Virginia Retirement Benefits Plan

Description

How to fill out Retirement Benefits Plan?

US Legal Forms - one of many largest libraries of lawful forms in America - gives a variety of lawful file web templates you may obtain or printing. While using site, you can find 1000s of forms for enterprise and personal purposes, sorted by categories, says, or keywords and phrases.You will discover the latest models of forms just like the Virginia Retirement Benefits Plan in seconds.

If you currently have a registration, log in and obtain Virginia Retirement Benefits Plan in the US Legal Forms catalogue. The Obtain option will show up on each and every develop you view. You have accessibility to all earlier acquired forms from the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, allow me to share basic guidelines to help you get started off:

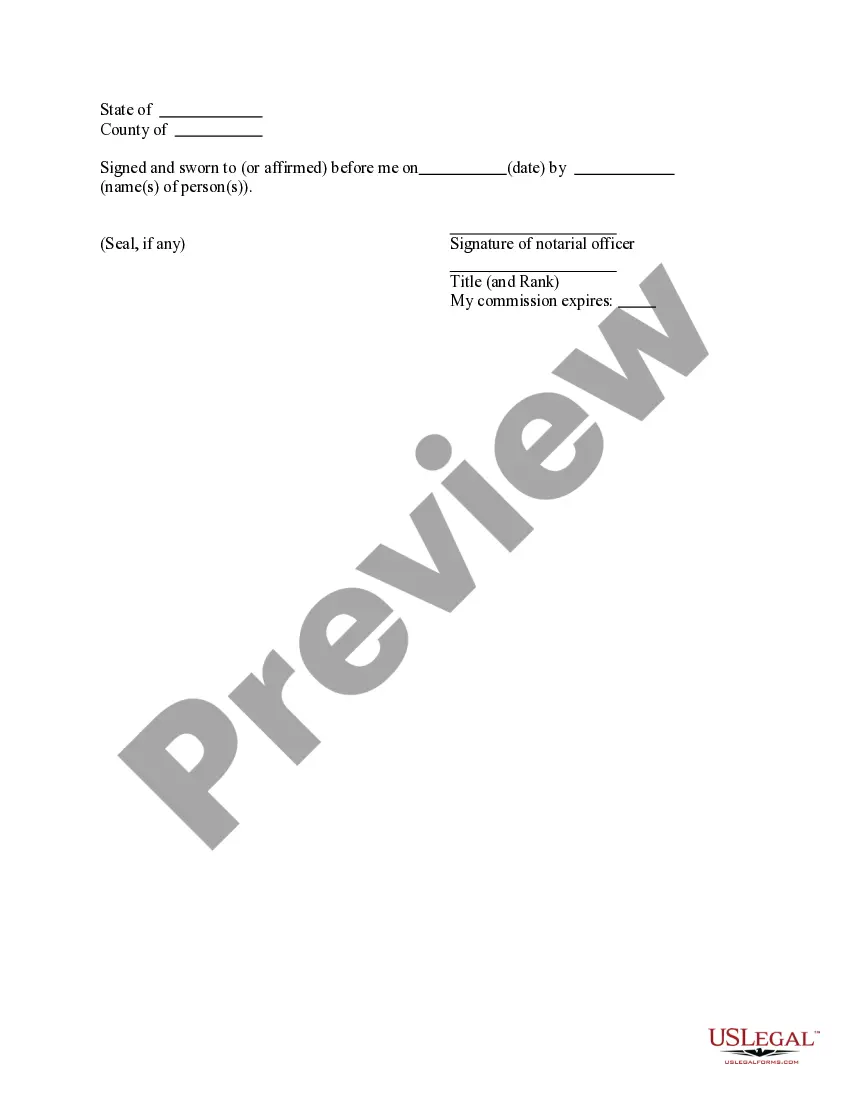

- Make sure you have picked out the proper develop to your metropolis/region. Click on the Review option to check the form`s content. See the develop information to actually have selected the appropriate develop.

- If the develop does not fit your requirements, take advantage of the Search field on top of the display screen to get the one that does.

- Should you be satisfied with the form, affirm your decision by visiting the Get now option. Then, opt for the prices strategy you want and offer your credentials to register to have an bank account.

- Process the transaction. Make use of bank card or PayPal bank account to complete the transaction.

- Find the format and obtain the form on your device.

- Make changes. Fill out, edit and printing and signal the acquired Virginia Retirement Benefits Plan.

Each and every template you included with your bank account does not have an expiry particular date and is also your own permanently. So, in order to obtain or printing one more version, just proceed to the My Forms segment and click on the develop you want.

Obtain access to the Virginia Retirement Benefits Plan with US Legal Forms, the most considerable catalogue of lawful file web templates. Use 1000s of expert and express-particular web templates that fulfill your company or personal needs and requirements.

Form popularity

FAQ

Normal retirement age under VRS Plan 1 is age 65. You become eligible for an unreduced benefit at age 65 with at least five years of service credit or at age 50 with at least 30 years of service credit.

The VRS Plan 1 is a defined benefit plan. This plan provides a lifetime monthly benefit during retirement based on your age, total service credit and average final compensation. Average final compensation is the average of your 36 consecutive months of highest creditable compensation as a covered employee.

As a VA employee, you are part of the Federal Employees Retirement System (FERS). Under FERS, you are eligible for monthly retirement benefits after just 10 years of Federal service. This retirement system is portable.

It's the law: Virginia businesses with more than 25 employees must offer a retirement saving opportunity. Those who haven't yet adopted an employer-based plan have two choices: Adopt their own retirement plan. Register for RetirePath Virginia, the state-sponsored retirement savings program.

As a VA employee, you are part of the Federal Employees Retirement System (FERS). Under FERS, you are eligible for monthly retirement benefits after just 10 years of Federal service. This retirement system is portable.

Why do people retire to Virginia? Low taxes: Virginia has relatively low taxes compared to many other states. Social Security benefits and retirement income are exempt from state income taxes, and property taxes are generally lower than in neighboring states.

Why do people retire to Virginia? Low taxes: Virginia has relatively low taxes compared to many other states. Social Security benefits and retirement income are exempt from state income taxes, and property taxes are generally lower than in neighboring states.

VRS ranks as the 14th largest public or private pension fund in the U.S. and the 42nd largest in the world, serving more than 778,000 active and inactive members, retirees and beneficiaries.