Virginia Bylaws of Great American Bank, FSB

Description

How to fill out Bylaws Of Great American Bank, FSB?

You are able to devote time on the web trying to find the authorized document template that meets the federal and state demands you want. US Legal Forms provides 1000s of authorized varieties which can be reviewed by pros. It is simple to acquire or produce the Virginia Bylaws of Great American Bank, FSB from our support.

If you already possess a US Legal Forms account, you can log in and click the Acquire option. After that, you can total, modify, produce, or sign the Virginia Bylaws of Great American Bank, FSB. Every authorized document template you get is yours for a long time. To have an additional copy for any purchased kind, proceed to the My Forms tab and click the related option.

If you work with the US Legal Forms website for the first time, follow the simple guidelines beneath:

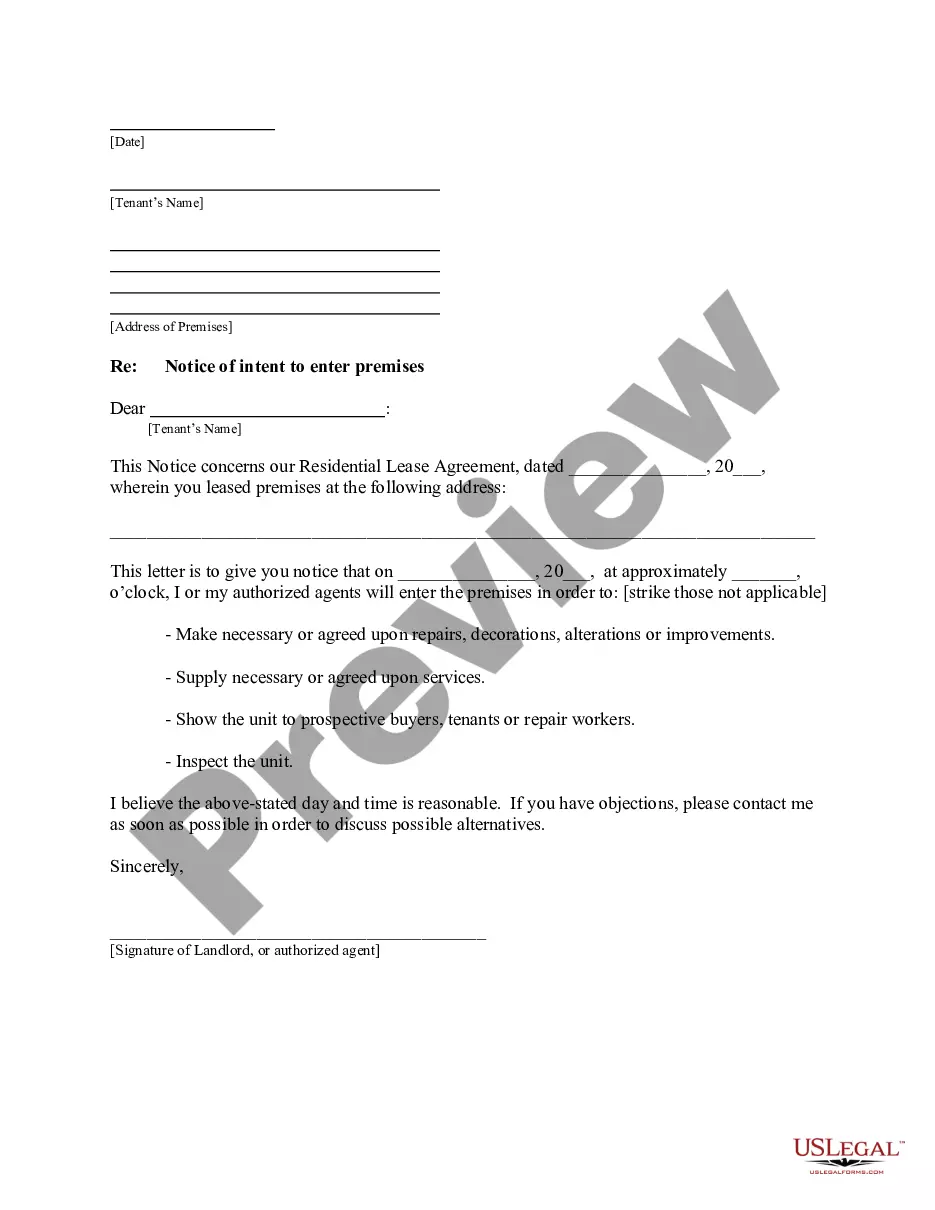

- Very first, be sure that you have selected the right document template for the state/metropolis of your choosing. See the kind information to ensure you have picked the appropriate kind. If available, use the Preview option to check from the document template at the same time.

- If you want to find an additional model in the kind, use the Look for discipline to obtain the template that fits your needs and demands.

- When you have located the template you desire, just click Buy now to continue.

- Pick the pricing plan you desire, type in your credentials, and sign up for your account on US Legal Forms.

- Full the financial transaction. You can use your bank card or PayPal account to purchase the authorized kind.

- Pick the structure in the document and acquire it for your device.

- Make changes for your document if necessary. You are able to total, modify and sign and produce Virginia Bylaws of Great American Bank, FSB.

Acquire and produce 1000s of document layouts while using US Legal Forms site, which provides the greatest assortment of authorized varieties. Use expert and express-distinct layouts to deal with your small business or individual requirements.