Virginia Form of Convertible Promissory Note, Preferred Stock The Virginia Form of Convertible Promissory Note, Preferred Stock is a legal document that outlines the terms and conditions for a convertible promissory note that can be converted into preferred stock. This form is specific to the state of Virginia and is used when a company seeks investment through the issuance of convertible notes. Keywords: Virginia, Convertible Promissory Note, Preferred Stock, legal document, terms and conditions, convertible notes, investment, issuance. There are different types of Virginia Form of Convertible Promissory Note, Preferred Stock that can be named based on their specific characteristics or parties involved. Some of these variations include: 1. "Virginia Form of Convertible Promissory Note, Preferred Stock — Series A": This refers to a specific series of preferred stock that can be converted from a convertible promissory note. Series A typically represents the first round of preferred stock issued by a company and is commonly associated with early-stage investments. 2. "Virginia Form of Convertible Promissory Note, Preferred Stock — Bridge Financing": This denotes a convertible promissory note that is used as a short-term financing mechanism to bridge a funding gap before a larger investment round, such as a Series A preferred stock issuance. Bridge financing is typically used to support a company's operations until a more substantial funding round can be completed. 3. "Virginia Form of Convertible Promissory Note, Preferred Stock — Seed Funding": This variation is specific to convertible notes utilized in seed funding rounds. Seed funding is an initial round of investment typically provided by angel investors or venture capitalists to help start-ups and early-stage companies launch or grow their operations. 4. "Virginia Form of Convertible Promissory Note, Preferred Stock — Late Stage": This type of convertible promissory note is often associated with later-stage investment rounds, where a company has already achieved certain milestones and is closer to an exit event, such as an initial public offering (IPO) or acquisition. Late-stage investments typically involve larger sums of money and are aimed at further growth and expansion. In conclusion, the Virginia Form of Convertible Promissory Note, Preferred Stock is a legal document specific to the state of Virginia, used for the issuance of convertible promissory notes that can be converted into preferred stock. The variations mentioned above highlight different scenarios and characteristics under which these convertible notes may be used, such as seed funding, bridge financing, series distinction, or late-stage investments.

Virginia Form of Convertible Promissory Note, Preferred Stock

Description

How to fill out Virginia Form Of Convertible Promissory Note, Preferred Stock?

Are you presently inside a position the place you need to have documents for both enterprise or person uses almost every day? There are a variety of legal file templates available on the net, but discovering ones you can rely on isn`t simple. US Legal Forms gives thousands of kind templates, like the Virginia Form of Convertible Promissory Note, Preferred Stock, which can be written to meet federal and state requirements.

When you are currently acquainted with US Legal Forms internet site and get an account, merely log in. Following that, it is possible to down load the Virginia Form of Convertible Promissory Note, Preferred Stock template.

If you do not have an bank account and wish to start using US Legal Forms, follow these steps:

- Discover the kind you need and make sure it is for that correct metropolis/region.

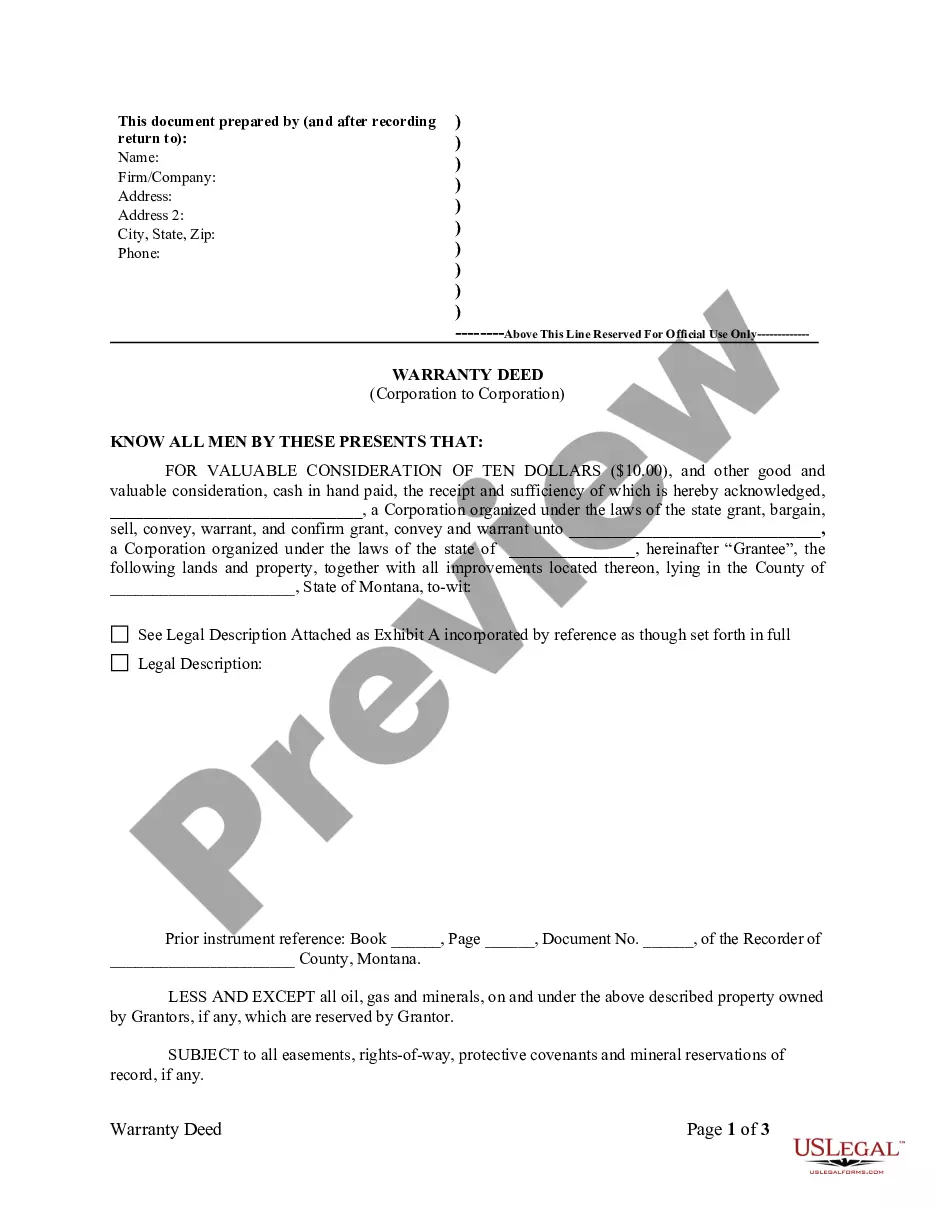

- Take advantage of the Review option to examine the form.

- Read the information to ensure that you have selected the appropriate kind.

- In case the kind isn`t what you are seeking, use the Look for field to obtain the kind that fits your needs and requirements.

- When you get the correct kind, just click Buy now.

- Select the rates program you need, submit the required details to make your bank account, and purchase the transaction making use of your PayPal or credit card.

- Choose a handy data file format and down load your duplicate.

Get each of the file templates you might have purchased in the My Forms food list. You can get a more duplicate of Virginia Form of Convertible Promissory Note, Preferred Stock whenever, if required. Just click the necessary kind to down load or print the file template.

Use US Legal Forms, by far the most considerable variety of legal types, in order to save time and avoid blunders. The assistance gives expertly made legal file templates which can be used for an array of uses. Produce an account on US Legal Forms and start generating your lifestyle easier.