Virginia Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation

Description

How to fill out Agreement Of Merger Between Barber Oil Corporation And Stock Transfer Restriction Corporation?

It is possible to commit hrs on the Internet searching for the authorized document format which fits the state and federal needs you require. US Legal Forms provides a huge number of authorized varieties which can be analyzed by experts. You can easily down load or print out the Virginia Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation from our service.

If you already possess a US Legal Forms profile, it is possible to log in and then click the Download key. Next, it is possible to total, change, print out, or indicator the Virginia Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation. Every authorized document format you get is yours forever. To obtain another backup for any bought kind, proceed to the My Forms tab and then click the related key.

If you are using the US Legal Forms website the first time, adhere to the simple recommendations under:

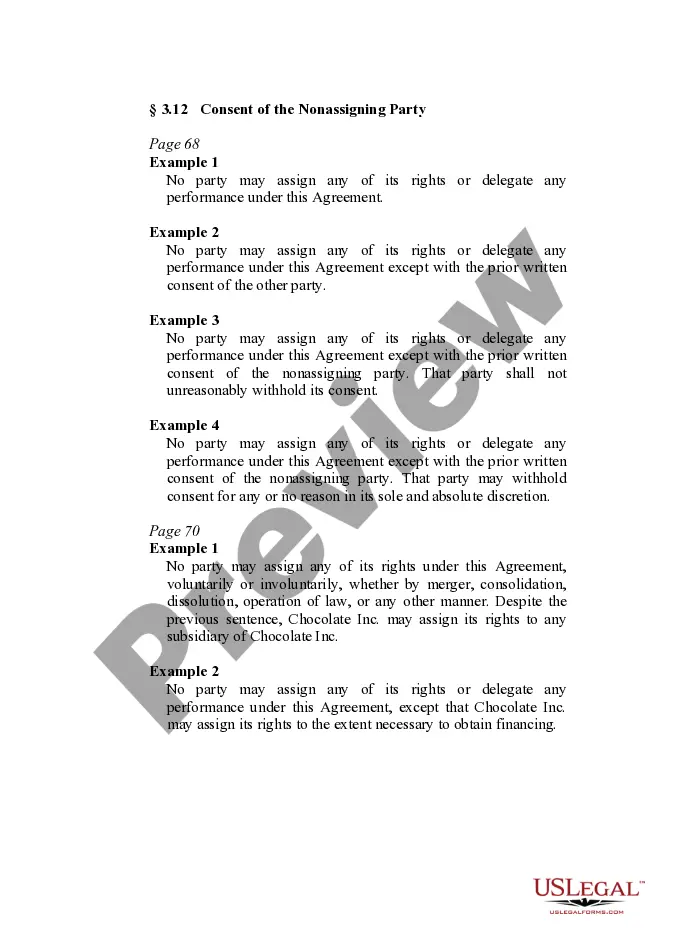

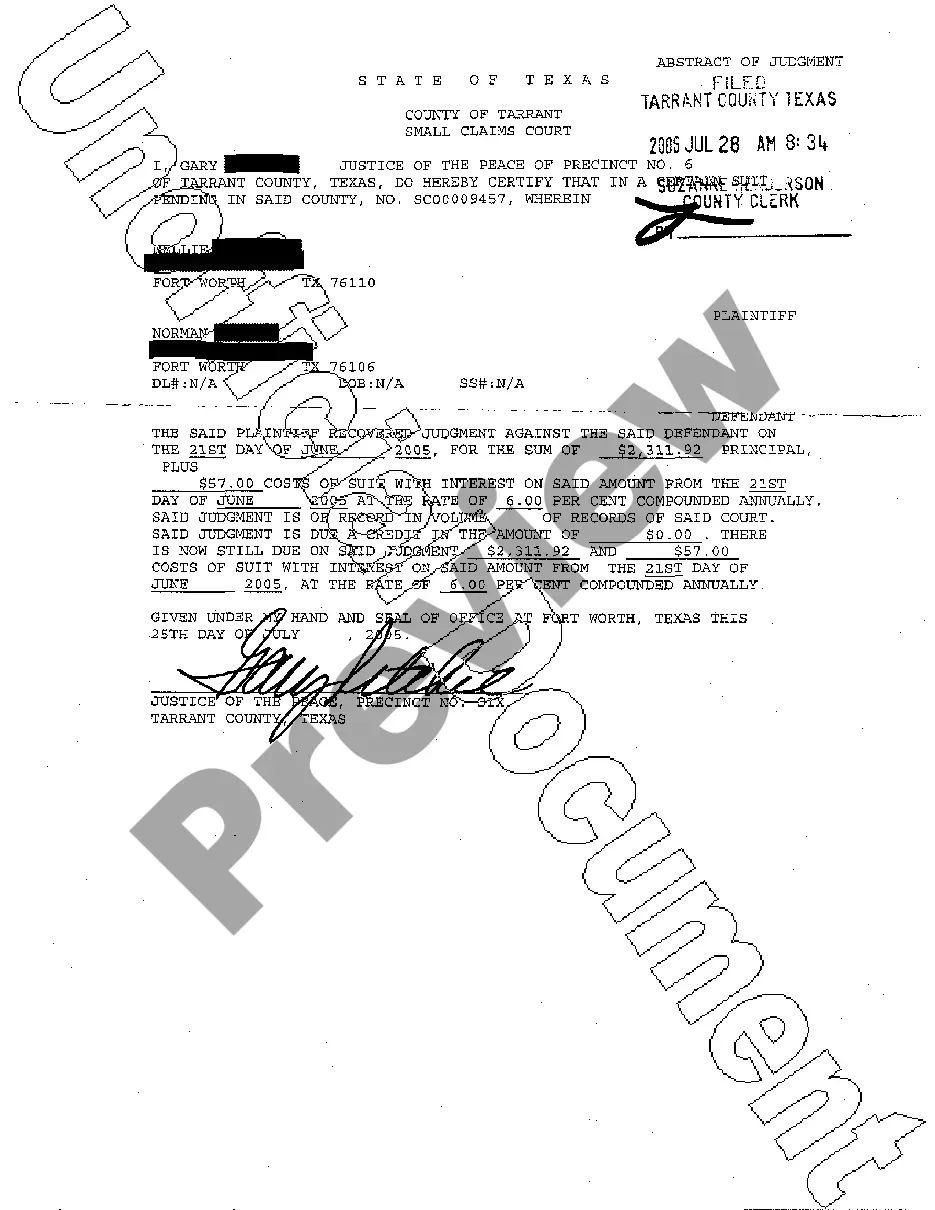

- Initial, make certain you have chosen the best document format for your region/metropolis that you pick. Browse the kind description to make sure you have picked out the proper kind. If accessible, make use of the Review key to check with the document format also.

- In order to find another version from the kind, make use of the Look for industry to find the format that meets your needs and needs.

- When you have identified the format you would like, click Buy now to proceed.

- Pick the costs strategy you would like, key in your accreditations, and sign up for your account on US Legal Forms.

- Complete the transaction. You can utilize your bank card or PayPal profile to purchase the authorized kind.

- Pick the structure from the document and down load it to your system.

- Make modifications to your document if needed. It is possible to total, change and indicator and print out Virginia Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation.

Download and print out a huge number of document layouts while using US Legal Forms website, which provides the greatest variety of authorized varieties. Use professional and condition-distinct layouts to take on your company or specific needs.

Form popularity

FAQ

The Institute for Mergers, Acquisitions and Alliances has the world's largest free-of-charge M&A Statistics database. Our faculty are the authors of many leading M&A books. M&A Database: Statistics, Publications, E-Library - Imaa-institute.org imaa-institute.org ? resources imaa-institute.org ? resources

Once a merger agreement has been reached and approved by the merging entities' owners, the merging entities face the complex process of completing the public records filings that will make the statutory merger legally binding. Public Records Filings for Statutory Mergers | Wolters Kluwer Wolters Kluwer ? ... ? Expert Insights Wolters Kluwer ? ... ? Expert Insights

Reporting to the SEC If public, both target and acquirer must disclose merger activity to the SEC. Terms can also be included as exhibits to the company's 10-K or 10-Q reports. Merger Filings - Mergers and Acquisitions - Research Guides cuny.edu ? c.php cuny.edu ? c.php

Business Source Complete, ABI/INFORM, Mergent Online, and Nexis Uni (formerly LexisNexis) will provide news articles on recent mergers and acquisitions, as well as industry reports. These industry reports may indicate whether an industry is consolidating or growing industry. How do I find information about company mergers and acquisitions? libanswers.com ? faq libanswers.com ? faq

Articles of merger are legal documents outlining the roles and responsibilities of two or more parties as they merge into a single entity. Articles of merger may also be called a certificate of merger. This agreement outlines the intent of multiple parties to merge and outline the merger's operational aspects. Articles Of Merger: Definition & Sample - Contracts Counsel contractscounsel.com ? articles-of-merger contractscounsel.com ? articles-of-merger