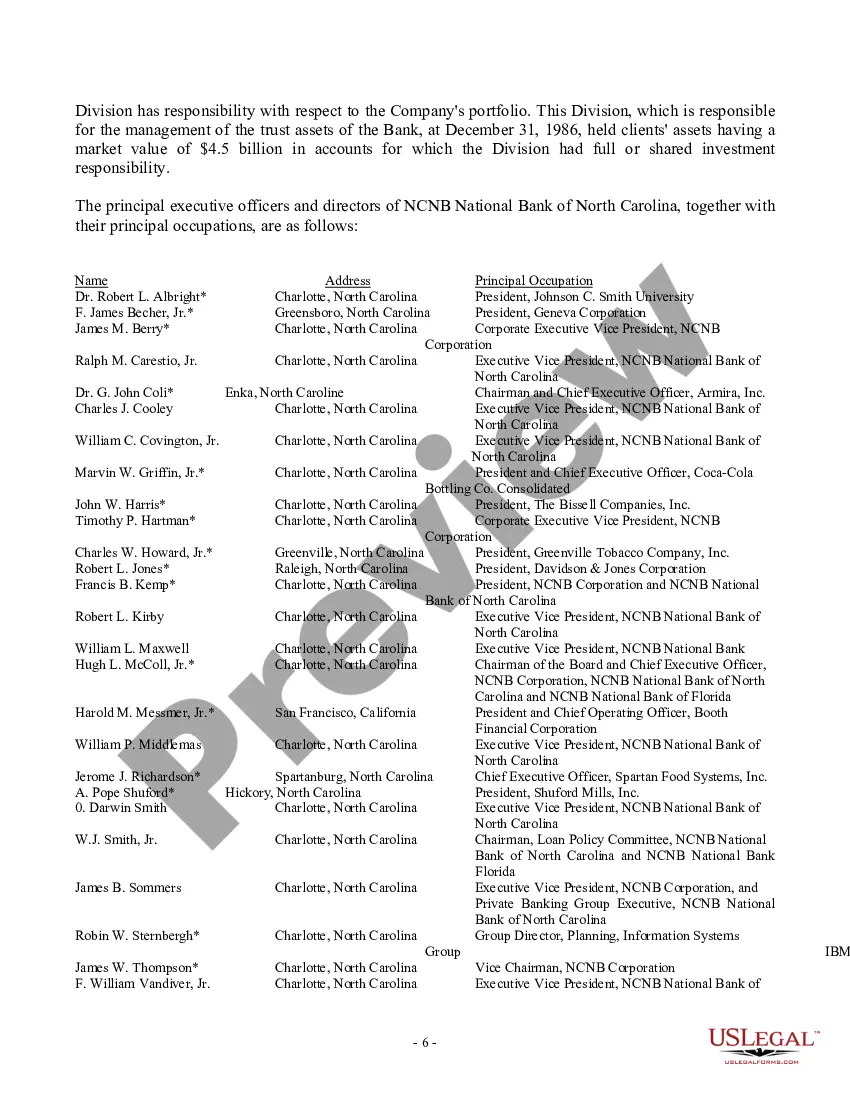

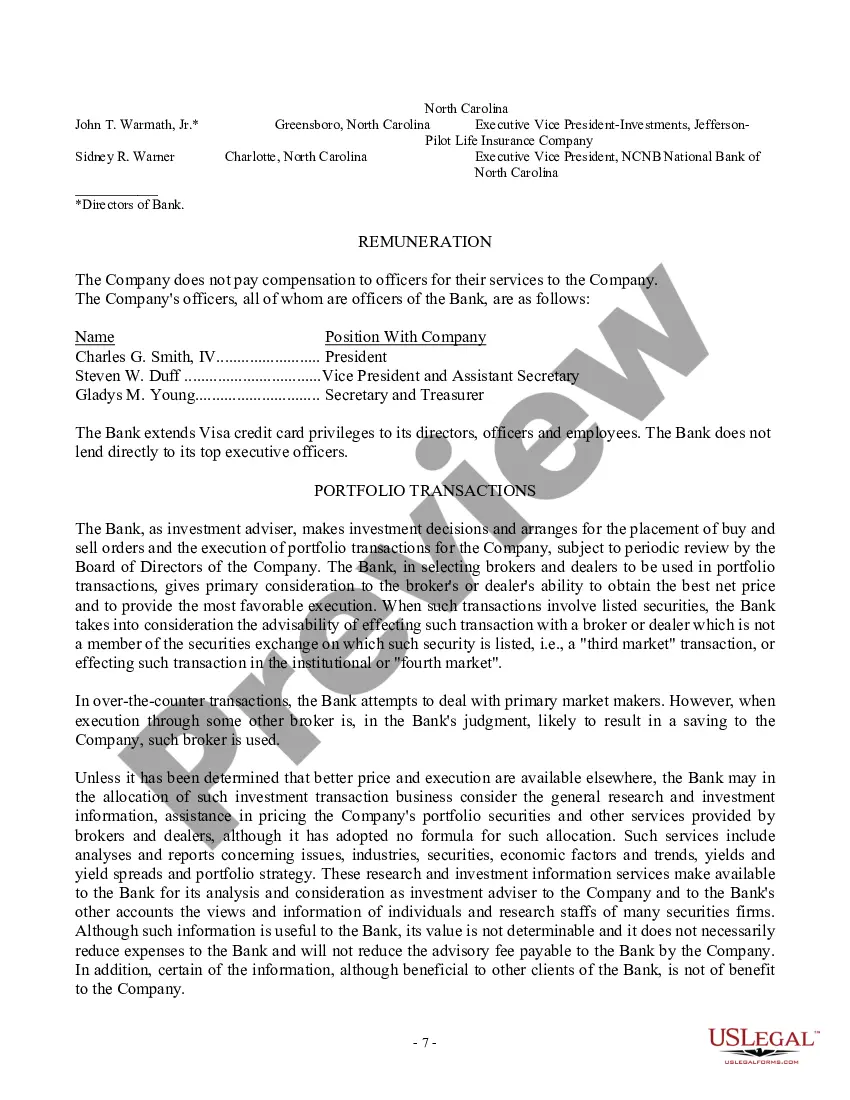

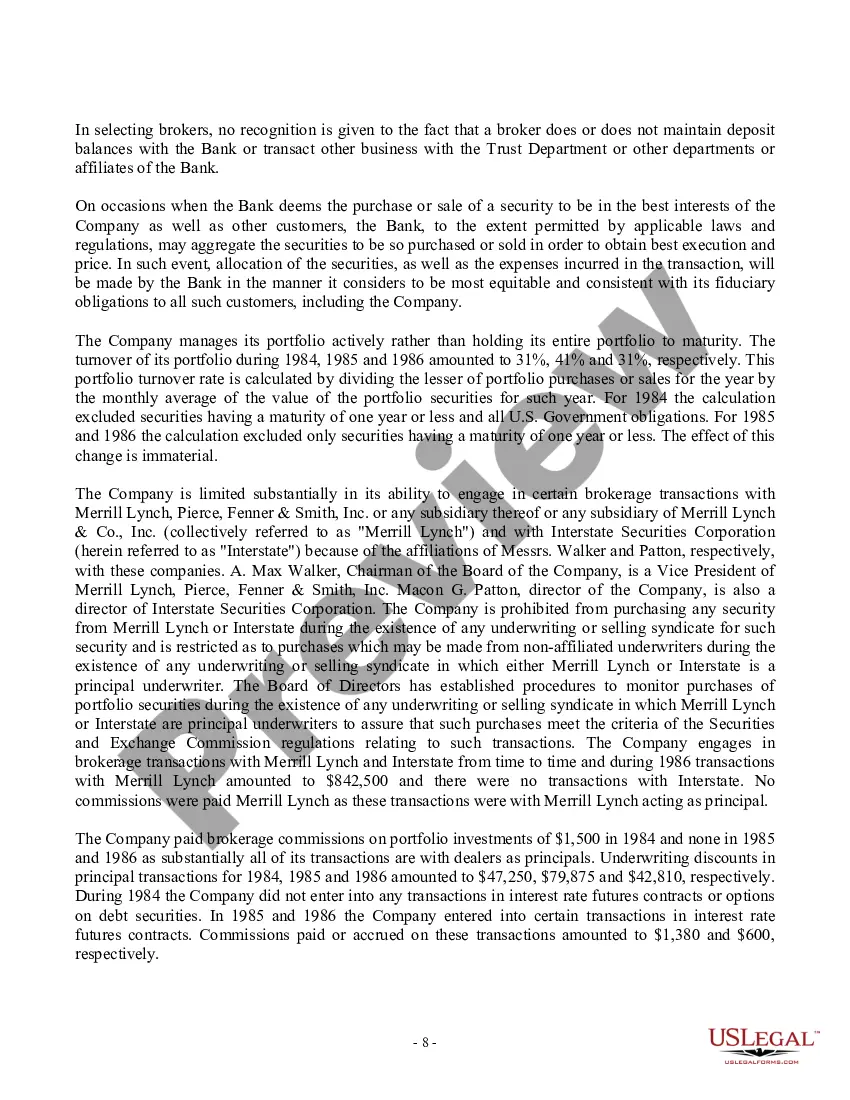

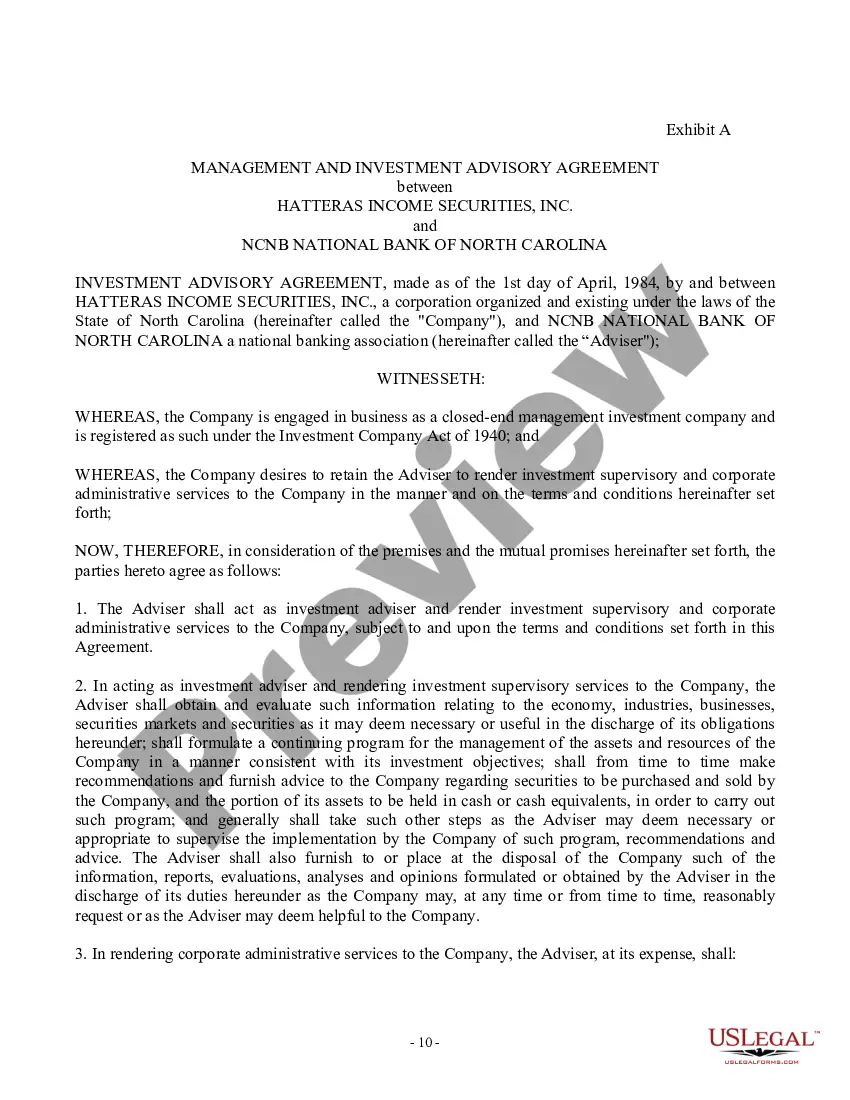

A Virginia Proxy Statement refers to a document issued by Hatteras Income Securities, Inc., a Virginia-based company, in order to inform its shareholders about important matters requiring their voting decisions during its annual meeting. This statement provides shareholders with relevant information and proposals that require their approval and allows them to cast their votes either in person or by proxy. The Hatteras Income Securities, Inc. Proxy Statement includes a crucial attachment — a copy of the advisory agreement. This agreement highlights the contractual arrangements between the company and its advisory firm, ensuring transparency and accountability in their partnership. The advisory agreement specifies the roles, responsibilities, and compensation terms of the advisory firm, which plays a pivotal role in managing the investment activities of Hatteras Income Securities, Inc. Such an agreement safeguards the interests of the shareholders by outlining the obligations and expectations of the advisory firm. Different types of Virginia Proxy Statements — Hatteras Income Securities, Inc. may include: 1. Annual Proxy Statement: This document is released once a year to update shareholders on essential matters like board elections, executive compensation, and proposed amendments to the company's bylaws or articles of incorporation. It may also feature important financial disclosures and revisions to voting procedures. 2. Special Proxy Statement: Occasionally, the company may issue a special proxy statement to address specific exceptional circumstances or urgent matters that require immediate shareholder attention. This could include significant mergers or acquisitions, extraordinary governance changes, or other crucial decisions seeking shareholder approval. The combination of a Virginia Proxy Statement and a copy of the advisory agreement ensures that Hatteras Income Securities, Inc. shareholders are well-informed about corporate proposals, guiding them in making informed voting decisions that align with their interests. Upholding transparency, these documents facilitate shareholder participation and foster accountability within the company's management.

A Virginia Proxy Statement refers to a document issued by Hatteras Income Securities, Inc., a Virginia-based company, in order to inform its shareholders about important matters requiring their voting decisions during its annual meeting. This statement provides shareholders with relevant information and proposals that require their approval and allows them to cast their votes either in person or by proxy. The Hatteras Income Securities, Inc. Proxy Statement includes a crucial attachment — a copy of the advisory agreement. This agreement highlights the contractual arrangements between the company and its advisory firm, ensuring transparency and accountability in their partnership. The advisory agreement specifies the roles, responsibilities, and compensation terms of the advisory firm, which plays a pivotal role in managing the investment activities of Hatteras Income Securities, Inc. Such an agreement safeguards the interests of the shareholders by outlining the obligations and expectations of the advisory firm. Different types of Virginia Proxy Statements — Hatteras Income Securities, Inc. may include: 1. Annual Proxy Statement: This document is released once a year to update shareholders on essential matters like board elections, executive compensation, and proposed amendments to the company's bylaws or articles of incorporation. It may also feature important financial disclosures and revisions to voting procedures. 2. Special Proxy Statement: Occasionally, the company may issue a special proxy statement to address specific exceptional circumstances or urgent matters that require immediate shareholder attention. This could include significant mergers or acquisitions, extraordinary governance changes, or other crucial decisions seeking shareholder approval. The combination of a Virginia Proxy Statement and a copy of the advisory agreement ensures that Hatteras Income Securities, Inc. shareholders are well-informed about corporate proposals, guiding them in making informed voting decisions that align with their interests. Upholding transparency, these documents facilitate shareholder participation and foster accountability within the company's management.