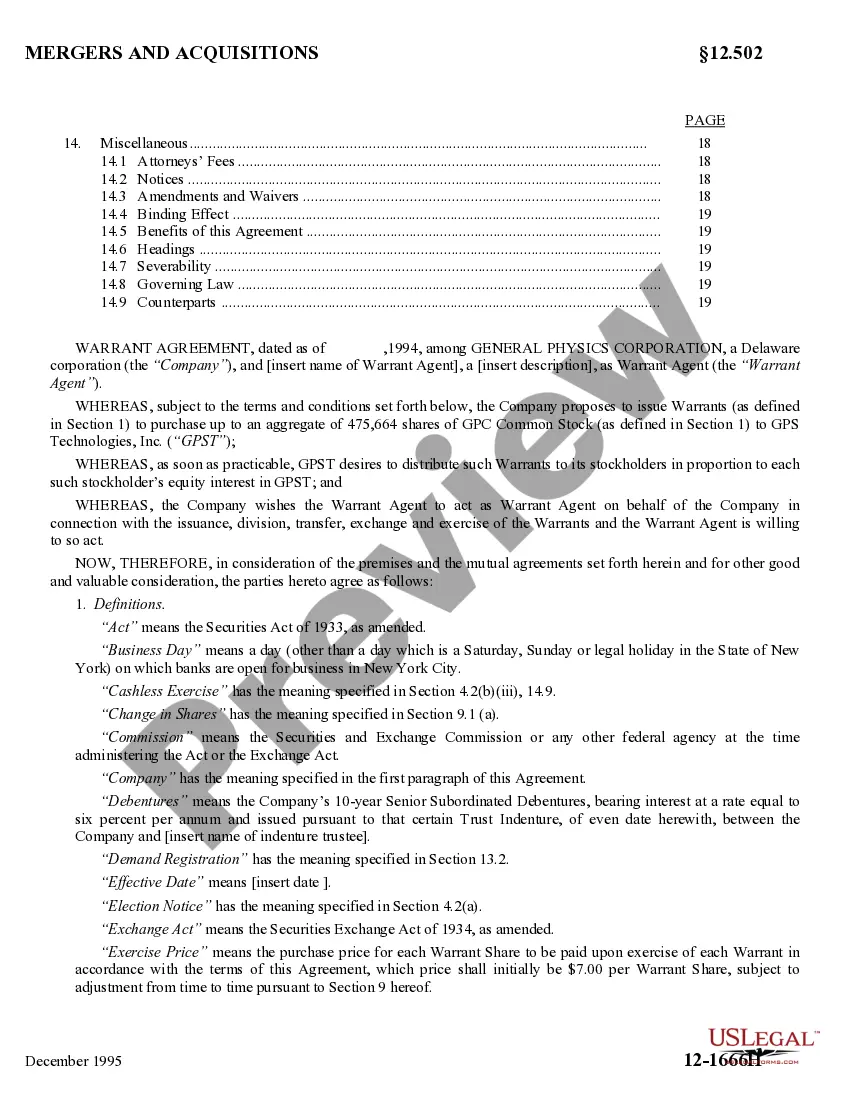

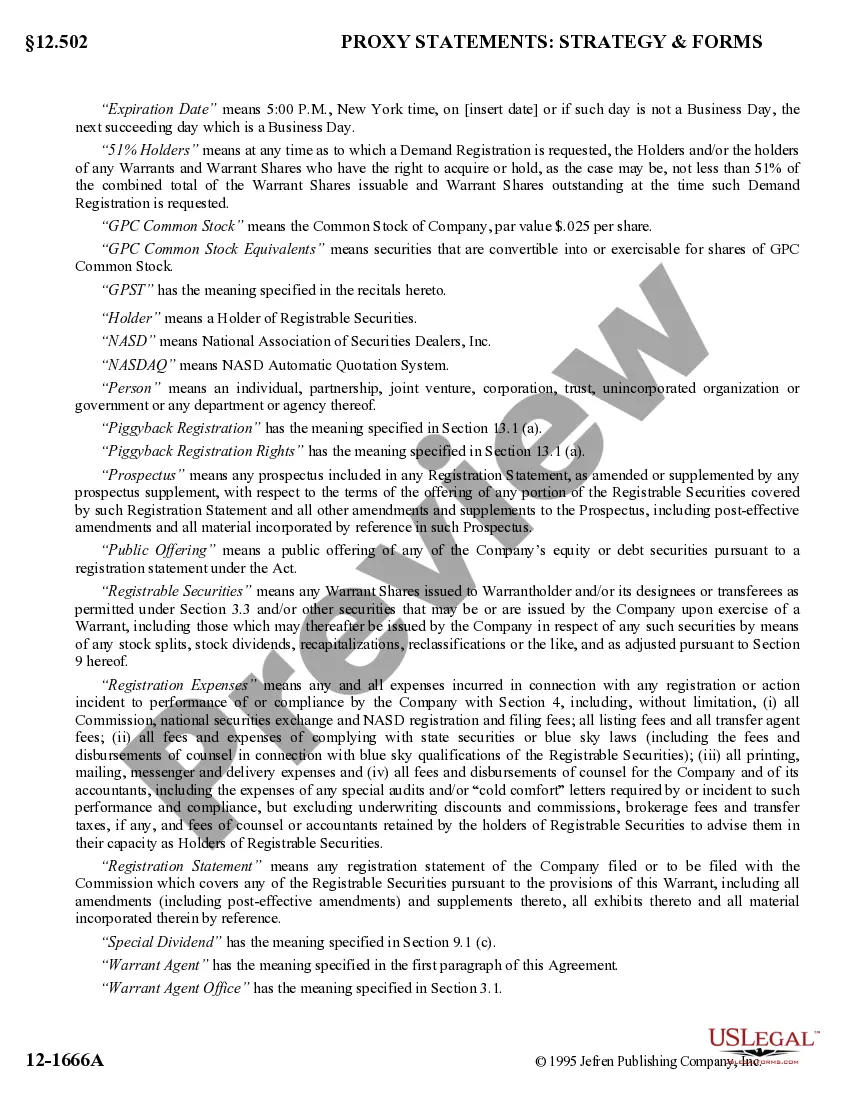

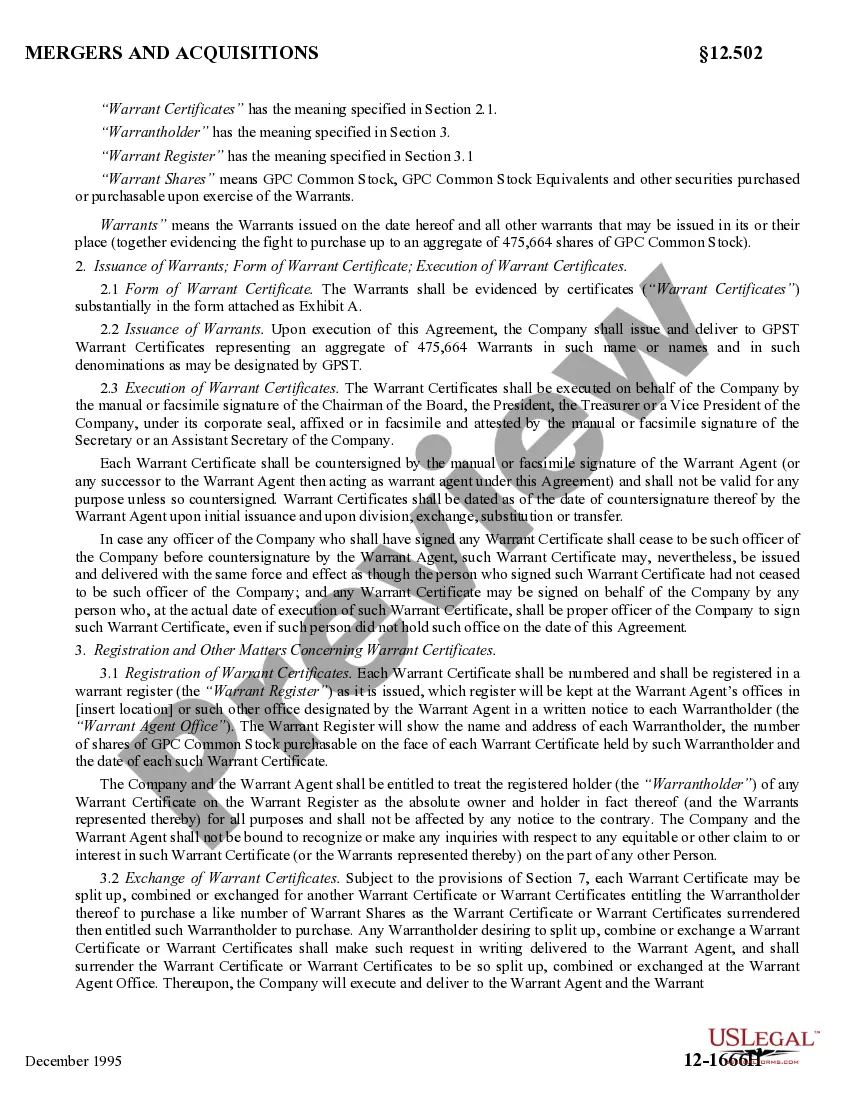

The Virginia Second Warrant Agreement is a legal agreement established by General Physics Corp., which outlines specific terms and conditions regarding the issuance and exercise of warrants. This agreement serves as a supplementary document to an existing contract or agreement, providing additional details and provisions related to warrants. General Physics Corp., a reputable organization, has implemented various types of Second Warrant Agreements in Virginia. These may include: 1. Virginia Second Warrant Agreement for Shareholders: This type of agreement is designed to establish the rights and obligations of existing shareholders of General Physics Corp. It addresses the issuance and exercise of warrants, detailing shareholder entitlements and any restrictions associated with the warrants. 2. Virginia Second Warrant Agreement for Employees: This agreement type focuses on warrants issued to employees of General Physics Corp. It defines the terms of warrant allocation and specifies the conditions under which they can be exercised. Employee-related considerations such as vesting schedules and termination clauses may be covered as well. 3. Virginia Second Warrant Agreement for Investors: When General Physics Corp. seeks additional funding or investment, they may issue warrants to investors. This agreement type outlines the specifics of the warrants offered to investors, including the exercise price, expiration date, and other relevant terms. 4. Virginia Second Warrant Agreement for Lenders: General Physics Corp. may enter into agreements with lenders to secure financing, wherein warrants are issued as an additional form of collateral. This agreement delineates the terms governing the warrants held by lenders, including any restrictions and the consequences of default. Overall, the Virginia Second Warrant Agreement is an essential legal document created by General Physics Corp. to regulate the rights and obligations associated with warrants. It provides a comprehensive framework for the issuance, exercise, and management of warrants tailored to different stakeholders, such as shareholders, employees, investors, and lenders.

Virginia Second Warrant Agreement by General Physics Corp.

Description

How to fill out Virginia Second Warrant Agreement By General Physics Corp.?

Are you in a place the place you need to have paperwork for either enterprise or personal uses virtually every day time? There are plenty of legitimate file web templates available on the Internet, but locating types you can rely on is not easy. US Legal Forms provides a huge number of type web templates, just like the Virginia Second Warrant Agreement by General Physics Corp., which can be composed to meet federal and state specifications.

Should you be already familiar with US Legal Forms internet site and also have a merchant account, simply log in. Following that, it is possible to download the Virginia Second Warrant Agreement by General Physics Corp. format.

Should you not have an account and want to start using US Legal Forms, abide by these steps:

- Obtain the type you require and ensure it is for that correct city/region.

- Utilize the Preview button to analyze the form.

- Browse the outline to ensure that you have selected the right type.

- If the type is not what you`re seeking, utilize the Search field to find the type that meets your needs and specifications.

- Once you get the correct type, click Purchase now.

- Opt for the pricing program you want, fill in the required info to generate your money, and pay money for your order using your PayPal or charge card.

- Decide on a convenient file structure and download your version.

Get each of the file web templates you possess bought in the My Forms food selection. You can obtain a extra version of Virginia Second Warrant Agreement by General Physics Corp. anytime, if necessary. Just go through the needed type to download or produce the file format.

Use US Legal Forms, one of the most extensive selection of legitimate varieties, to conserve some time and prevent mistakes. The services provides professionally created legitimate file web templates which you can use for an array of uses. Make a merchant account on US Legal Forms and initiate generating your life easier.