The Virginia Sale of Stock refers to the process of transferring ownership of shares or stock in a corporation from one party to another within the state of Virginia. It is a crucial aspect of business transactions and investment activities. In this article, we will delve into the intricate details of the Virginia Sale of Stock, discussing its legal framework, requirements, and different types. The sale of stock in Virginia is governed by the Virginia Stock Corporation Act, which provides the legal framework for corporations to issue and sell shares to interested investors. Under this act, the sale of stock involves the transfer of ownership rights, such as voting rights and potential dividends, from the seller (often the shareholder) to the buyer. The sale can happen in various scenarios, including initial public offerings (IPOs), private placements, or secondary market transactions. One common type of Virginia Sale of Stock is the IPO. In an IPO, a private company decides to go public, offering its shares to the public for the first time. During an IPO, the company and its underwriters determine the number of shares to be issued, the price per share, and other relevant details. This public sale of stock allows the company to raise capital and expand its operations. Additionally, existing shareholders may also choose to sell their shares during the IPO. Private placements are another type of Virginia Sale of Stock. Unlike IPOs, private placements involve the sale of stock to a select group of private investors, rather than the public. These transactions typically occur when companies are seeking capital from a specific group of investors or institutions, such as venture capitalists or private equity firms. Private placements offer more flexibility in terms of pricing and regulatory requirements compared to IPOs. Secondary market transactions are yet another type of Virginia Sale of Stock. Once shares have been initially sold, they can be traded on secondary markets, such as stock exchanges or over-the-counter platforms. Secondary market transactions involve the sale of previously issued shares from one investor to another. In this case, the company does not directly benefit from the transaction, as the shares are already in circulation. These transactions are crucial for liquidity purposes, allowing shareholders to buy or sell their holdings at prevailing market prices. To engage in the sale of stock in Virginia, certain requirements must be met. These typically include completing necessary paperwork, such as a Stock Purchase Agreement, ensuring compliance with securities laws and regulations, and obtaining any necessary approvals from regulatory authorities. It is essential for both buyers and sellers to thoroughly research and understand the legal implications and risks associated with the sale of stock in Virginia. In conclusion, the Virginia Sale of Stock encompasses various types of transactions, including IPOs, private placements, and secondary market transactions. Each form serves different purposes and entails specific requirements and legal considerations. By understanding the nuances of the Virginia Sale of Stock, individuals and corporations can make informed decisions related to investing, raising capital, or transferring ownership in the dynamic world of stock markets.

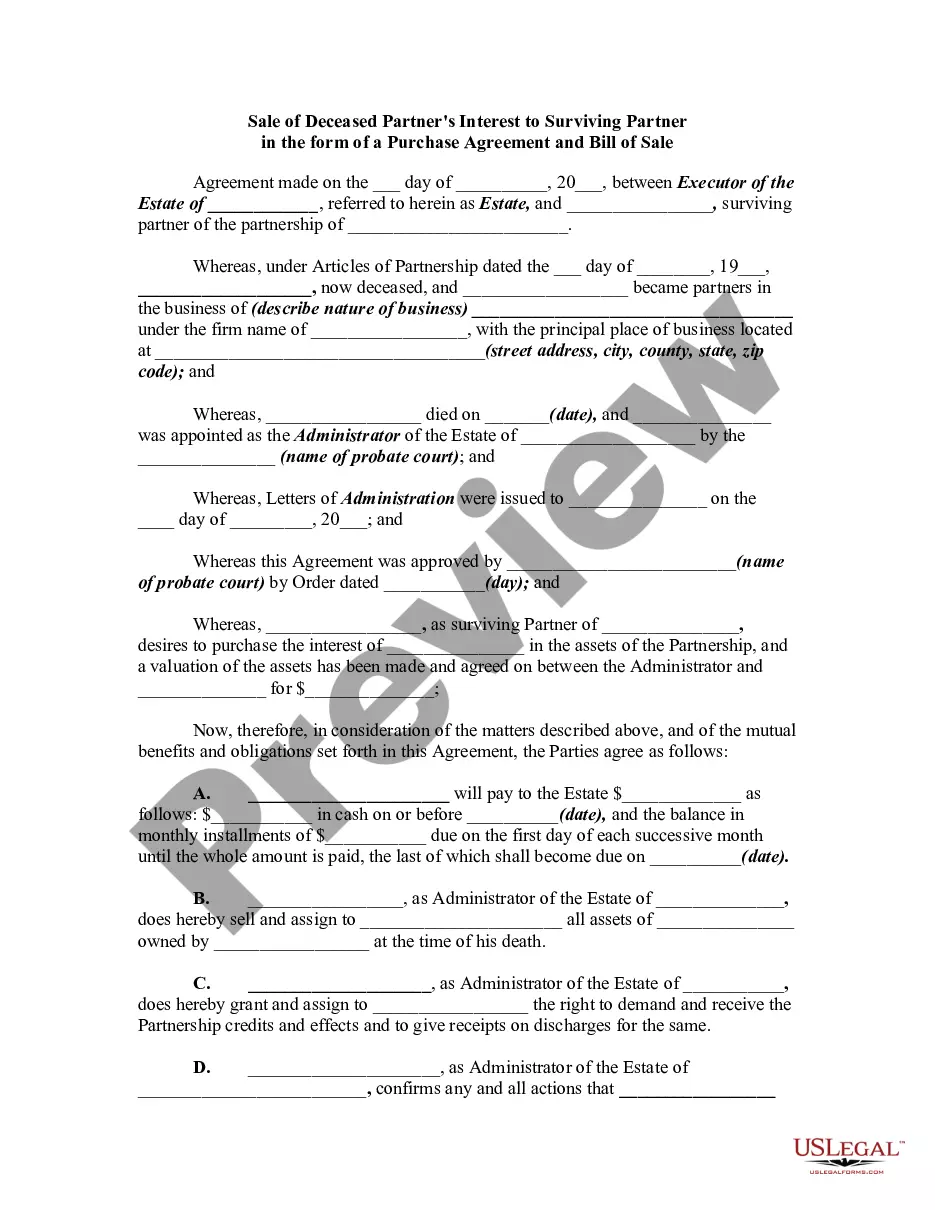

Virginia Sale of stock

Description

How to fill out Virginia Sale Of Stock?

If you want to comprehensive, obtain, or printing lawful record templates, use US Legal Forms, the greatest selection of lawful types, which can be found on the web. Take advantage of the site`s simple and easy convenient lookup to discover the files you will need. Various templates for business and personal purposes are categorized by types and says, or search phrases. Use US Legal Forms to discover the Virginia Sale of stock with a handful of clicks.

If you are presently a US Legal Forms client, log in for your account and click the Obtain button to obtain the Virginia Sale of stock. You can even gain access to types you previously saved inside the My Forms tab of your own account.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for that correct city/land.

- Step 2. Utilize the Review method to look over the form`s articles. Do not neglect to read the explanation.

- Step 3. If you are not happy using the kind, make use of the Search field near the top of the display screen to find other models in the lawful kind design.

- Step 4. After you have located the shape you will need, select the Acquire now button. Opt for the pricing plan you prefer and put your references to sign up to have an account.

- Step 5. Procedure the deal. You should use your Мisa or Ьastercard or PayPal account to perform the deal.

- Step 6. Select the file format in the lawful kind and obtain it in your system.

- Step 7. Total, modify and printing or indication the Virginia Sale of stock.

Each lawful record design you buy is your own eternally. You possess acces to each and every kind you saved with your acccount. Go through the My Forms segment and choose a kind to printing or obtain once more.

Contend and obtain, and printing the Virginia Sale of stock with US Legal Forms. There are thousands of expert and condition-distinct types you may use for your personal business or personal needs.

Form popularity

FAQ

The tax code states that all U.S. citizens and permanent residents must pay taxes on all income, regardless of source. That means the IRS taxes the money you make from your online sales in the same manner as the income from your job.

11 Sources Of Tax-Free Income There are still ways to earn income that is free from federal income tax. ... Gifts and Inheritances. ... Tax-Free Home Sale Gains. ... Life Insurance Proceeds. ... Economic Impact Payments (EIPs) ... Qualified Roth IRA Withdrawals. ... Qualified Section 529 Withdrawals.

Capital Gains Taxes Virginia taxes capital gains at the same income tax rate, up to 5.75%.

Sale of business. If any dealer liable for any tax, penalty, or interest levied hereunder sells out his business or stock of goods or quits the business, he shall make a final return and payment within fifteen days after the date of selling or quitting the business.

Government Purchases Things sold to federal or state governments, or their political subdivisions, are not subject to sales tax. The exemption doesn't apply to property purchased by the Commonwealth of Virginia, then transferred to a private business.

How to Avoid Capital Gains Tax on Sale of Business Negotiate wisely. As mentioned, you and the buyer will have competing interests with regard to the allocation of the purchase price. ... Consider an installment sale. ... Watch the timing. ... Sell to employees. ... Explore Opportunity Zone reinvestment.

One-off sales where you sell an item for less than what you paid are considered nondeductible losses by the IRS. You can't deduct the loss, but you won't have to pay taxes on it either.

Starting on January 1, 2023, IRS regulations require all businesses that process payments, including online marketplaces like eBay, to issue a Form 1099-K to sellers who receive $600 or more in gross payouts.