Virginia Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

Are you in a placement the place you need to have documents for sometimes organization or specific uses virtually every time? There are a variety of lawful record templates available on the net, but finding versions you can depend on isn`t straightforward. US Legal Forms delivers a huge number of type templates, just like the Virginia Directors Stock Appreciation Rights Plan of American Annuity Group, Inc., which are written to meet state and federal needs.

In case you are currently familiar with US Legal Forms website and possess your account, just log in. Afterward, it is possible to acquire the Virginia Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. format.

Unless you provide an profile and need to begin using US Legal Forms, adopt these measures:

- Get the type you want and make sure it is for the correct area/county.

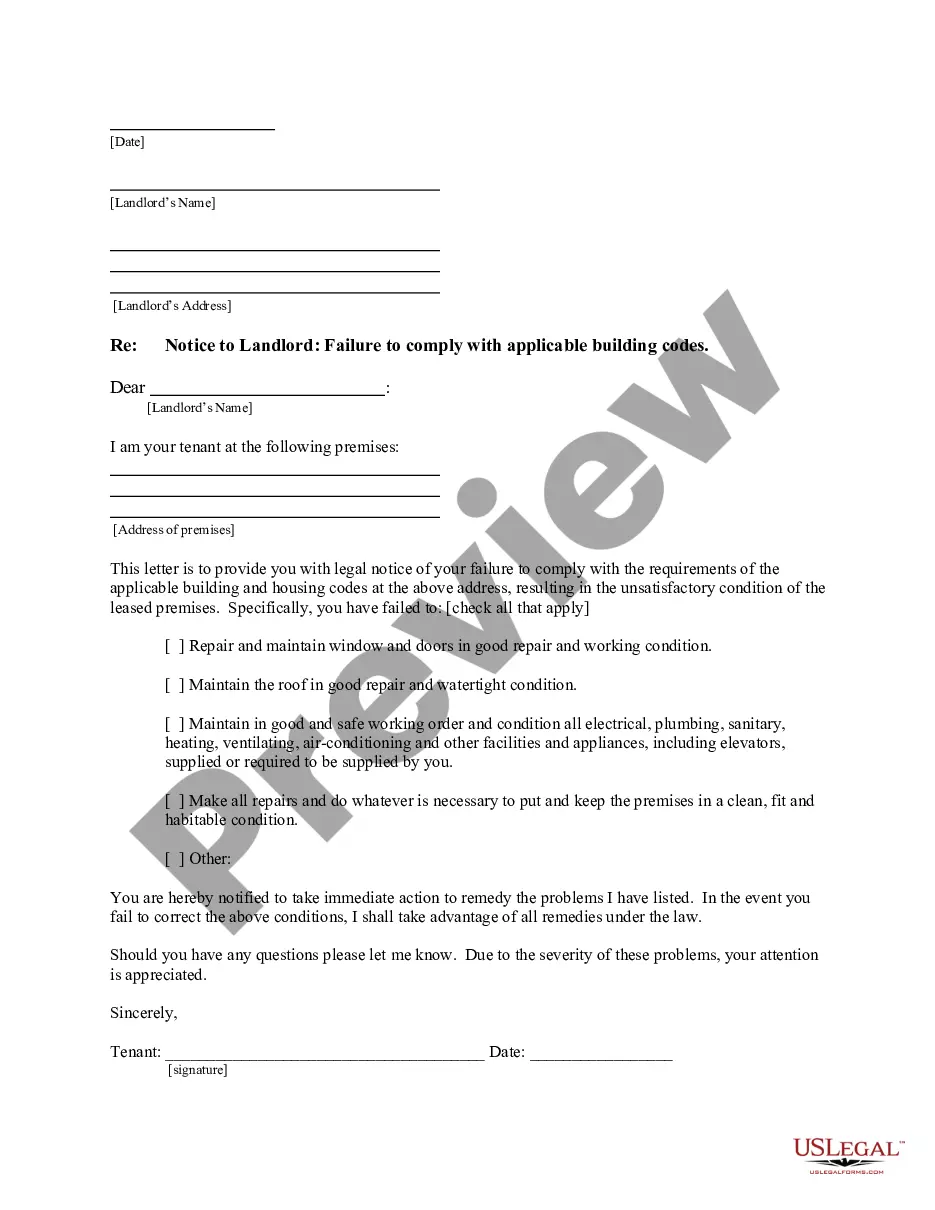

- Utilize the Preview key to check the form.

- Browse the description to actually have chosen the appropriate type.

- In case the type isn`t what you are searching for, utilize the Research area to obtain the type that fits your needs and needs.

- Whenever you find the correct type, click on Acquire now.

- Choose the rates prepare you want, complete the required info to produce your account, and buy an order making use of your PayPal or charge card.

- Choose a hassle-free document formatting and acquire your copy.

Locate every one of the record templates you may have bought in the My Forms food list. You may get a more copy of Virginia Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. at any time, if required. Just click the required type to acquire or print out the record format.

Use US Legal Forms, the most comprehensive assortment of lawful kinds, to save lots of efforts and stay away from faults. The assistance delivers skillfully made lawful record templates that you can use for an array of uses. Generate your account on US Legal Forms and commence generating your daily life easier.

Form popularity

FAQ

Once a SAR vests, an employee can exercise it at any time prior to its expiration. The proceeds will be paid either in cash, shares, or a combination of cash and shares depending on the rules of an employee's plan.

The equivalent of the share price of the firm or the rise in share price over a specified period is paid to employees. However, stock appreciation rights are not promised to the employees. They are incentives given to employees when the company's stock value exceeds the option exercise price.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.

?Stock Appreciation Right? or ?SAR? means a hypothetical or ?phantom? unit of ownership in the Corporation, as awarded to a Participant under Section 5 of this Plan, having a total value equivalent to one share of Common Stock.

SARs may be settled in cash or shares. However, it is more common for SARs to be settled in cash. A SAR is similar to a stock option except that the recipient is not required to pay an exercise price to exercise the SAR.