Virginia Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options

Description

How to fill out Stock Option Plan Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options, And Exchange Options?

Choosing the best legal record template can be a have a problem. Naturally, there are a lot of layouts available online, but how would you discover the legal kind you want? Use the US Legal Forms internet site. The assistance gives a huge number of layouts, such as the Virginia Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options, that can be used for organization and personal requires. All of the varieties are examined by specialists and meet up with federal and state specifications.

When you are already listed, log in to the bank account and click the Down load option to have the Virginia Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options. Make use of your bank account to search through the legal varieties you may have bought in the past. Check out the My Forms tab of your own bank account and have one more backup of your record you want.

When you are a new customer of US Legal Forms, listed here are basic instructions that you should stick to:

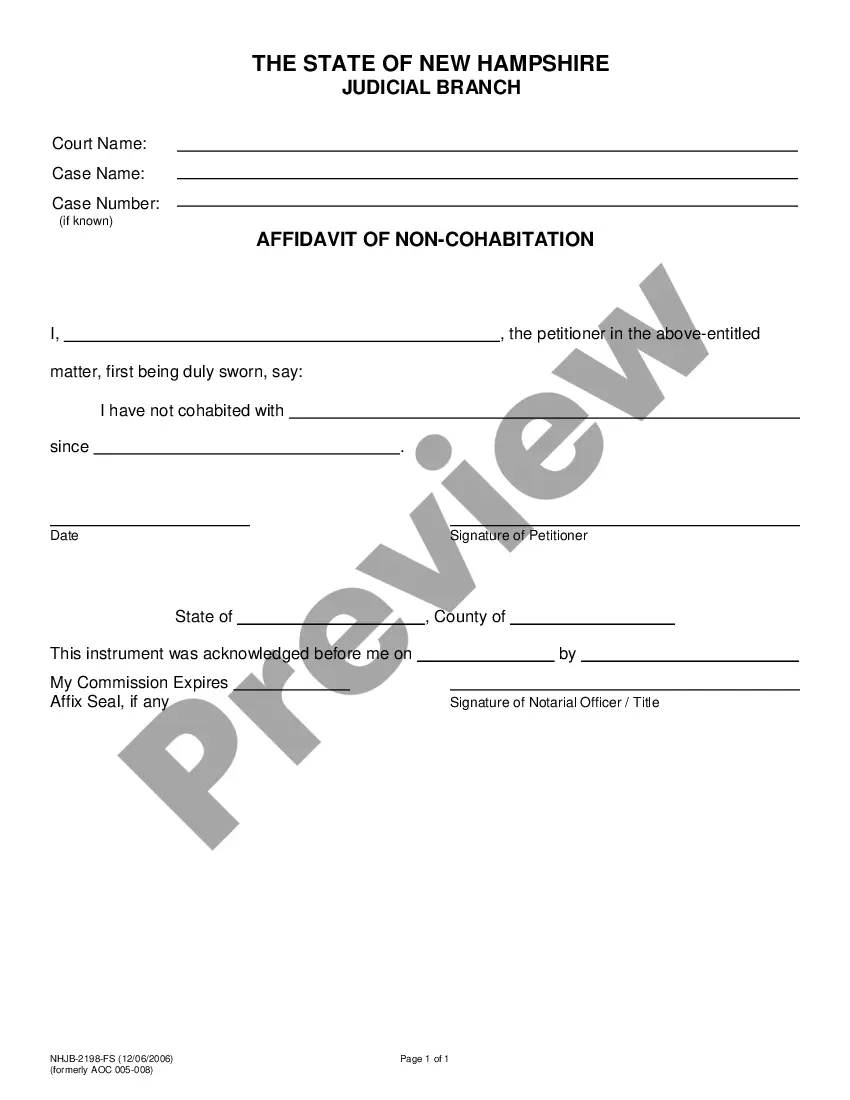

- Initially, ensure you have chosen the correct kind for your personal area/county. You may examine the form using the Preview option and study the form description to make certain this is the right one for you.

- When the kind will not meet up with your expectations, use the Seach discipline to obtain the proper kind.

- Once you are positive that the form is suitable, select the Acquire now option to have the kind.

- Choose the rates program you desire and enter in the needed information and facts. Build your bank account and pay for your order utilizing your PayPal bank account or credit card.

- Select the document file format and acquire the legal record template to the system.

- Comprehensive, revise and print and indicator the attained Virginia Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options.

US Legal Forms is definitely the largest catalogue of legal varieties where you can see a variety of record layouts. Use the company to acquire expertly-made files that stick to status specifications.

Form popularity

FAQ

Incentive Stock Options (ISO) are one example of a qualified stock option plan. With ISO plans, there is no tax due at the time the option is granted and no tax due at the time the option is exercised. Instead, the tax on the option is deferred until the time you sell the stock.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.

qualified stock option gives employees the right to purchase company stock at a predetermined price. There are several key elements to a stock option. Grant date: The date when the employee receives the option to buy the stock. Exercise price: The price at which the employee can buy the stock from the company.

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment. ISOs are often awarded as part of an employee's hiring or promotion package.

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.