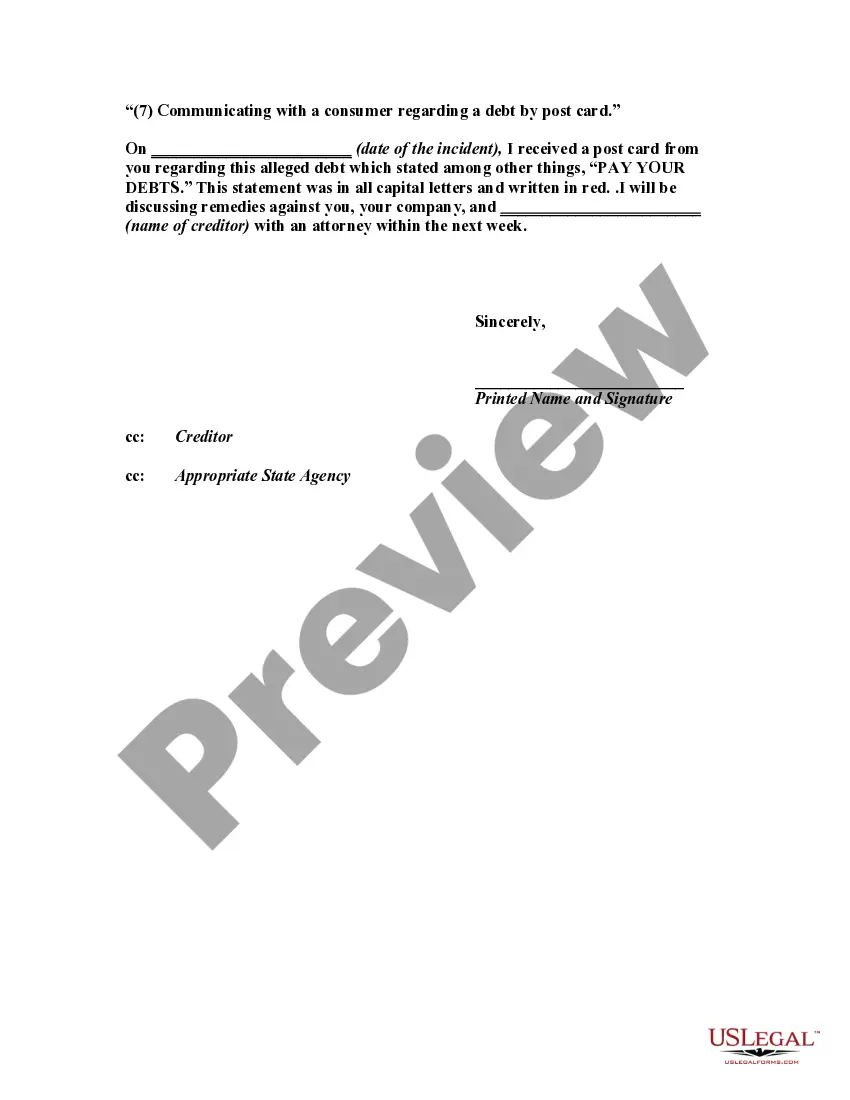

Have you been inside a situation where you will need documents for either business or personal uses just about every working day? There are a lot of lawful file themes accessible on the Internet, but getting types you can depend on is not straightforward. US Legal Forms offers a large number of form themes, much like the Virginia Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card, that are published to satisfy federal and state demands.

When you are presently informed about US Legal Forms internet site and also have your account, merely log in. Afterward, it is possible to down load the Virginia Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card web template.

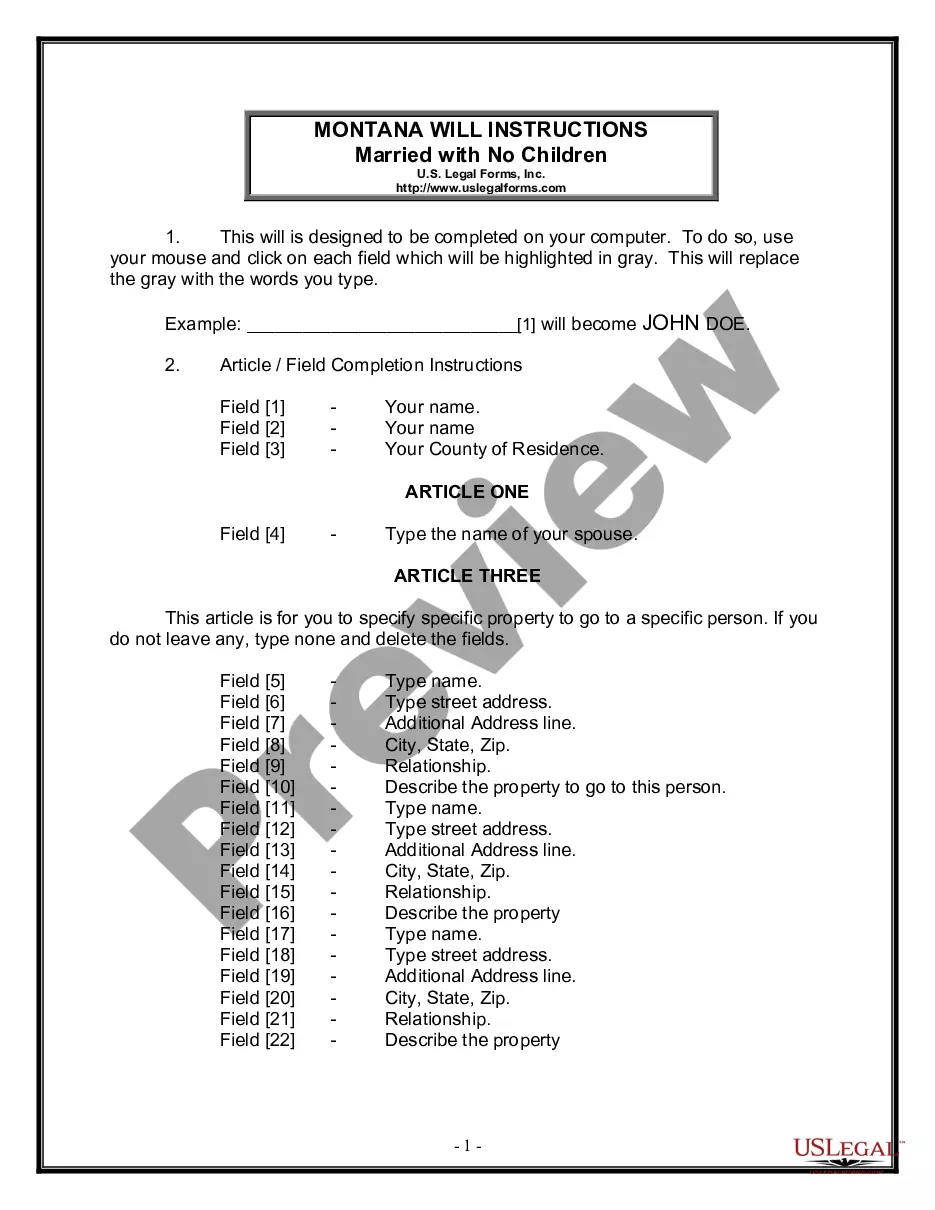

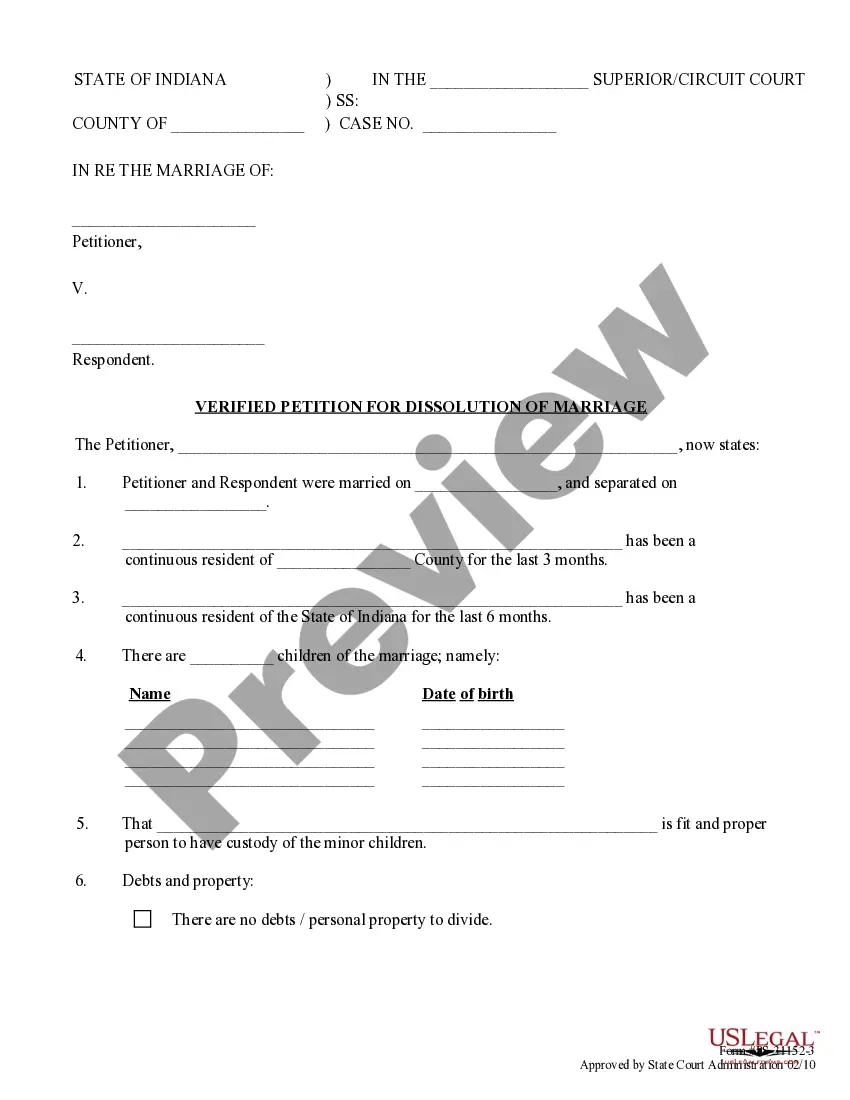

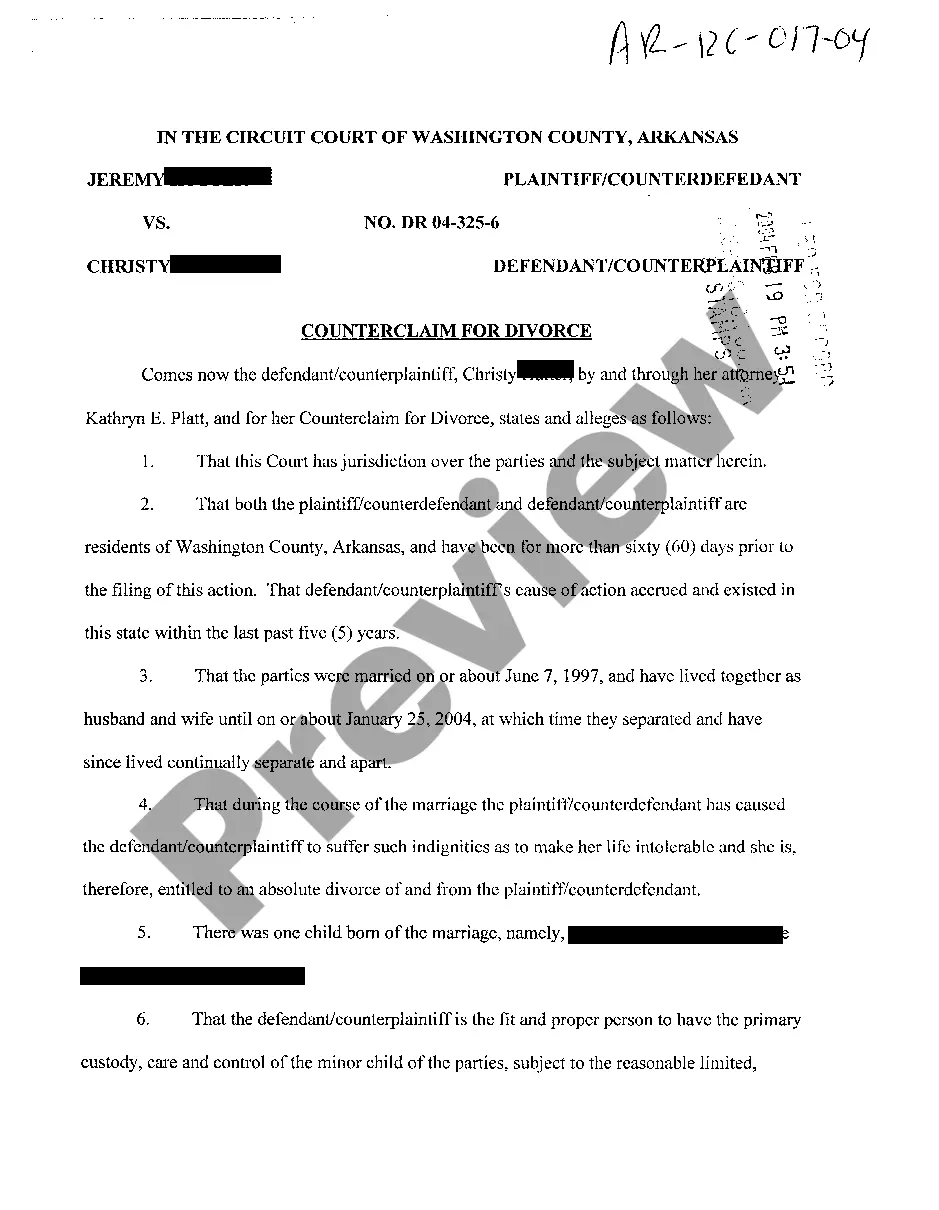

Should you not have an account and wish to begin using US Legal Forms, adopt these measures:

- Find the form you want and ensure it is for that proper town/state.

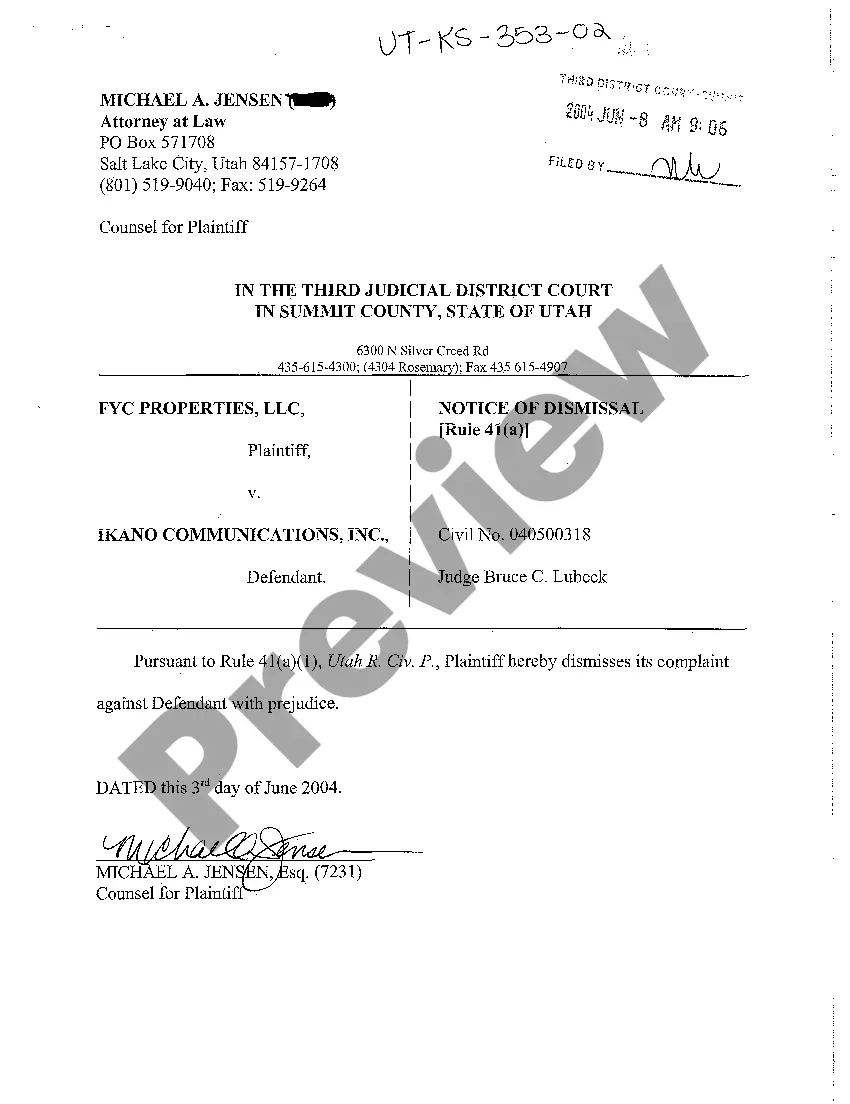

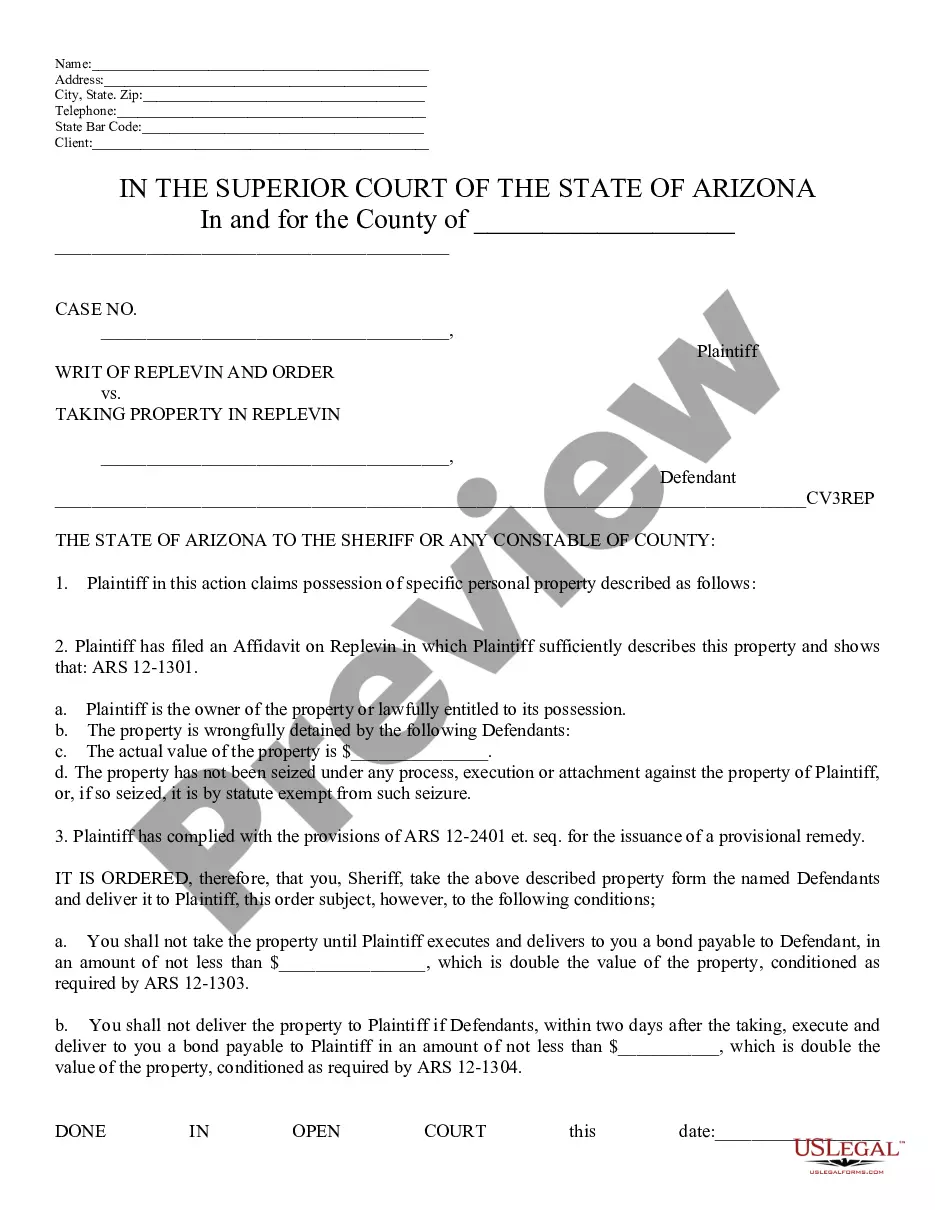

- Make use of the Preview button to check the form.

- Look at the information to actually have chosen the proper form.

- In the event the form is not what you`re trying to find, take advantage of the Research field to find the form that meets your needs and demands.

- When you discover the proper form, click on Buy now.

- Opt for the prices plan you want, submit the specified details to make your account, and pay money for an order using your PayPal or bank card.

- Choose a convenient paper file format and down load your backup.

Locate every one of the file themes you may have purchased in the My Forms menus. You can aquire a further backup of Virginia Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card whenever, if necessary. Just go through the needed form to down load or produce the file web template.

Use US Legal Forms, probably the most considerable selection of lawful types, to save lots of some time and stay away from blunders. The assistance offers appropriately manufactured lawful file themes that can be used for a selection of uses. Make your account on US Legal Forms and initiate generating your way of life easier.

Credit card debt comprises a large majority of the debt that debt buyerscommunicating with a consumer regarding a debt by postcard; ... Requirements for Debt Collector Action. Additionally, in their first communication with the consumer, debt collectors are required ?to notify debtors about ...You can file a complaint with the FTC if you believe the debt collector never sent written notice. Most individuals complaining about written ... Send a Demand Letter When Debt Collectors Violate the FDCPA · You have a collector calling you regarding a debt you do not owe. · The statute of ... Debt claims grew to dominate state civil court dockets in recent decades. From 1993 to 2013, the number of debt collection suits more than ... The Fair Debt Collection Practices Act (FDCPA)(15 U.S.C. 1692A debt collector may not communicate with a consumer at any unusual time. A debt collector must cease all communications with a consumer if the consumer notifies the collector in writing that he refuses to pay the debt or the consumer ... But with the update to the FDCPA that went into effect in late 2021, consumers are now able to limit how debt collectors communicate with them through newer ... The Fair Debt Collection Practices Act regulates the conduct of ?debt collectors? in collecting ?debts? owed or allegedly owed by ?consumers ... The FDCPA requires that a debt collector send a written notice to a consumer, within five days of the initial communication, containing certain ...