The Virginia Proposal to authorize and issue subordinated convertible debentures aims to provide comprehensive details on the authorization and issuance of these financial instruments. Subordinated convertible debentures are a type of debt security issued by corporations or governmental entities to raise capital from investors. In this proposal, Virginia's governing body outlines its intent to authorize the issuance of subordinated convertible debentures, highlighting various key aspects such as terms, conditions, and use of funds. The proposal emphasizes the convertible feature of these debentures, which provides the option for investors to convert their debt into equity at a predetermined conversion ratio and price. To ensure clarity and transparency, the proposal elaborates on the eligibility criteria for investors, including any limitations or restrictions. It also discusses the purpose for which the funds raised through the issuance of subordinated convertible debentures will be utilized. This may include financing capital-intensive projects, expansion initiatives, research and development, or the refinancing of existing debts. Additionally, the proposal provides an overview of the maturity period and interest rate associated with the debentures. It may mention a fixed coupon rate or a floating rate, depending on market conditions or the preferences of the issuer. Subordinated debentures rank below senior debt in terms of priority during liquidation, making them riskier but potentially more attractive due to higher interest rates. Keywords: Virginia, proposal, authorize, issue, subordinated, convertible debentures, debt security, capital, investors, terms, conditions, use of funds, convertible feature, equity, conversion ratio, price, eligibility criteria, limitations, restrictions, purpose, financing, projects, expansion, research and development, refinancing, maturity period, interest rate, coupon rate, floating rate, senior debt, liquidation. Different types of Virginia Proposal to authorize and issue subordinated convertible debentures may include variations based on the specific purpose, issuer, or target investor base. For example, proposals may differ based on whether the debentures are issued by a private corporation, a government entity, or a non-profit organization. The proposed terms, conditions, and use of funds may also vary, depending on the specific projects or objectives being financed.

Virginia Proposal to authorize and issue subordinated convertible debentures

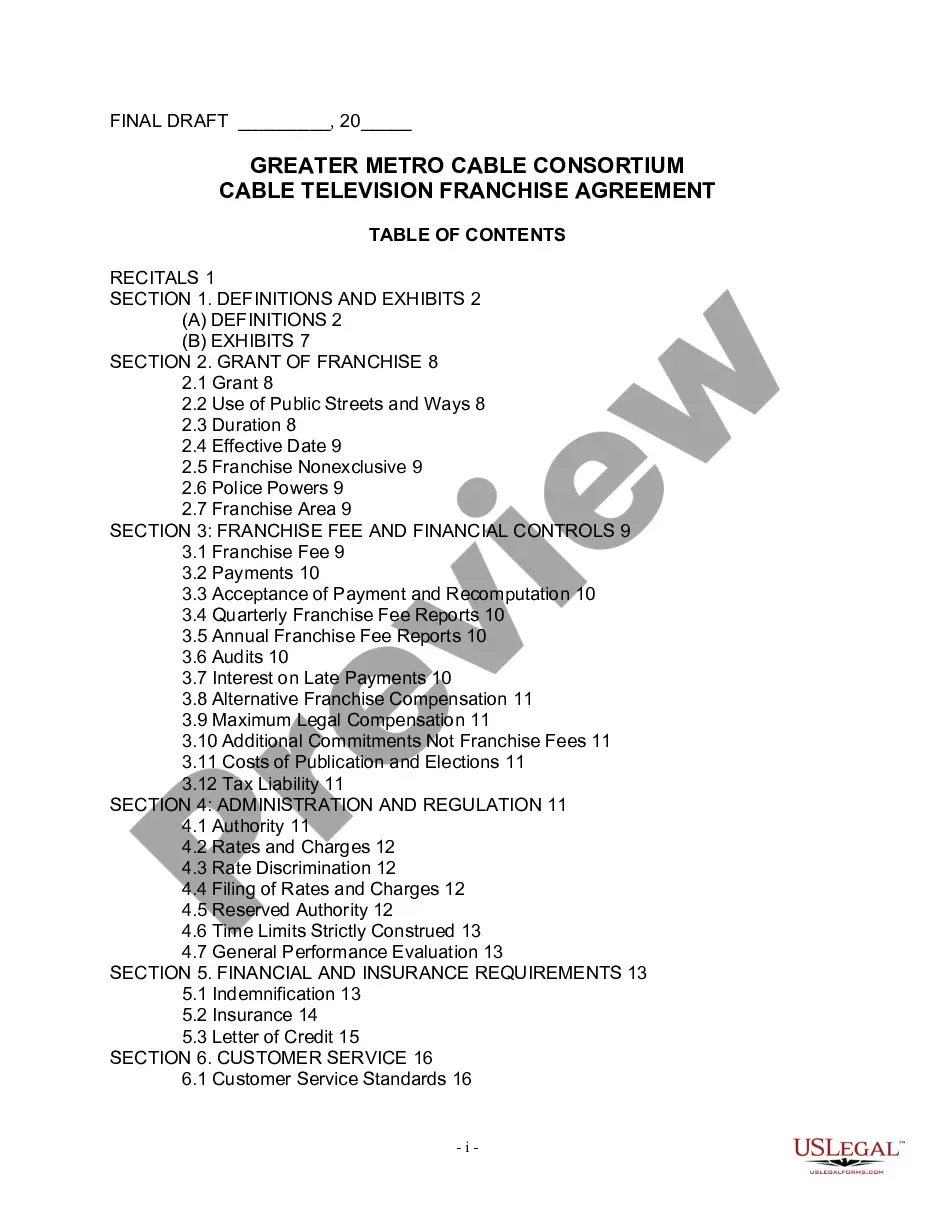

Description

How to fill out Virginia Proposal To Authorize And Issue Subordinated Convertible Debentures?

Finding the right lawful record template could be a have a problem. Of course, there are a variety of themes available online, but how do you find the lawful kind you need? Make use of the US Legal Forms internet site. The service delivers a huge number of themes, such as the Virginia Proposal to authorize and issue subordinated convertible debentures, which can be used for organization and personal requirements. All the types are inspected by pros and satisfy federal and state needs.

In case you are currently registered, log in for your bank account and click on the Acquire option to have the Virginia Proposal to authorize and issue subordinated convertible debentures. Make use of bank account to look through the lawful types you possess purchased earlier. Go to the My Forms tab of the bank account and acquire an additional version from the record you need.

In case you are a new end user of US Legal Forms, here are easy directions for you to stick to:

- Very first, be sure you have selected the proper kind to your area/region. You may check out the form making use of the Review option and read the form outline to guarantee it is the best for you.

- In case the kind will not satisfy your preferences, use the Seach industry to find the appropriate kind.

- When you are certain that the form is suitable, go through the Acquire now option to have the kind.

- Select the pricing plan you want and type in the essential information. Create your bank account and pay for the order making use of your PayPal bank account or Visa or Mastercard.

- Pick the document structure and obtain the lawful record template for your system.

- Total, revise and printing and sign the attained Virginia Proposal to authorize and issue subordinated convertible debentures.

US Legal Forms is the most significant local library of lawful types where you can see a variety of record themes. Make use of the service to obtain professionally-manufactured documents that stick to state needs.