Virginia Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank

Description

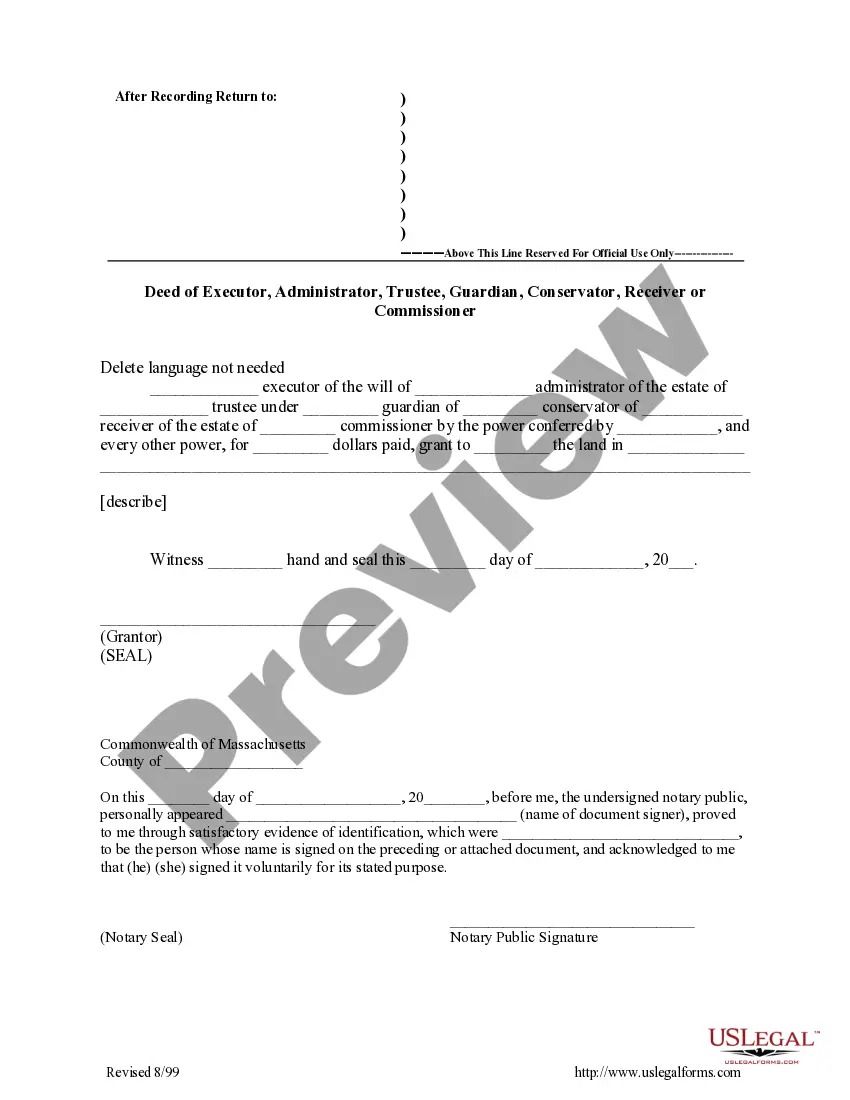

How to fill out Form Of Agreement And Plan Of Merger By Regional Bancorp, Inc., Medford Interim, Inc., And Medford Savings Bank?

US Legal Forms - one of several largest libraries of legitimate types in America - gives an array of legitimate papers web templates you may down load or print. Using the web site, you can find a large number of types for enterprise and specific functions, categorized by categories, says, or search phrases.You can find the newest variations of types like the Virginia Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank in seconds.

If you have a subscription, log in and down load Virginia Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank through the US Legal Forms local library. The Acquire switch can look on every single develop you perspective. You get access to all in the past downloaded types in the My Forms tab of your respective bank account.

If you want to use US Legal Forms the first time, listed below are simple guidelines to help you started out:

- Be sure to have picked out the correct develop to your area/region. Click on the Preview switch to examine the form`s articles. Look at the develop information to ensure that you have chosen the appropriate develop.

- In case the develop does not suit your requirements, use the Look for area at the top of the display screen to find the one which does.

- When you are happy with the shape, verify your choice by clicking the Acquire now switch. Then, select the prices prepare you like and give your qualifications to sign up on an bank account.

- Procedure the financial transaction. Make use of credit card or PayPal bank account to accomplish the financial transaction.

- Find the format and down load the shape on your product.

- Make changes. Fill up, modify and print and signal the downloaded Virginia Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank.

Each format you included with your account lacks an expiration day and it is yours eternally. So, if you wish to down load or print yet another backup, just visit the My Forms section and click on on the develop you require.

Gain access to the Virginia Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank with US Legal Forms, probably the most substantial local library of legitimate papers web templates. Use a large number of professional and condition-specific web templates that meet up with your business or specific requires and requirements.