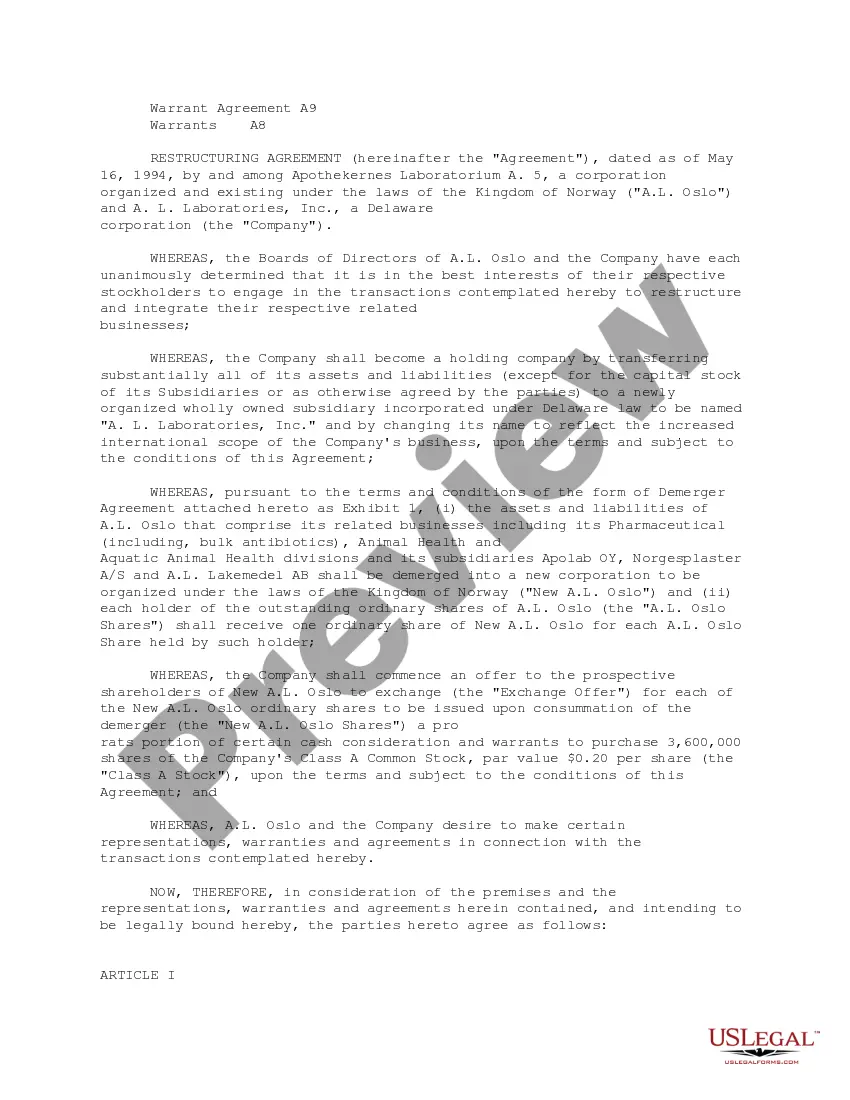

Virginia Restructuring Agreement

Description

How to fill out Restructuring Agreement?

If you want to complete, obtain, or print out authorized file templates, use US Legal Forms, the most important selection of authorized forms, that can be found online. Make use of the site`s basic and handy search to get the papers you want. Numerous templates for business and person reasons are sorted by classes and says, or keywords and phrases. Use US Legal Forms to get the Virginia Restructuring Agreement in a handful of mouse clicks.

In case you are already a US Legal Forms consumer, log in for your account and click on the Acquire button to obtain the Virginia Restructuring Agreement. You can also gain access to forms you previously delivered electronically within the My Forms tab of your own account.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape to the right city/region.

- Step 2. Make use of the Review method to examine the form`s articles. Do not forget to see the explanation.

- Step 3. In case you are unhappy with the kind, utilize the Search discipline on top of the screen to get other types of the authorized kind design.

- Step 4. When you have identified the shape you want, go through the Get now button. Choose the rates program you like and include your qualifications to sign up to have an account.

- Step 5. Method the purchase. You can utilize your bank card or PayPal account to accomplish the purchase.

- Step 6. Pick the format of the authorized kind and obtain it in your product.

- Step 7. Full, modify and print out or sign the Virginia Restructuring Agreement.

Each and every authorized file design you acquire is your own property permanently. You have acces to each kind you delivered electronically in your acccount. Go through the My Forms area and pick a kind to print out or obtain again.

Remain competitive and obtain, and print out the Virginia Restructuring Agreement with US Legal Forms. There are millions of professional and condition-distinct forms you can utilize for the business or person demands.

Form popularity

FAQ

The Restructured Higher Education Financial and Administrative Operations Act of 2005 (Restructuring Act) provided public colleges and universities with more operational and administrative autonomy in exchange for a renewed commitment to their public missions.

The Higher Education Opportunity Act of 2008 (HEOA) requires that universities make available to current and prospective students important information concerning each institution's academic programs, retention rates, graduation rates, crime reports, financial aid procedures and much more in an effort to ensure ... Higher Education Opportunity Act (HEOA) | Compliance and Ethics usm.edu ? compliance-ethics ? highereducat... usm.edu ? compliance-ethics ? highereducat...

The Higher Education Opportunity Act (P.L. 110-315) (HEOA) was enacted on August 14, 2008 and it reauthorized the Higher Education Act of 1965. This law contains a number of important new provisions that will improve access to postsecondary education for students with intellectual disabilities. Overview of the Federal Higher Education Opportunity Act thinkcollege.net ? resource ? federal-legislation thinkcollege.net ? resource ? federal-legislation

60 years of age or older Be 60 years of age or older. Be a legal resident of Virginia. Senior Citizens | Northern Virginia Community College nvcc.edu ? admissions ? apply ? senior-citiz... nvcc.edu ? admissions ? apply ? senior-citiz...