Virginia Warrant Agreement between A.L. Pharma, Inc., and The First National Bank of Boston

Description

How to fill out Warrant Agreement Between A.L. Pharma, Inc., And The First National Bank Of Boston?

Discovering the right authorized record template might be a battle. Of course, there are a lot of themes available online, but how would you obtain the authorized develop you will need? Utilize the US Legal Forms website. The support offers thousands of themes, such as the Virginia Warrant Agreement between A.L. Pharma, Inc., and The First National Bank of Boston, that you can use for company and private demands. All of the varieties are inspected by experts and fulfill state and federal specifications.

When you are currently listed, log in to your account and click on the Acquire switch to obtain the Virginia Warrant Agreement between A.L. Pharma, Inc., and The First National Bank of Boston. Make use of account to appear from the authorized varieties you have purchased previously. Proceed to the My Forms tab of your own account and obtain one more backup of your record you will need.

When you are a fresh user of US Legal Forms, here are simple guidelines for you to follow:

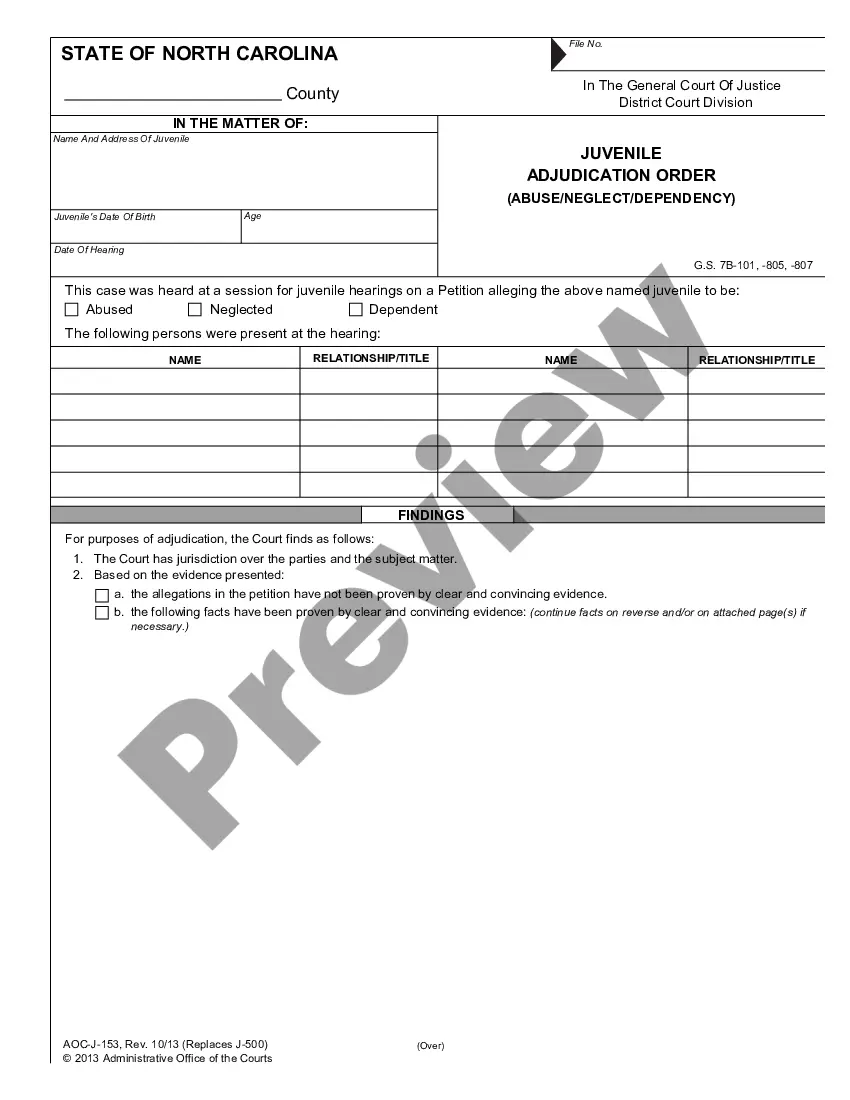

- Initial, be sure you have chosen the appropriate develop for your area/area. You may look over the shape utilizing the Preview switch and read the shape explanation to guarantee it will be the right one for you.

- In the event the develop is not going to fulfill your expectations, utilize the Seach industry to obtain the correct develop.

- When you are positive that the shape is proper, click on the Acquire now switch to obtain the develop.

- Choose the costs prepare you want and enter the necessary information. Build your account and purchase the transaction utilizing your PayPal account or charge card.

- Choose the data file file format and obtain the authorized record template to your gadget.

- Complete, modify and produce and indication the obtained Virginia Warrant Agreement between A.L. Pharma, Inc., and The First National Bank of Boston.

US Legal Forms is definitely the most significant collection of authorized varieties for which you can see a variety of record themes. Utilize the company to obtain skillfully-made papers that follow express specifications.