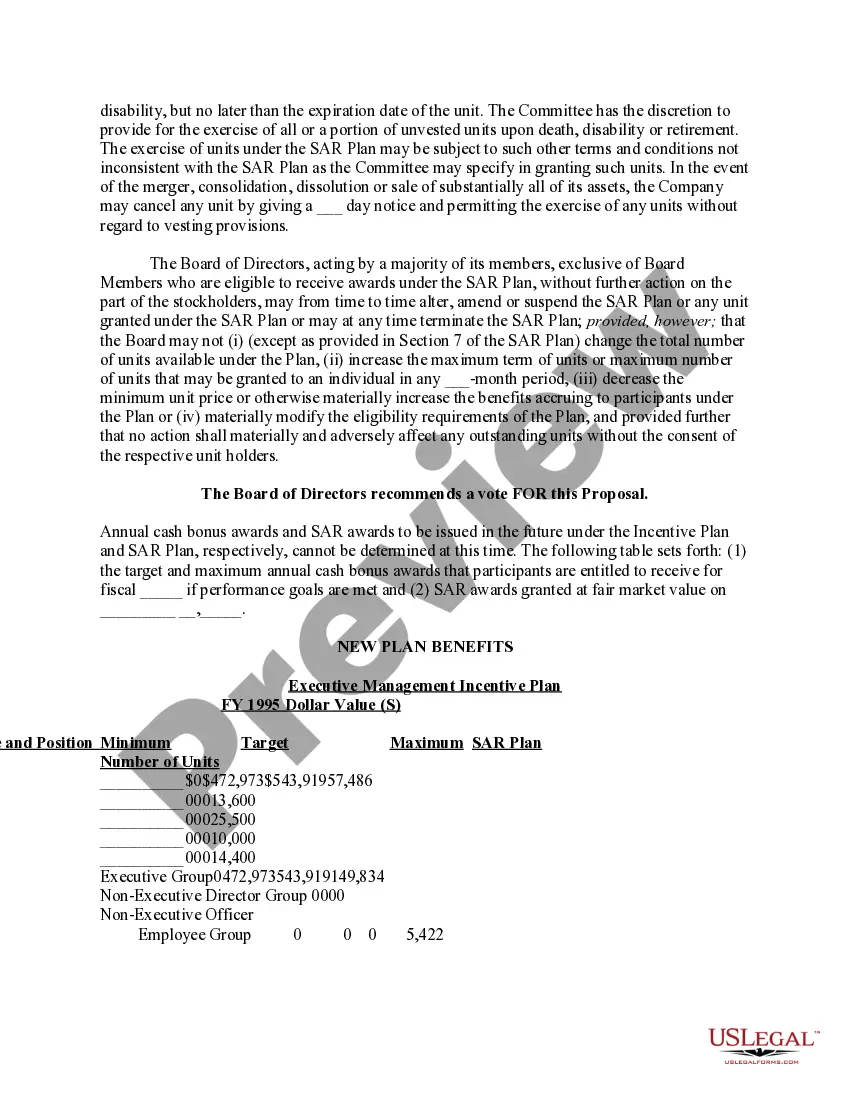

Virginia Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

Are you presently inside a place where you require paperwork for possibly business or person functions virtually every working day? There are a variety of legal record layouts available on the net, but locating types you can trust isn`t effortless. US Legal Forms gives 1000s of type layouts, like the Virginia Proposal to approve material terms of stock appreciation right plan, that happen to be written to meet federal and state needs.

When you are previously informed about US Legal Forms website and also have an account, just log in. Next, you may download the Virginia Proposal to approve material terms of stock appreciation right plan web template.

Unless you come with an bank account and want to begin using US Legal Forms, follow these steps:

- Obtain the type you need and ensure it is for the appropriate area/area.

- Make use of the Review button to review the shape.

- Look at the outline to ensure that you have chosen the right type.

- If the type isn`t what you`re seeking, take advantage of the Look for area to obtain the type that suits you and needs.

- Whenever you discover the appropriate type, click on Buy now.

- Choose the prices prepare you would like, fill out the necessary info to create your bank account, and buy the transaction using your PayPal or credit card.

- Choose a hassle-free document formatting and download your copy.

Discover every one of the record layouts you have bought in the My Forms menu. You can obtain a extra copy of Virginia Proposal to approve material terms of stock appreciation right plan anytime, if possible. Just click the essential type to download or print the record web template.

Use US Legal Forms, by far the most extensive variety of legal forms, to save efforts and prevent mistakes. The support gives expertly created legal record layouts which can be used for a variety of functions. Produce an account on US Legal Forms and initiate generating your daily life easier.

Form popularity

FAQ

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a predetermined period. SARs are profitable for employees when the company's stock price rises, which makes them similar to employee stock options (ESOs).

The part of the change in the value of the stocks held by a business over any period which is due to price changes.

A Stock Appreciation Right (SAR) refers to the right to be paid compensation equivalent to an increase in the company's common stock price over a base or the value of appreciation of the equity shares currently being traded on the public market.

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.

A ?Stock Appreciation Right? is the right to receive a payment from the Company in an amount equal to the ?Spread,? which is defined as the excess of the Fair Market Value (as defined in Plan) of one share of common stock, $1.00 par value (the ?Stock?) of the Company at the Exercise Date (as defined below) over a ...

However, when a stock appreciation right is exercised, the employee does not have to pay to acquire the underlying security. Instead, the employee receives the appreciation in value of the underlying security, which would equal the current market value less the grant price.

Employee stock ownership plans (ESOPs), which can be stock bonus plans or stock bonus/money purchase plans, are qualified defined contribution plans under IRC section 401(a). Similar to stock options, stock appreciation rights are given at a predetermined price and often have a vesting period and expiration date.