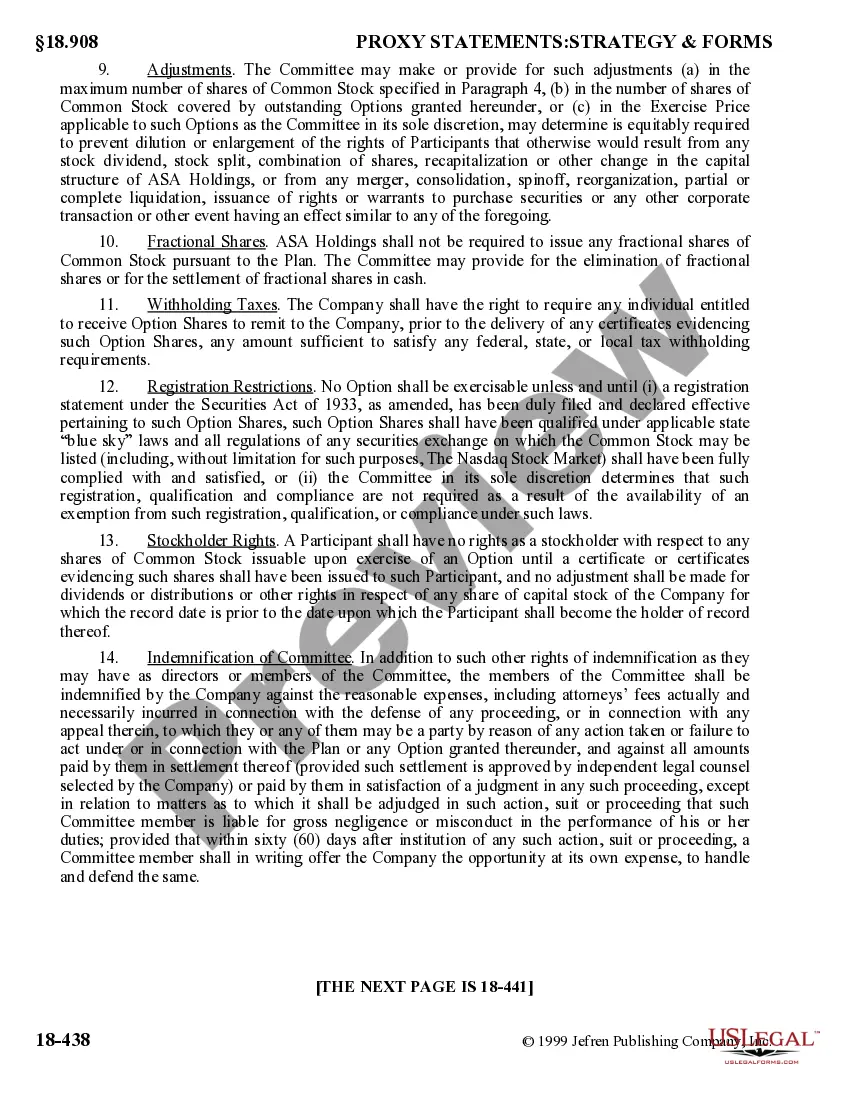

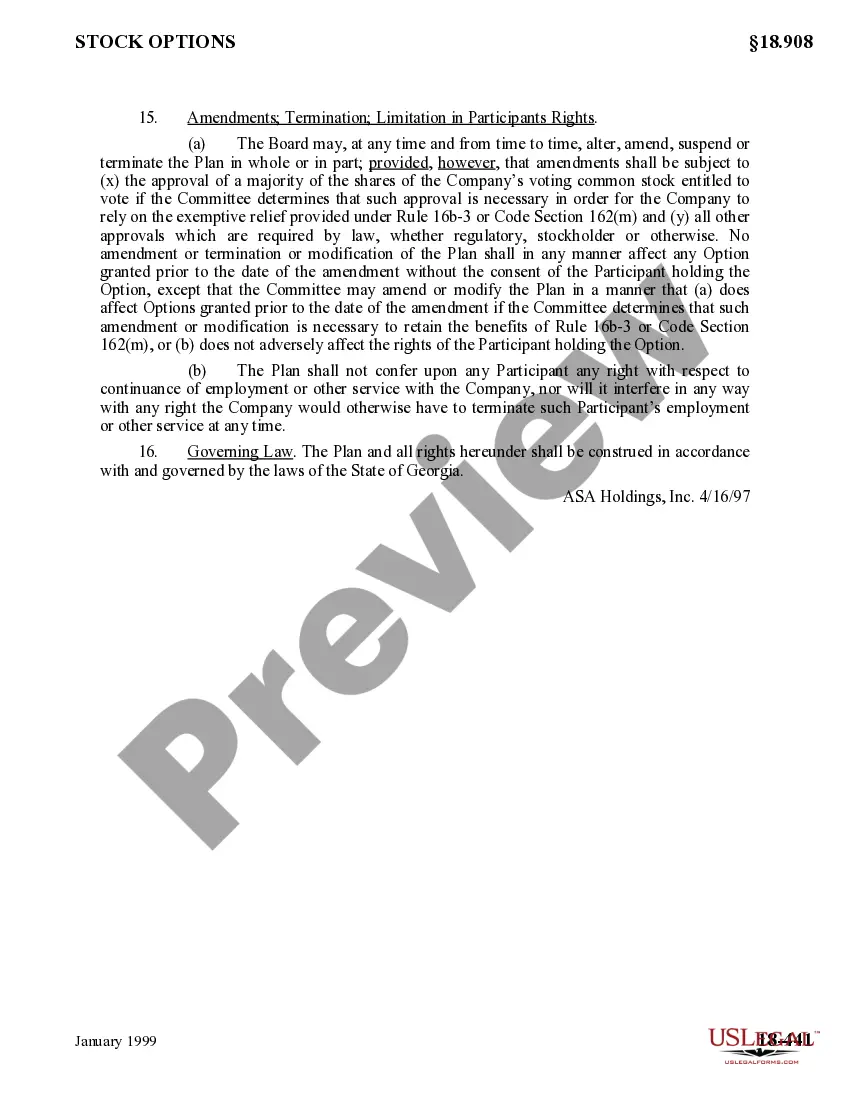

Virginia Nonqualified Stock Option Plan of ASA Holdings, Inc.

Description

How to fill out Nonqualified Stock Option Plan Of ASA Holdings, Inc.?

Finding the right legal file format could be a battle. Of course, there are a lot of layouts available on the net, but how will you obtain the legal form you will need? Utilize the US Legal Forms site. The assistance provides 1000s of layouts, including the Virginia Nonqualified Stock Option Plan of ASA Holdings, Inc., which can be used for company and personal requirements. All of the forms are checked out by specialists and meet state and federal requirements.

In case you are already authorized, log in to your account and click the Acquire option to get the Virginia Nonqualified Stock Option Plan of ASA Holdings, Inc.. Use your account to check with the legal forms you may have bought in the past. Proceed to the My Forms tab of your own account and get one more copy of the file you will need.

In case you are a new customer of US Legal Forms, here are straightforward instructions that you should follow:

- Initial, make sure you have chosen the appropriate form for your metropolis/area. You are able to look through the shape utilizing the Preview option and look at the shape explanation to make certain this is the best for you.

- When the form will not meet your requirements, utilize the Seach industry to find the proper form.

- Once you are certain that the shape is acceptable, go through the Purchase now option to get the form.

- Choose the rates prepare you desire and type in the essential information. Create your account and buy your order making use of your PayPal account or Visa or Mastercard.

- Select the document file format and download the legal file format to your device.

- Full, change and print out and signal the received Virginia Nonqualified Stock Option Plan of ASA Holdings, Inc..

US Legal Forms will be the most significant catalogue of legal forms in which you can discover a variety of file layouts. Utilize the company to download expertly-produced paperwork that follow express requirements.

Form popularity

FAQ

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

For example, if you're based in the US, you can offer ISOs to your domestic employees. However, as you cannot use an EOR to offer ISOs to foreign employees, you would need to offer an alternative, such as NSOs, RSUs, or VSOs.

These stock options are also given to contractors, consultants and other non-employees if companies want to give them more than $100,000 worth of stock annually. Because NSOs do not meet the requirements of IRS Code Section 422, they do not benefit from the (potential) corresponding tax benefits that ISOs benefit from.

A share option is a contract issued to an employee (or another stakeholder) giving them the right to purchase shares in a company at a later date for a predetermined strike price.

Stock options are only for people Finally, Rule 701 generally provides that only natural persons can be granted options under a stock option plan. This issue often arises when a consultant provides services to the company and asks to have their options titled in the name of their LLC.