Title: Virginia Proposed Merger with the Grossman Corporation: A Comprehensive Overview of the Merger Process Introduction: In the world of business, mergers and acquisitions play a crucial role in shaping industry landscapes. One such significant development is the proposed merger between Virginia and the Grossman Corporation. This article aims to provide a detailed description of this merger, exploring its key aspects, potential benefits, and different types within the Virginia Proposed merger with the Grossman Corporation. Key Terms: 1. Merger: A merger refers to the consolidation of two or more companies into a single entity, typically aimed at achieving synergies, market expansion, increased operational efficiency, and improved shareholder value. 2. Acquisition: An acquisition occurs when one company purchases another, resulting in the acquiring company gaining control over the assets, operations, and management of the target company. 3. Virginia: Virginia is a business entity or an organization considering a merger with the Grossman Corporation. Virginia's specific industry and background will determine the merger's purpose and objectives. 4. Grossman Corporation: The Grossman Corporation is a business entity or organization that shows an interest in merging with Virginia. Their industry, size, and expertise will also influence the merger's nature and strategic goals. Details of the Virginia Proposed Merger with Grossman Corporation: 1. Rationale: The Virginia Proposed merger with the Grossman Corporation is driven by a shared vision, strategic alignment, and identified synergies between the two entities. This strategic move aims to leverage their combined resources, expertise, and market presence for sustained growth, increased competitiveness, and enhanced customer value. 2. Synergistic Benefits: The proposed merger between Virginia and the Grossman Corporation is expected to yield several synergistic benefits. These may include economies of scale, technological advancements, expanded product offerings, improved distribution networks, enhanced market reach, and optimized cost structures. 3. Types of Mergers: a. Horizontal Merger: In a horizontal merger, Virginia and the Grossman Corporation operate in the same industry and are direct competitors. By combining their operations, this merger aims to create a market leader, eliminate redundant costs, and consolidate market share. b. Vertical Merger: In a vertical merger, Virginia and the Grossman Corporation operate in different stages of the supply chain or distribution channels. This merger type intends to improve operational efficiency, streamline processes, and create cost savings by integrating complementary activities. c. Conglomerate Merger: A conglomerate merger involves Virginia and the Grossman Corporation operating in unrelated industries. This merger aims to diversify business portfolios, minimize risk, access new markets, and capitalize on shared resources. 4. Due Diligence: Prior to finalizing the merger, both Virginia and the Grossman Corporation will undergo a comprehensive due diligence process. This entails a thorough examination of financials, legal obligations, market position, intellectual property rights, and potential risks to ensure informed decision-making. Conclusion: The proposed merger between Virginia and the Grossman Corporation holds immense potential to bring forth transformative changes for both entities. Whether pursuing a horizontal, vertical, or conglomerate merger, careful planning, strategic alignment, and thorough due diligence are essential. Successful integration of Virginia and the Grossman Corporation has the power to redefine industries, unlock growth opportunities, and drive long-term value for all stakeholders involved.

Virginia Proposed merger with the Grossman Corporation

Description

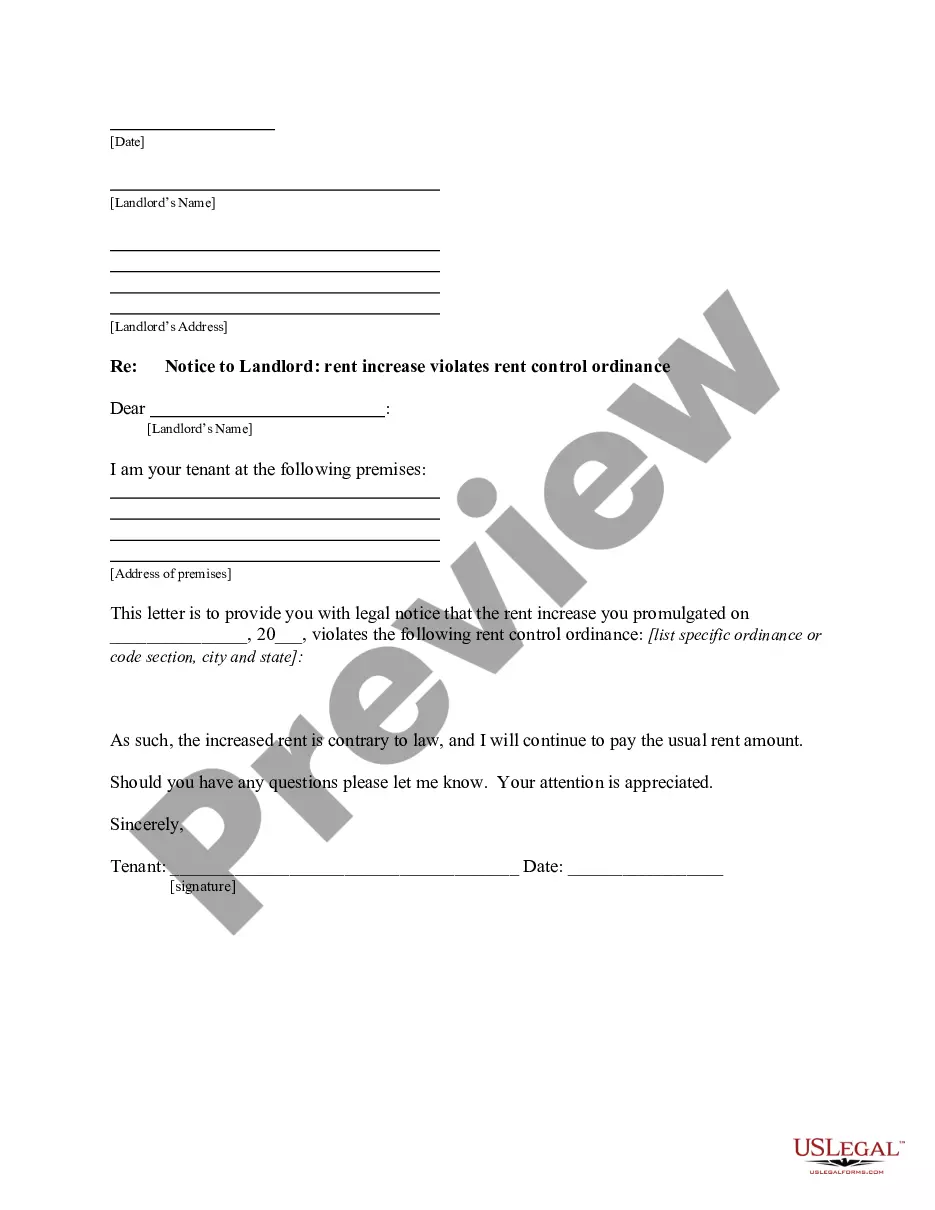

How to fill out Virginia Proposed Merger With The Grossman Corporation?

Choosing the right legitimate record format can be quite a struggle. Of course, there are plenty of templates available on the Internet, but how would you get the legitimate kind you require? Use the US Legal Forms internet site. The support gives 1000s of templates, such as the Virginia Proposed merger with the Grossman Corporation, that you can use for business and private demands. Every one of the types are inspected by pros and satisfy state and federal needs.

In case you are presently registered, log in to your profile and click the Acquire option to find the Virginia Proposed merger with the Grossman Corporation. Use your profile to search with the legitimate types you have bought in the past. Go to the My Forms tab of your own profile and acquire another backup of your record you require.

In case you are a whole new user of US Legal Forms, here are straightforward instructions for you to follow:

- First, ensure you have selected the right kind for your area/area. You can look through the shape utilizing the Preview option and read the shape description to make certain it will be the best for you.

- In case the kind is not going to satisfy your preferences, utilize the Seach area to get the appropriate kind.

- When you are certain the shape is suitable, click on the Buy now option to find the kind.

- Choose the pricing prepare you desire and enter in the necessary information and facts. Make your profile and pay for an order utilizing your PayPal profile or credit card.

- Opt for the data file file format and down load the legitimate record format to your device.

- Complete, revise and print and sign the obtained Virginia Proposed merger with the Grossman Corporation.

US Legal Forms may be the most significant catalogue of legitimate types that you can find a variety of record templates. Use the service to down load professionally-produced files that follow condition needs.