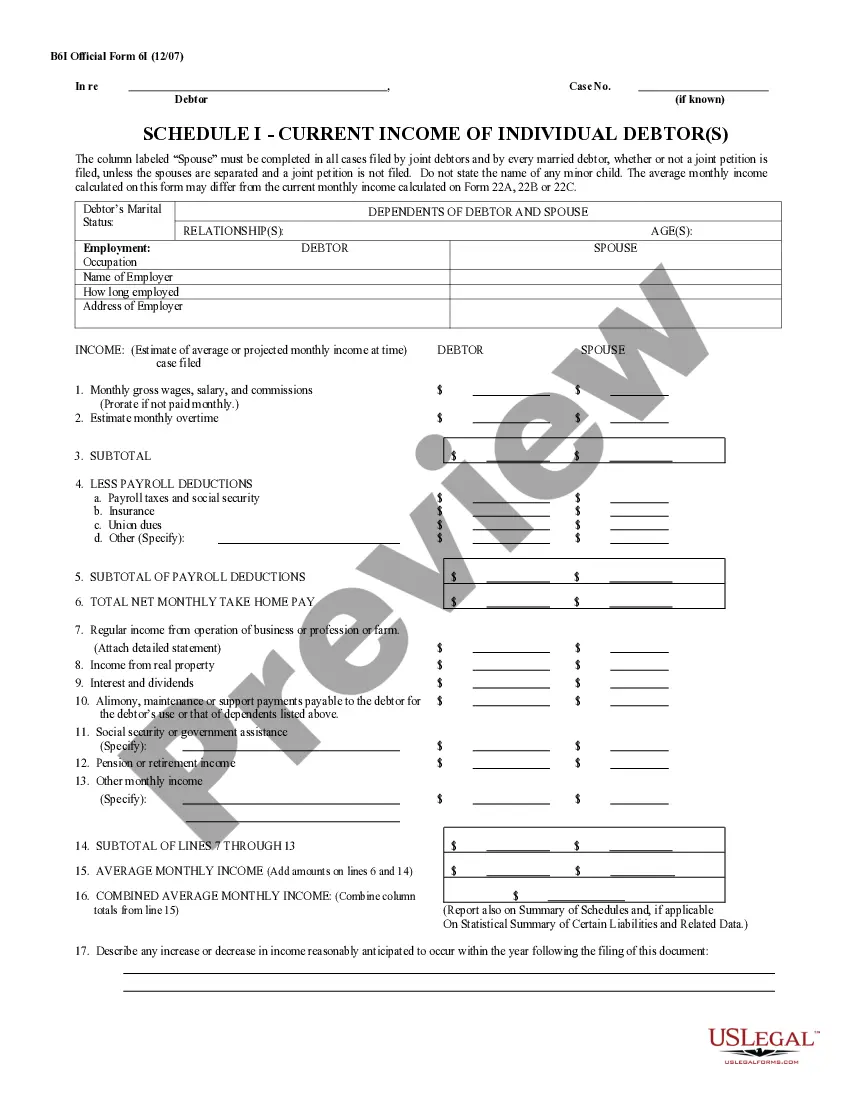

Virginia Summary of Schedules - Form 6CONTSUM - Post 2005

Description

How to fill out Summary Of Schedules - Form 6CONTSUM - Post 2005?

US Legal Forms - among the biggest libraries of lawful forms in the States - provides a variety of lawful file layouts you are able to down load or produce. While using site, you can get 1000s of forms for company and specific reasons, categorized by categories, claims, or keywords.You can find the latest versions of forms such as the Virginia Summary of Schedules - Form 6CONTSUM - Post 2005 in seconds.

If you currently have a subscription, log in and down load Virginia Summary of Schedules - Form 6CONTSUM - Post 2005 through the US Legal Forms library. The Down load option will show up on every type you see. You get access to all previously saved forms inside the My Forms tab of your bank account.

If you would like use US Legal Forms the first time, here are easy guidelines to help you get started:

- Be sure you have picked out the correct type to your metropolis/county. Click on the Preview option to review the form`s information. Browse the type information to ensure that you have chosen the right type.

- When the type doesn`t match your demands, take advantage of the Search field towards the top of the display to discover the one who does.

- Should you be happy with the shape, validate your option by visiting the Acquire now option. Then, select the pricing strategy you prefer and supply your references to sign up on an bank account.

- Approach the deal. Use your bank card or PayPal bank account to complete the deal.

- Pick the structure and down load the shape on your gadget.

- Make adjustments. Load, change and produce and indicator the saved Virginia Summary of Schedules - Form 6CONTSUM - Post 2005.

Each template you included in your bank account lacks an expiration time and is also the one you have permanently. So, in order to down load or produce an additional version, just go to the My Forms segment and click around the type you require.

Get access to the Virginia Summary of Schedules - Form 6CONTSUM - Post 2005 with US Legal Forms, the most extensive library of lawful file layouts. Use 1000s of professional and express-distinct layouts that satisfy your company or specific requirements and demands.

Form popularity

FAQ

During your lifetime, you can file for bankruptcy protection as many times as you need it. There is no limit to how many times you can file, but there are time limits between filing dates. You could file but not receive any debt discharge in some cases, so you need to be careful.

Chapter 13 to Chapter 13 ? Time Limit You can file a second Chapter 13 after two years, but that's an unusual maneuver since the minimum length of a Chapter 13 repayment is three years. Unforeseen hardships may hit and necessitate a quicker second filing.

During your lifetime, you can file for bankruptcy protection as many times as you need it. There is no limit to how many times you can file, but there are time limits between filing dates. You could file but not receive any debt discharge in some cases, so you need to be careful.

This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

Experiencing a bankruptcy dismissal can be an overwhelming experience, especially when creditors start reaching out to you for payment. In such situations, one way to handle this is through debt settlement. Debt settlement is negotiating with creditors to reorganize the debt by agreeing on a payment schedule.

The law says that a person who has received a ?discharge? in bankruptcy must wait several years before being eligible for discharge in another case. However, if you were in a Chapter 13 case that was dismissed before you received a discharge, then this limitation doesn't apply. You would be free to refile immediately.

The law says that a person who has received a ?discharge? in bankruptcy must wait several years before being eligible for discharge in another case. However, if you were in a Chapter 13 case that was dismissed before you received a discharge, then this limitation doesn't apply. You would be free to refile immediately.

Assets are what a business owns, and liabilities are what a business owes. Both are listed on a company's balance sheet, a financial statement that shows a company's financial health. Assets minus liabilities equal equity?or the company's net worth.