A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Virginia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

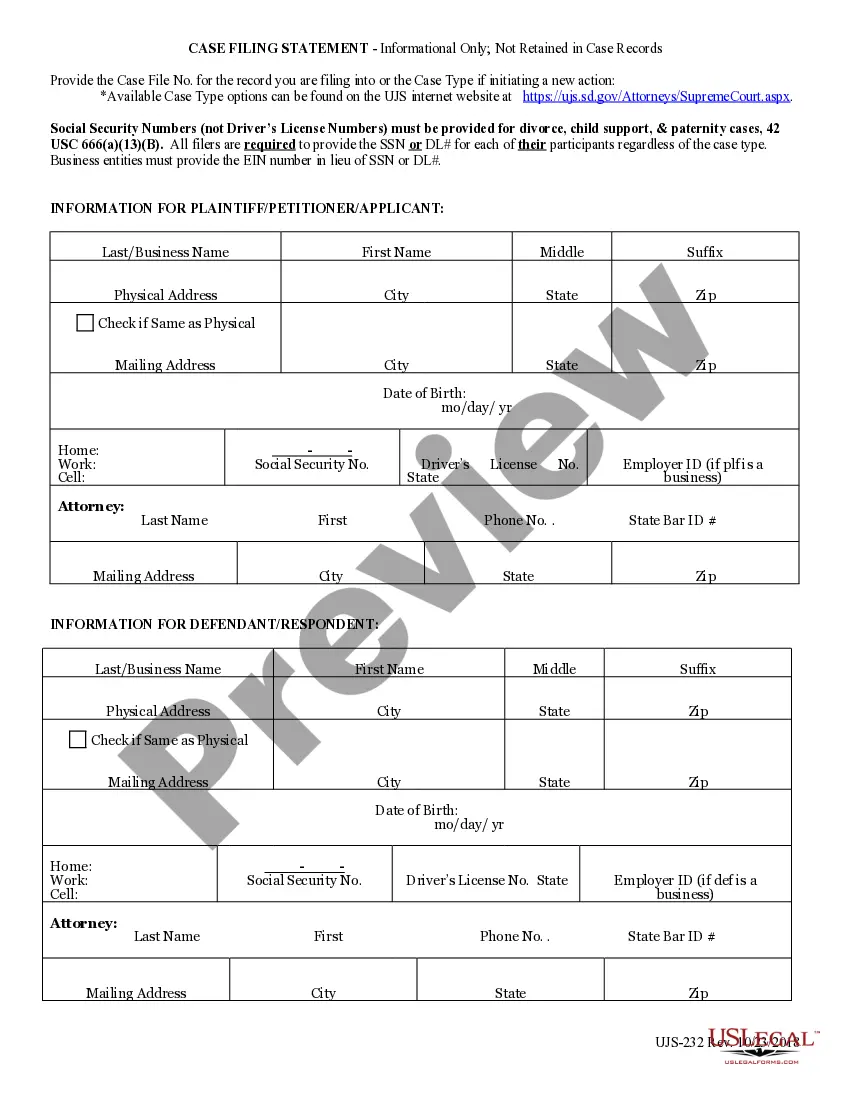

How to fill out Virginia Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

Are you currently in a position in which you need to have documents for either business or person purposes nearly every day? There are a lot of legitimate document templates accessible on the Internet, but finding types you can rely on is not simple. US Legal Forms provides a large number of develop templates, much like the Virginia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law, which can be composed in order to meet federal and state demands.

If you are currently informed about US Legal Forms site and have a merchant account, just log in. Next, you may down load the Virginia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law template.

If you do not offer an account and need to start using US Legal Forms, abide by these steps:

- Obtain the develop you need and ensure it is for that proper area/region.

- Use the Preview key to review the shape.

- Look at the explanation to actually have chosen the correct develop.

- When the develop is not what you`re seeking, take advantage of the Research field to get the develop that suits you and demands.

- If you get the proper develop, click on Get now.

- Pick the costs prepare you desire, fill in the necessary info to generate your account, and pay money for the order utilizing your PayPal or bank card.

- Pick a hassle-free data file formatting and down load your duplicate.

Find each of the document templates you might have purchased in the My Forms food selection. You can get a further duplicate of Virginia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law whenever, if needed. Just click the essential develop to down load or produce the document template.

Use US Legal Forms, the most comprehensive collection of legitimate varieties, in order to save time and prevent mistakes. The services provides skillfully made legitimate document templates which you can use for an array of purposes. Generate a merchant account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

Unpaid credit card debt will drop off an individual's credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the person's credit score.

In Virginia, there is a statute of limitations, also known as the length of time debt collectors have to recover the unpaid debt. In a written contract, debt collectors generally have a five-year period to try and collect or take legal action. However, a three-year period applies for oral contracts.

In Virginia, there is a statute of limitations, also known as the length of time debt collectors have to recover the unpaid debt. In a written contract, debt collectors generally have a five-year period to try and collect or take legal action. However, a three-year period applies for oral contracts.

This finite period of time is known as the statute of limitations. In Virginia, the applicable statute of limitations for credit card debts, mortgage debts, and medical debts is five years.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

In California, the statute of limitations on most debts is four years. With some limited exceptions, creditors and debt buyers can't sue to collect debt that is more than four years old. When the debt is based on a verbal agreement, that time is reduced to two years.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

No execution shall be issued and no action brought on a judgment, including a judgment in favor of the Commonwealth and a judgment rendered in another state or country, after 20 years from the date of such judgment or domestication of such judgment, unless the period is extended as provided in this section.