Virginia Approval of Incentive Stock Option Plan: A Comprehensive Overview Introduction: The Virginia Approval of Incentive Stock Option Plan is a crucial aspect of corporate governance in the state of Virginia. This plan enables companies to reward and incentivize their employees by granting them stock options, thereby aligning employee interests with the long-term success of the organization. In this article, we will provide a detailed description of what the Virginia Approval of Incentive Stock Option Plan entails, along with key information and relevant keywords. Additionally, we will explore different types of Virginia Approval of Incentive Stock Option Plans commonly implemented by companies. Keywords: Virginia, Approval, Incentive Stock Option Plan, corporate governance, employees, stock options, rewards, incentivize, alignment, long-term success, organization. Detailed Description: The Virginia Approval of Incentive Stock Option Plan refers to the legal framework and regulations set forth by the state of Virginia to govern the implementation and operation of incentive stock option plans. Under this plan, companies grant their employees the opportunity to purchase company shares at a predetermined price, known as the exercise price, within a specified time frame. One of the primary objectives of this plan is to motivate and retain talented employees by offering them a stake in the company's future performance. It encourages employees to contribute their best efforts, enhances loyalty, and fosters a sense of ownership. Additionally, the plan is designed to align employee interests with the shareholders' interests, promoting long-term growth and overall success for the organization. The Virginia Approval of Incentive Stock Option Plan requires companies to obtain approval from relevant authorities, such as the Virginia State Corporation Commission or other applicable regulatory bodies, before implementing such stock option plans. This ensures compliance with legal requirements and safeguards the interests of both the company and its employees. Types of Virginia Approval of Incentive Stock Option Plans: 1. Incentive Stock Option Plan for Executives: This type of plan specifically targets top-level executives within an organization, offering them stock options as a part of their compensation package. It aims to attract and retain high-performing executives by tying their financial rewards closely to the company's performance. 2. Employee Stock Option Plan (ESOP): This plan broadens the scope of stock option grants beyond the executive level and extends it to a wider range of employees. Sops provide an opportunity for employees at various levels to participate in the company's growth, thereby fostering a sense of loyalty and driving organizational success. 3. Restricted Stock Unit (RSU) Plan: While not strictly categorized as stock options, RSU plans are another form of equity compensation granted to employees. Under this plan, employees receive units that convert into company shares over a vesting period. RSU plans are subject to specific rules and regulations and are often utilized as an alternative or in combination with traditional stock option plans. Conclusion: The Virginia Approval of Incentive Stock Option Plan is a crucial component of corporate governance in Virginia, enabling companies to reward and motivate their employees through the granting of stock options. These plans align employee interests with the long-term success of the organization and contribute to overall growth. By obtaining the necessary approvals and implementing different types of incentive stock option plans, companies in Virginia can effectively attract, retain, and motivate a talented workforce, thereby driving organizational success in the competitive business landscape.

Virginia Approval of Incentive Stock Option Plan

Description

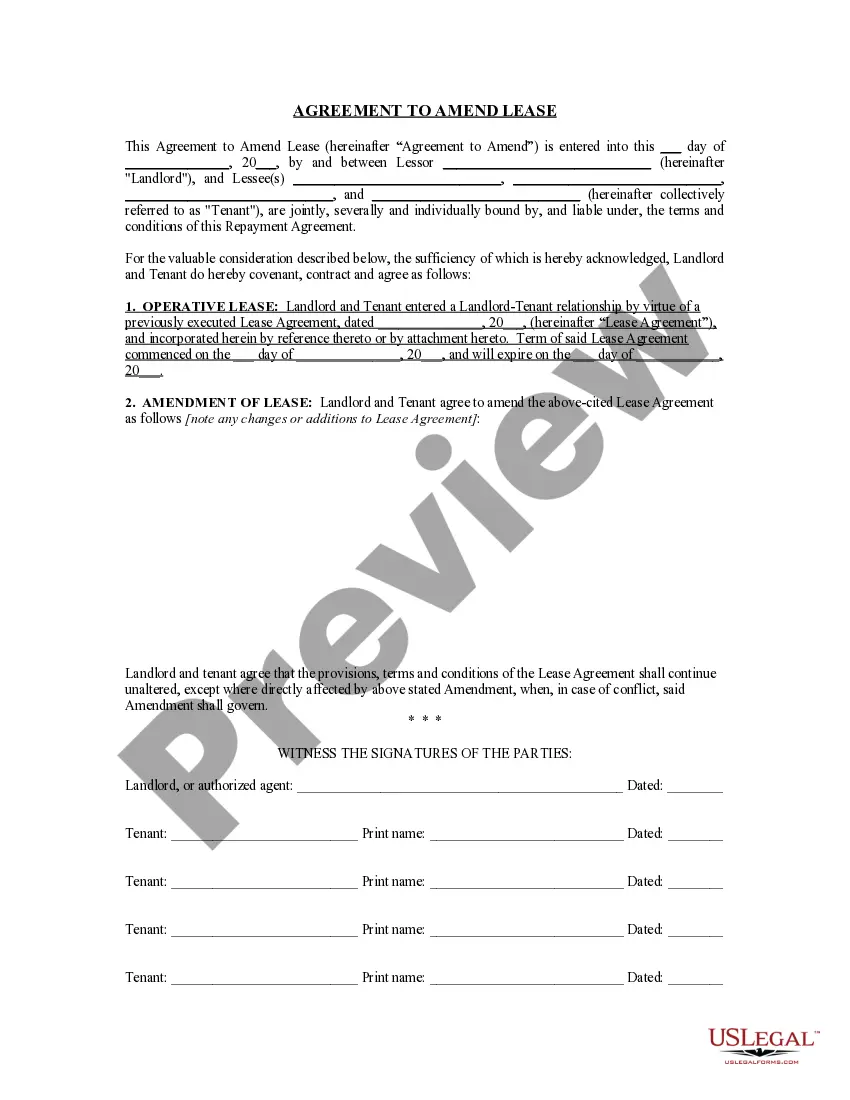

How to fill out Virginia Approval Of Incentive Stock Option Plan?

Are you presently in the placement where you need papers for both organization or person purposes almost every time? There are a variety of authorized record templates available on the Internet, but discovering kinds you can trust is not simple. US Legal Forms gives thousands of form templates, just like the Virginia Approval of Incentive Stock Option Plan, which can be written to meet state and federal needs.

In case you are already knowledgeable about US Legal Forms site and get a merchant account, simply log in. Following that, you can down load the Virginia Approval of Incentive Stock Option Plan web template.

Should you not come with an account and want to begin to use US Legal Forms, adopt these measures:

- Find the form you want and make sure it is to the appropriate area/region.

- Make use of the Review key to examine the shape.

- See the information to ensure that you have selected the proper form.

- When the form is not what you`re seeking, take advantage of the Lookup area to obtain the form that meets your needs and needs.

- If you find the appropriate form, just click Get now.

- Select the rates prepare you want, complete the required information to create your account, and pay for the transaction making use of your PayPal or Visa or Mastercard.

- Decide on a convenient file formatting and down load your backup.

Discover all of the record templates you have bought in the My Forms menu. You can get a additional backup of Virginia Approval of Incentive Stock Option Plan anytime, if required. Just go through the needed form to down load or print the record web template.

Use US Legal Forms, by far the most considerable variety of authorized types, to save lots of time as well as stay away from errors. The support gives skillfully produced authorized record templates that can be used for a variety of purposes. Create a merchant account on US Legal Forms and initiate creating your way of life easier.