The Virginia Agreement and Plan of Reorganization, also known as the Virginia Plan, is a legal framework used to reorganize or restructure a company's operations and financial structure. It is commonly employed for troubled businesses facing insolvency or major financial difficulties. This plan provides a blueprint for bringing the company back to financial stability and sustaining its operations. In the context of bankruptcy proceedings, the Virginia Agreement and Plan of Reorganization outline the terms under which a debtor company will repay its creditors and restructure its financial obligations. It aims to maximize the value of the company's assets while avoiding liquidation or shutdown. This plan typically involves negotiations between the debtor company, its creditors, and other relevant parties. These negotiations take place under the guidance of bankruptcy courts and may entail discussions about debt restructuring, debt forgiveness, asset sales, and operational changes. The Virginia Plan may establish new agreements regarding payment terms, interest rates, and maturity dates for outstanding debts. It may also involve the creation of a repayment plan, usually spanning several years, allowing the company to gradually repay its creditors from future earnings or asset sales. Moreover, the Virginia Agreement and Plan of Reorganization often include provisions for the restructuring of the company's equity ownership. This may involve the issuance of new shares, conversion of debt into equity, or the transfer of ownership to creditors, equity investors, or other interested parties. While the core principles of the Virginia Plan remain consistent across various reorganization scenarios, there might be specific types or variations of this plan based on the nature of the distressed company. Examples include the Virginia Agreement and Plan of Reorganization for financial institutions, manufacturing companies, retail businesses, and technology firms. Overall, the Virginia Agreement and Plan of Reorganization is a crucial legal tool used to navigate the complex process of reviving financially struggling companies. It serves as a detailed roadmap for restructuring both the operational and financial aspects of the business, ultimately aiming to restore long-term viability and protect the interests of all stakeholders involved.

Virginia Agreement and plan of reorganization

Description

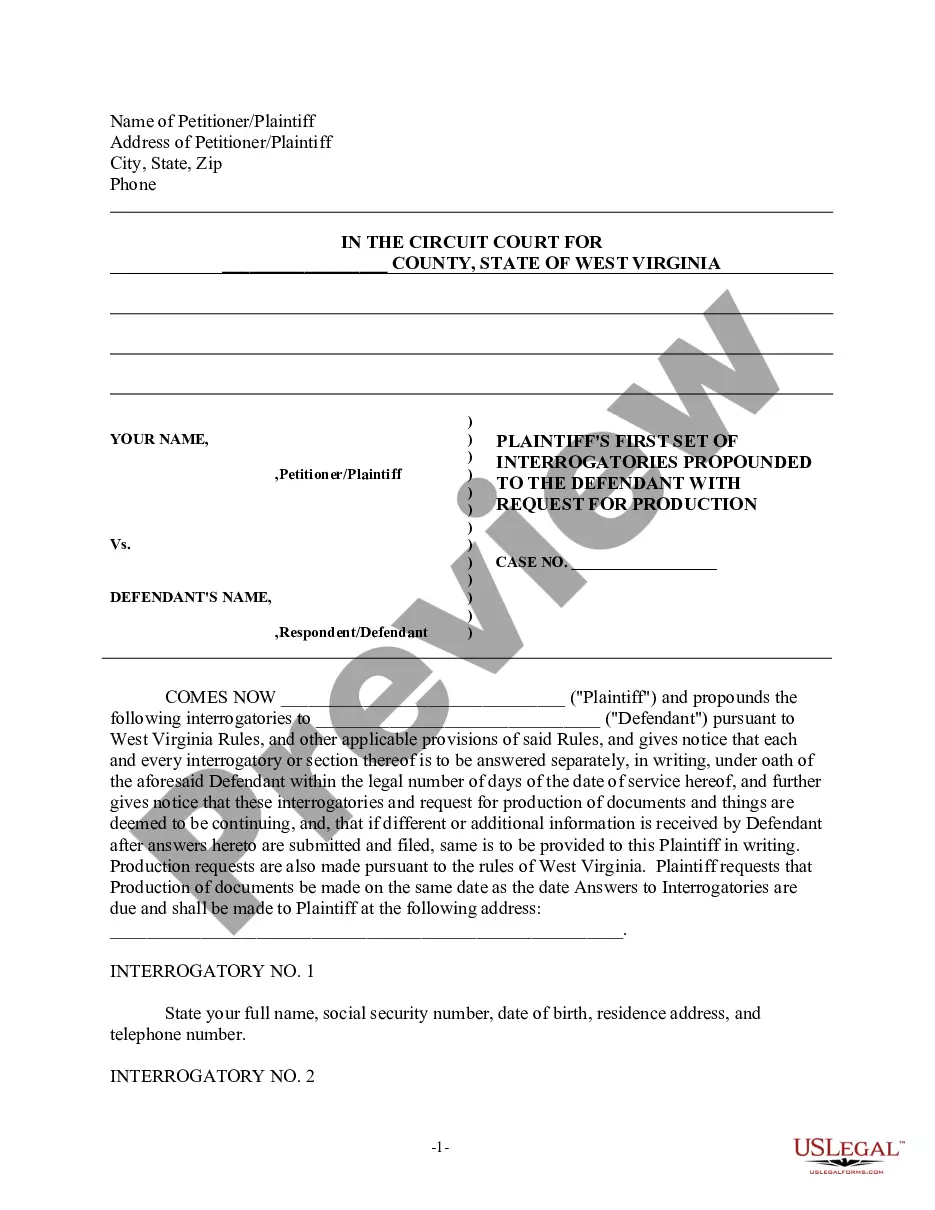

How to fill out Virginia Agreement And Plan Of Reorganization?

If you want to complete, download, or print out legitimate file layouts, use US Legal Forms, the most important collection of legitimate kinds, which can be found on the web. Utilize the site`s easy and convenient look for to find the documents you want. Various layouts for business and specific reasons are sorted by categories and says, or keywords. Use US Legal Forms to find the Virginia Agreement and plan of reorganization within a few click throughs.

If you are already a US Legal Forms consumer, log in for your accounts and then click the Obtain button to have the Virginia Agreement and plan of reorganization. You can even gain access to kinds you in the past delivered electronically in the My Forms tab of the accounts.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the shape for your appropriate area/land.

- Step 2. Use the Review choice to check out the form`s articles. Do not overlook to read the outline.

- Step 3. If you are unhappy using the kind, utilize the Look for industry near the top of the monitor to find other models of the legitimate kind design.

- Step 4. When you have located the shape you want, select the Get now button. Opt for the pricing program you favor and add your credentials to register for the accounts.

- Step 5. Process the financial transaction. You may use your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Choose the structure of the legitimate kind and download it on your own device.

- Step 7. Total, edit and print out or indication the Virginia Agreement and plan of reorganization.

Every single legitimate file design you get is the one you have for a long time. You may have acces to every single kind you delivered electronically inside your acccount. Click on the My Forms portion and select a kind to print out or download yet again.

Be competitive and download, and print out the Virginia Agreement and plan of reorganization with US Legal Forms. There are many specialist and condition-particular kinds you can utilize for your business or specific requires.

Form popularity

FAQ

A Type A reorganization must fulfill the continuity of interests requirement. That is, the shareholders in the acquired company must receive enough stock in the acquiring firm that they have a continuing financial interest in the buyer. Type A Reorganization - Definition and Explanation corporatefinanceinstitute.com ? valuation ? type-a... corporatefinanceinstitute.com ? valuation ? type-a...

In a qualifying Type A merger, the assets and liabilities of the target corporation (?Target?) must be transferred to the acquiring corporation (?Acquiror?), and the Target must dissolve by operation of law (Rev. Rul.

While other consideration besides stock can be paid under a type A reorganization, the price paid under a type B reorganization must be solely in stock. And while the target is dissolved in a type A reorganization, it can be retained in a type B reorganization.

Also, to qualify as a section 368(a) reorganization, a transaction generally must satisfy three nonstatutory requirements: business purpose, continuity of interest, and continuity of business enterprise.

Parties enter into Restructuring and Reorganization Agreements when they want to change the financial, equity, legal or operational structures of a company (or companies within an affiliated group). Restructuring and Reorganization Agreements - Bloomberg Law bloomberglaw.com ? XUUIB88000000 ? m... bloomberglaw.com ? XUUIB88000000 ? m...