Virginia Proposed employees' loan and guaranty benefit plan

Description

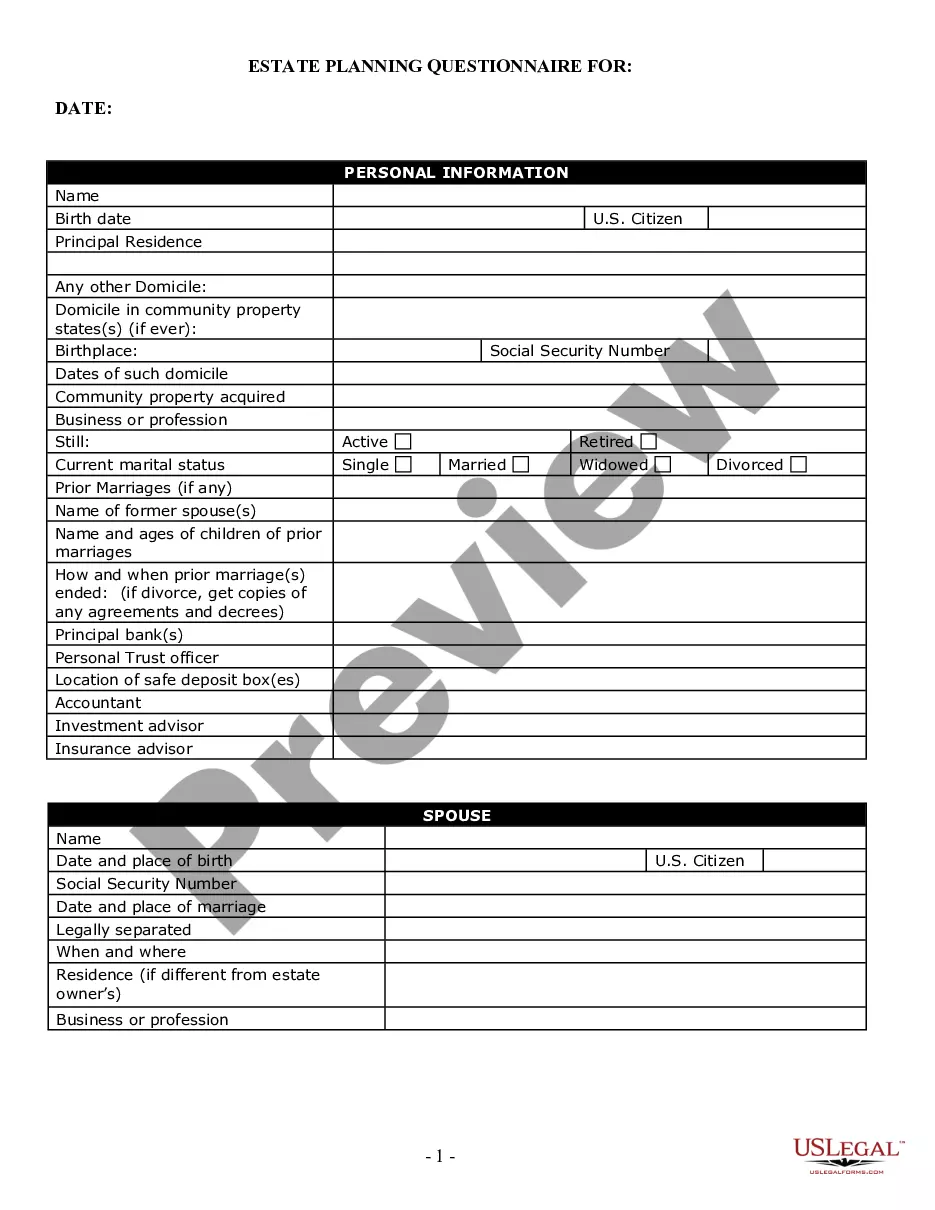

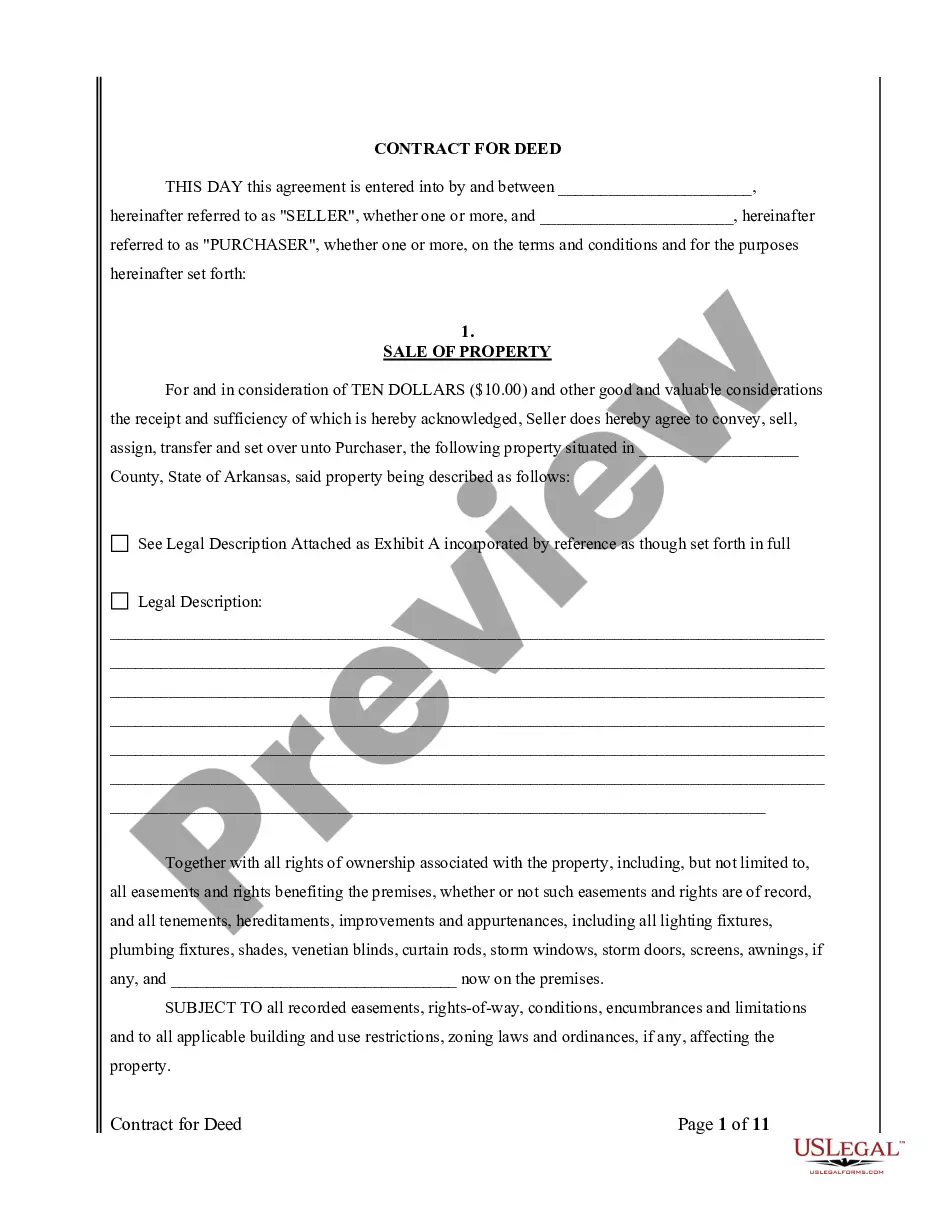

How to fill out Proposed Employees' Loan And Guaranty Benefit Plan?

You may spend hrs online looking for the lawful file design which fits the federal and state needs you will need. US Legal Forms offers a huge number of lawful forms that happen to be reviewed by pros. It is simple to obtain or printing the Virginia Proposed employees' loan and guaranty benefit plan from my support.

If you have a US Legal Forms account, it is possible to log in and click on the Download button. Afterward, it is possible to full, change, printing, or indicator the Virginia Proposed employees' loan and guaranty benefit plan. Each and every lawful file design you purchase is your own forever. To obtain another backup of any obtained form, visit the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms site for the first time, stick to the straightforward directions under:

- Initial, ensure that you have chosen the correct file design for the area/town of your choosing. Read the form explanation to ensure you have picked out the correct form. If offered, take advantage of the Preview button to look from the file design too.

- In order to find another variation of the form, take advantage of the Look for field to find the design that fits your needs and needs.

- When you have located the design you would like, click on Acquire now to carry on.

- Choose the rates program you would like, enter your accreditations, and sign up for your account on US Legal Forms.

- Total the purchase. You can utilize your bank card or PayPal account to fund the lawful form.

- Choose the format of the file and obtain it to the product.

- Make adjustments to the file if needed. You may full, change and indicator and printing Virginia Proposed employees' loan and guaranty benefit plan.

Download and printing a huge number of file layouts utilizing the US Legal Forms Internet site, that offers the most important selection of lawful forms. Use skilled and status-distinct layouts to take on your organization or specific demands.

Form popularity

FAQ

As long as you're still eligible for a VA loan and are able to qualify with a lender, there's no limit to how many of these mortgages you can take out over the course of your life. In fact, it's even possible to have more than one VA loan at the same time in certain circumstances.

VA Loan Gift Fund Requirements The amount of money given to the individual. The date the funds are transferred to the borrower. Specific language that states there is no expectation of repayment of the funds. That no one involved in the loan transaction is the gifter of these funds.

What are some of the disadvantages of a VA loan? You will be required to pay VA funding fees. ... Consider the total cost of loan compared to total cost of house. ... Manufactured homes may require a minimum down payment and may not be eligible for a 30-year term. You cannot use a VA loan for rental properties.

Here are some important facts to take into consideration. Common Problems with VA Mortgage Loans. ... Some Sellers Don't Want VA Buyers. ... Lender Overlays. ... Lender Limits. ... Closing Costs Are Not Covered. ... VA Mortgage Loans Take Longer. ... Appraisals.